What is 2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP) - Global Market?

2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP) is a specialized chemical compound that plays a significant role in various industrial applications due to its unique properties. This compound is primarily known for its use in the production of high-performance materials, particularly in the optical and coatings industries. PETP is valued for its ability to enhance the durability and performance of products, making it a sought-after ingredient in the manufacturing sector. The global market for PETP has been steadily growing, driven by increasing demand in sectors such as construction and electronics, where its properties are highly beneficial. The compound's ability to improve the longevity and efficiency of materials makes it an attractive option for manufacturers looking to innovate and improve their product offerings. As industries continue to evolve and seek more advanced materials, the demand for PETP is expected to rise, further solidifying its position in the global market. The compound's versatility and effectiveness in enhancing product performance are key factors contributing to its growing popularity across various sectors.

1.67 Lens Monomer, 1.60 Lens Monomer, Otherr in the 2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP) - Global Market:

The global market for lens monomers, particularly those based on 2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP), is a dynamic and evolving sector. Among the most notable types of lens monomers are the 1.67 and 1.60 variants, which are widely used in the production of high-index lenses. These lenses are favored for their ability to provide superior optical clarity and reduced thickness compared to traditional lenses, making them ideal for eyewear applications. The 1.67 lens monomer, in particular, is known for its high refractive index, which allows for thinner and lighter lenses without compromising on optical performance. This makes it a popular choice among consumers seeking both aesthetic appeal and functionality in their eyewear. Similarly, the 1.60 lens monomer offers a balance between performance and cost, providing an affordable option for those looking for enhanced optical properties. The demand for these lens monomers is driven by the growing need for advanced eyewear solutions, as consumers increasingly prioritize comfort and style. In addition to eyewear, PETP-based lens monomers are also used in other optical applications, such as camera lenses and optical instruments, where precision and clarity are paramount. The versatility of PETP in enhancing optical performance makes it a valuable component in the production of high-quality lenses. Beyond the optical industry, PETP-based monomers are also finding applications in other sectors, such as coatings and construction. In the coatings industry, PETP is used to improve the durability and resistance of coatings, making them more effective in protecting surfaces from environmental damage. This is particularly important in industries where surfaces are exposed to harsh conditions, such as automotive and aerospace. The construction industry also benefits from PETP-based materials, as they offer enhanced strength and longevity, contributing to the development of more durable and sustainable building materials. As the demand for high-performance materials continues to grow, the market for PETP-based lens monomers is expected to expand, driven by advancements in technology and increasing consumer expectations for quality and performance. The ability of PETP to enhance the properties of materials across various applications underscores its importance in the global market, making it a key player in the development of innovative solutions for modern challenges.

Optical, Coatings, Construction, Otherr in the 2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP) - Global Market:

The usage of 2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP) spans several key industries, each benefiting from its unique properties. In the optical industry, PETP is integral to the production of high-index lenses, which are prized for their ability to deliver superior optical clarity while maintaining a lightweight and thin profile. This makes them particularly appealing for eyewear, where both aesthetics and functionality are crucial. The compound's high refractive index allows for the creation of lenses that are not only thinner but also more effective in correcting vision, meeting the growing consumer demand for advanced eyewear solutions. Beyond eyewear, PETP is also used in the manufacturing of camera lenses and other optical instruments, where precision and clarity are essential. In the coatings industry, PETP is valued for its ability to enhance the durability and resistance of coatings. This is particularly important in sectors such as automotive and aerospace, where surfaces are frequently exposed to harsh environmental conditions. PETP-based coatings provide superior protection against wear and tear, extending the lifespan of products and reducing maintenance costs. The construction industry also benefits from the properties of PETP, as it is used to develop materials that offer enhanced strength and longevity. This is crucial in the creation of sustainable building materials that can withstand the test of time and environmental challenges. The versatility of PETP in improving the performance of materials across various applications highlights its significance in the global market. As industries continue to seek innovative solutions to meet evolving consumer demands, the role of PETP in enhancing product performance and durability is expected to grow. Its ability to contribute to the development of high-performance materials makes it a valuable asset in the pursuit of more efficient and sustainable solutions across multiple sectors.

2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP) - Global Market Outlook:

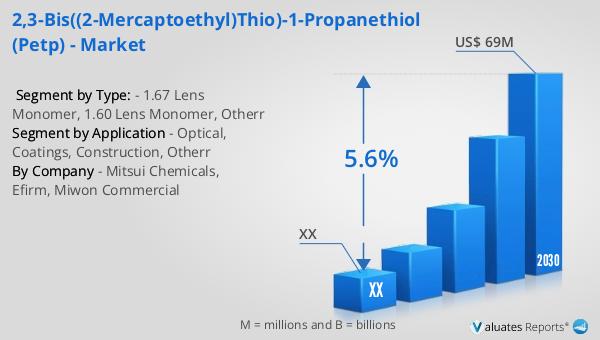

The global market outlook for 2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP) indicates a promising growth trajectory. In 2023, the market was valued at approximately US$ 46 million, and it is projected to reach an adjusted size of US$ 69 million by 2030, reflecting a compound annual growth rate (CAGR) of 5.6% during the forecast period from 2024 to 2030. This growth is indicative of the increasing demand for PETP across various industries, driven by its unique properties and versatility. In North America, the market for PETP is also expected to experience significant growth, although specific figures for the region were not provided. The anticipated expansion of the PETP market in North America aligns with the broader global trend, as industries continue to seek advanced materials that offer enhanced performance and durability. The projected growth in the PETP market underscores the compound's importance in the development of innovative solutions across multiple sectors, including optical, coatings, and construction. As industries evolve and consumer expectations for quality and performance rise, the demand for PETP is likely to increase, further solidifying its position in the global market. The ability of PETP to enhance the properties of materials and contribute to the development of high-performance solutions makes it a valuable asset in the pursuit of more efficient and sustainable products.

| Report Metric | Details |

| Report Name | 2,3-bis((2-mercaptoethyl)thio)-1-propanethiol (PETP) - Market |

| Forecasted market size in 2030 | US$ 69 million |

| CAGR | 5.6% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Mitsui Chemicals, Efirm, Miwon Commercial |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |