What is Durable Water Repellent for Fabrics - Global Market?

Durable Water Repellent (DWR) for fabrics is a specialized coating applied to textiles to make them water-resistant or hydrophobic. This treatment is crucial for outdoor clothing, sportswear, and other fabric-based products that need to withstand wet conditions. The global market for DWR is driven by the increasing demand for high-performance fabrics in various industries, including fashion, sports, and outdoor activities. As consumers become more aware of the benefits of water-repellent fabrics, the demand for DWR-treated products continues to rise. The market is also influenced by technological advancements that have led to the development of more efficient and environmentally friendly DWR solutions. These advancements have made it possible to produce fabrics that not only repel water but also maintain breathability and comfort. The global market for DWR is expected to grow significantly as more industries recognize the value of water-repellent fabrics in enhancing product performance and consumer satisfaction. This growth is further supported by the increasing focus on sustainability and the development of fluorine-free DWR solutions that reduce environmental impact. Overall, the DWR market is poised for substantial growth as it continues to evolve and adapt to changing consumer preferences and environmental standards.

Fluorine Water Repellent, Fluorine-free Water Repellent in the Durable Water Repellent for Fabrics - Global Market:

Fluorine water repellents have been a staple in the durable water repellent (DWR) market for fabrics due to their exceptional ability to repel water and stains. These repellents work by creating a barrier on the fabric surface that prevents water molecules from penetrating, thus keeping the fabric dry. Fluorine-based repellents are highly effective and have been widely used in outdoor apparel, sportswear, and other applications where water resistance is crucial. However, the environmental impact of fluorine compounds, particularly perfluorinated chemicals (PFCs), has raised concerns. PFCs are persistent in the environment and can accumulate in living organisms, leading to potential health risks. As a result, there has been a growing demand for fluorine-free water repellents that offer similar performance without the environmental drawbacks. Fluorine-free water repellents are typically based on alternative chemistries, such as silicone or hydrocarbon-based compounds. These alternatives provide water repellency by forming a protective layer on the fabric surface, similar to fluorine-based repellents. While they may not always match the performance of fluorine-based solutions in terms of durability and stain resistance, they offer a more sustainable option for environmentally conscious consumers and manufacturers. The shift towards fluorine-free repellents is driven by regulatory pressures and consumer demand for eco-friendly products. Many companies are investing in research and development to improve the performance of fluorine-free repellents and make them a viable alternative to traditional fluorine-based solutions. This transition is not without challenges, as manufacturers must balance performance, cost, and environmental impact. However, the potential benefits of fluorine-free repellents, including reduced environmental footprint and compliance with stricter regulations, make them an attractive option for the future of the DWR market. As the industry continues to innovate and adapt, the adoption of fluorine-free water repellents is expected to increase, paving the way for a more sustainable and environmentally friendly approach to fabric treatment.

Textiles, Nonwovens, Papers and Packaging, Others in the Durable Water Repellent for Fabrics - Global Market:

Durable Water Repellent (DWR) treatments are widely used across various sectors, including textiles, nonwovens, papers and packaging, and other industries, to enhance the water resistance of materials. In the textile industry, DWR is primarily applied to outdoor clothing, sportswear, and fashion garments to provide protection against rain and moisture while maintaining breathability and comfort. This is particularly important for outdoor enthusiasts and athletes who require high-performance gear that can withstand harsh weather conditions. The application of DWR in textiles not only enhances the functionality of the garments but also extends their lifespan by preventing water damage. In the nonwovens sector, DWR treatments are used to improve the water resistance of products such as medical gowns, hygiene products, and industrial fabrics. These applications require materials that can provide a barrier against liquids while remaining lightweight and breathable. DWR treatments help achieve these properties, making nonwoven products more effective and reliable in their respective applications. In the paper and packaging industry, DWR is used to create water-resistant packaging materials that protect goods from moisture during transportation and storage. This is particularly important for food packaging, where maintaining the integrity of the packaging is crucial to preserving the quality and safety of the contents. DWR-treated papers and packaging materials offer an added layer of protection, ensuring that products remain dry and undamaged. Beyond these sectors, DWR treatments are also used in other industries, such as automotive and home furnishings, where water resistance is a desirable feature. In the automotive industry, DWR is applied to car interiors and convertible tops to protect against water damage and staining. In home furnishings, DWR-treated fabrics are used for upholstery and outdoor furniture to enhance durability and ease of maintenance. Overall, the use of DWR across these diverse applications highlights its versatility and importance in enhancing the performance and longevity of materials.

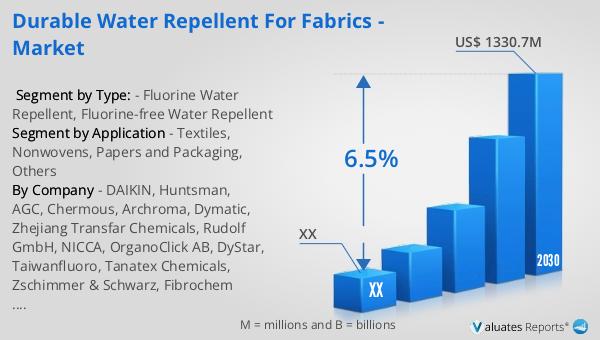

Durable Water Repellent for Fabrics - Global Market Outlook:

The global market for Durable Water Repellent (DWR) for fabrics was valued at approximately $876 million in 2023. It is projected to grow to a revised size of around $1,330.7 million by 2030, reflecting a compound annual growth rate (CAGR) of 6.5% during the forecast period from 2024 to 2030. This growth is driven by the increasing demand for water-repellent fabrics across various industries, including textiles, nonwovens, and packaging. As consumers become more aware of the benefits of DWR-treated products, the market is expected to expand further. The shift towards environmentally friendly and sustainable DWR solutions, such as fluorine-free repellents, is also contributing to market growth. Companies are investing in research and development to improve the performance and sustainability of DWR treatments, which is expected to drive innovation and create new opportunities in the market. The growing focus on sustainability and regulatory pressures to reduce the environmental impact of DWR treatments are encouraging manufacturers to develop alternative solutions that meet these requirements. As a result, the DWR market is poised for significant growth as it continues to evolve and adapt to changing consumer preferences and environmental standards. This positive market outlook reflects the increasing importance of DWR treatments in enhancing the performance and longevity of fabrics across various applications.

| Report Metric | Details |

| Report Name | Durable Water Repellent for Fabrics - Market |

| Forecasted market size in 2030 | US$ 1330.7 million |

| CAGR | 6.5% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | DAIKIN, Huntsman, AGC, Chermous, Archroma, Dymatic, Zhejiang Transfar Chemicals, Rudolf GmbH, NICCA, OrganoClick AB, DyStar, Taiwanfluoro, Tanatex Chemicals, Zschimmer & Schwarz, Fibrochem Advanced Materials (Shanghai) Co, HeiQ, Sarex, Go Yen Chemical, Pulcra Chemicals GmbH, ORCO, Zhejiang Kefeng, Zhuhai Huada WholeWin Chemical, Zhejiang Wellwin, LeMan Polymer, Liansheng Chemistry, IHEIR, Nano-Care |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |