What is Global Aluminized Polyester Film Market?

The Global Aluminized Polyester Film Market refers to the worldwide industry involved in the production, distribution, and utilization of aluminized polyester films. These films are essentially polyester films that have been coated with a thin layer of aluminum, giving them a shiny, reflective surface. This coating process enhances the film's barrier properties, making it resistant to moisture, gases, and light, which is crucial for various applications. The market encompasses a wide range of industries, including packaging, decoration, electronics, and construction, among others. The demand for aluminized polyester films is driven by their versatility, durability, and cost-effectiveness. They are used in food packaging to extend shelf life, in decorative applications for their aesthetic appeal, and in electronics for insulation and protection. The market is characterized by continuous innovation and development, with manufacturers constantly seeking to improve the performance and functionality of these films to meet the evolving needs of different industries. The global reach of this market indicates its significant role in modern industrial applications and consumer products.

Single Side, Both Side in the Global Aluminized Polyester Film Market:

In the Global Aluminized Polyester Film Market, films can be categorized based on whether they are aluminized on one side (Single Side) or both sides (Both Side). Single Side aluminized polyester films have the aluminum coating on only one surface of the film. This type of film is commonly used in applications where only one side needs to be reflective or have enhanced barrier properties. For instance, in the packaging industry, single side aluminized films are often used for wrapping food products where the reflective side faces outward to protect the contents from light and moisture, while the other side can be printed with branding and product information. In the decoration industry, single side aluminized films are used for creating reflective surfaces on items such as gift wraps, balloons, and party decorations, where only one side needs to be shiny and attractive. In the electronics industry, these films are used for insulation purposes, where the aluminized side provides a barrier against electromagnetic interference, while the other side can be adhered to other materials. On the other hand, Both Side aluminized polyester films have the aluminum coating on both surfaces of the film. This type of film is used in applications where both sides need to have reflective or barrier properties. In the packaging industry, both side aluminized films are used for products that require a high level of protection from external factors such as light, moisture, and gases. For example, in the packaging of perishable goods like snacks and pharmaceuticals, both side aluminized films help in extending the shelf life by providing a robust barrier on both sides. In the decoration industry, both side aluminized films are used for creating items that need to be reflective from all angles, such as decorative ribbons, streamers, and confetti. In the electronics industry, both side aluminized films are used in applications where insulation and protection are required on both sides of the component, such as in the manufacturing of capacitors and other electronic devices. In the construction industry, both side aluminized films are used for insulation purposes, where they help in reflecting heat and light, thereby improving the energy efficiency of buildings. The choice between single side and both side aluminized polyester films depends on the specific requirements of the application, with each type offering unique benefits and functionalities.

Packaging Industry, Decoration Industry, Electrics Industry, Construction Industry, Others in the Global Aluminized Polyester Film Market:

The Global Aluminized Polyester Film Market finds extensive usage across various industries due to its unique properties. In the Packaging Industry, aluminized polyester films are widely used for food packaging, pharmaceutical packaging, and other consumer goods. The reflective aluminum coating provides an excellent barrier against moisture, gases, and light, which helps in extending the shelf life of the products. These films are also used in flexible packaging solutions such as pouches, bags, and wrappers, where their durability and resistance to external factors are crucial. In the Decoration Industry, aluminized polyester films are used for creating shiny, reflective surfaces on items such as gift wraps, balloons, and party decorations. The films' aesthetic appeal and ability to reflect light make them ideal for decorative purposes, adding a touch of glamour and festivity to various items. In the Electrics Industry, aluminized polyester films are used for insulation and protection of electronic components. The aluminum coating provides a barrier against electromagnetic interference, which is essential for the proper functioning of electronic devices. These films are used in the manufacturing of capacitors, transformers, and other electronic components where insulation and protection are critical. In the Construction Industry, aluminized polyester films are used for insulation purposes. The reflective properties of the aluminum coating help in reflecting heat and light, thereby improving the energy efficiency of buildings. These films are used in roofing, walls, and other construction applications where insulation is required. In addition to these industries, aluminized polyester films are also used in other applications such as automotive, aerospace, and textiles. The versatility, durability, and cost-effectiveness of aluminized polyester films make them a preferred choice in various industries, driving the growth of the Global Aluminized Polyester Film Market.

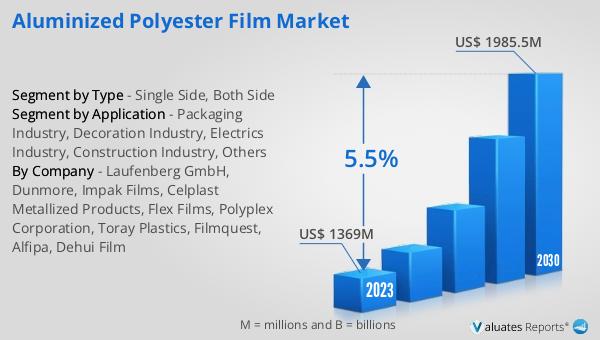

Global Aluminized Polyester Film Market Outlook:

The global Aluminized Polyester Film market was valued at US$ 1369 million in 2023 and is anticipated to reach US$ 1985.5 million by 2030, witnessing a CAGR of 5.5% during the forecast period 2024-2030. This market outlook indicates a steady growth trajectory for the aluminized polyester film industry over the next few years. The increasing demand for these films across various industries such as packaging, decoration, electronics, and construction is a key factor driving this growth. The reflective and barrier properties of aluminized polyester films make them highly suitable for a wide range of applications, contributing to their rising popularity. The market's growth is also supported by continuous innovation and development in film manufacturing technologies, which aim to enhance the performance and functionality of these films. As industries continue to seek cost-effective and efficient solutions for their packaging, insulation, and decorative needs, the demand for aluminized polyester films is expected to remain strong. This positive market outlook reflects the significant role that aluminized polyester films play in modern industrial applications and consumer products, highlighting their importance in the global market.

| Report Metric | Details |

| Report Name | Aluminized Polyester Film Market |

| Accounted market size in 2023 | US$ 1369 million |

| Forecasted market size in 2030 | US$ 1985.5 million |

| CAGR | 5.5% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Laufenberg GmbH, Dunmore, Impak Films, Celplast Metallized Products, Flex Films, Polyplex Corporation, Toray Plastics, Filmquest, Alfipa, Dehui Film |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |