What is Hydrodenitrogenation Catalyst (HDN) - Global Market?

Hydrodenitrogenation (HDN) catalysts play a crucial role in the refining industry by removing nitrogen compounds from petroleum products. These catalysts are essential in the hydroprocessing of crude oil, where they facilitate the conversion of nitrogen-containing impurities into harmless gases like ammonia. This process is vital because nitrogen compounds, such as pyridine and quinoline, can poison other catalysts used in refining, leading to reduced efficiency and increased costs. The global market for HDN catalysts is driven by the growing demand for cleaner fuels and stricter environmental regulations. As refineries strive to produce low-sulfur and low-nitrogen fuels, the need for effective HDN catalysts becomes more pronounced. These catalysts are typically composed of metals like nickel (Ni), molybdenum (Mo), and tungsten (W), which are supported on materials like alumina. The choice of catalyst depends on the specific requirements of the refining process, including the type of feedstock and the desired level of nitrogen removal. Overall, the HDN catalyst market is an integral part of the broader hydroprocessing catalyst market, which is expected to grow steadily as the demand for cleaner fuels continues to rise globally.

Ni-Mo, W-Mo-Ni, Other in the Hydrodenitrogenation Catalyst (HDN) - Global Market:

In the realm of hydrodenitrogenation catalysts, various formulations are employed to achieve optimal nitrogen removal from petroleum products. Among these, Ni-Mo (Nickel-Molybdenum) catalysts are widely used due to their effectiveness in breaking down nitrogen compounds. These catalysts are typically supported on alumina and are known for their ability to operate under moderate conditions, making them suitable for a range of hydroprocessing applications. Ni-Mo catalysts are particularly effective in treating middle distillates and are often used in conjunction with other catalysts to enhance overall performance. On the other hand, W-Mo-Ni (Tungsten-Molybdenum-Nickel) catalysts are designed for more demanding applications where higher temperatures and pressures are required. These catalysts offer superior resistance to deactivation and are capable of handling heavier feedstocks with higher nitrogen content. The addition of tungsten enhances the catalyst's stability and activity, making it a preferred choice for refineries dealing with challenging crude oils. Besides these, other catalyst formulations are also available, each tailored to specific refining needs. These may include combinations of different metals or the use of alternative support materials to improve performance. The selection of a particular catalyst formulation depends on various factors, including the type of feedstock, the desired level of nitrogen removal, and the specific conditions of the refining process. As the demand for cleaner fuels continues to grow, the development of more efficient and robust HDN catalysts remains a key focus for the industry.

Diesel Hydrotreat, Lube Oils, Naphtha, Residue Upgrading in the Hydrodenitrogenation Catalyst (HDN) - Global Market:

Hydrodenitrogenation catalysts are employed across various refining processes to improve the quality of petroleum products. In diesel hydrotreating, HDN catalysts are used to remove nitrogen compounds from diesel fuel, resulting in cleaner-burning diesel with lower emissions. This process is crucial for meeting stringent environmental regulations and improving the overall performance of diesel engines. The use of HDN catalysts in diesel hydrotreating also helps in reducing the sulfur content, further enhancing the fuel's quality. In the production of lube oils, HDN catalysts play a vital role in removing nitrogen impurities that can affect the stability and performance of the final product. By ensuring the removal of these impurities, HDN catalysts help in producing high-quality lube oils with improved viscosity and thermal stability. In naphtha processing, HDN catalysts are used to treat feedstocks before they are further processed into gasoline or other petrochemicals. The removal of nitrogen compounds is essential to prevent catalyst poisoning in subsequent refining steps, ensuring efficient conversion and high yields. Lastly, in residue upgrading, HDN catalysts are employed to treat heavy residues with high nitrogen content. This process helps in converting these residues into more valuable products, such as lighter fuels and petrochemical feedstocks. The use of HDN catalysts in residue upgrading is particularly important for refineries looking to maximize the value of their feedstocks and reduce waste. Overall, the application of HDN catalysts across these areas highlights their importance in the refining industry and their contribution to producing cleaner and more efficient fuels.

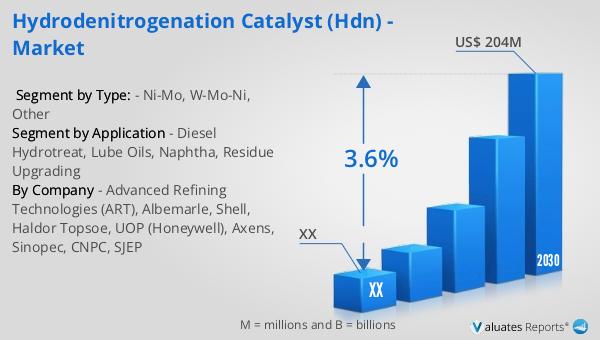

Hydrodenitrogenation Catalyst (HDN) - Global Market Outlook:

The global market for hydrodenitrogenation (HDN) catalysts was valued at approximately $158 million in 2023. It is projected to grow to a revised size of $204 million by 2030, reflecting a compound annual growth rate (CAGR) of 3.6% during the forecast period from 2024 to 2030. This growth is driven by the increasing demand for cleaner fuels and the need to comply with stringent environmental regulations. Nitrogen-containing compounds, such as pyridine and quinoline, are commonly found as impurities in crude oil and other hydrocarbons. These impurities can have detrimental effects on refining processes, leading to catalyst poisoning and reduced efficiency. As a result, the removal of nitrogen compounds through hydrodenitrogenation is essential for maintaining the performance and longevity of refining catalysts. The growing awareness of the environmental impact of nitrogen emissions and the push for cleaner fuels are key factors contributing to the expansion of the HDN catalyst market. Refineries are increasingly investing in advanced catalyst technologies to enhance their hydroprocessing capabilities and meet the rising demand for low-nitrogen fuels. As the market continues to evolve, the development of more efficient and cost-effective HDN catalysts will be crucial in supporting the transition to cleaner energy sources.

| Report Metric | Details |

| Report Name | Hydrodenitrogenation Catalyst (HDN) - Market |

| Forecasted market size in 2030 | US$ 204 million |

| CAGR | 3.6% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Advanced Refining Technologies (ART), Albemarle, Shell, Haldor Topsoe, UOP (Honeywell), Axens, Sinopec, CNPC, SJEP |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |