What is Global Mono-oriented Polypropylene (MOPP) Film Market?

The Global Mono-oriented Polypropylene (MOPP) Film Market is a specialized segment within the broader polypropylene film industry. MOPP films are unique due to their mono-oriented structure, which means the polymer chains are aligned in a single direction during the manufacturing process. This orientation gives the film exceptional tensile strength and clarity, making it suitable for various applications. MOPP films are widely used in packaging, labeling, and industrial applications due to their durability, resistance to moisture, and excellent printability. The market for MOPP films is expanding globally, driven by increasing demand in sectors such as food and beverage, pharmaceuticals, and cosmetics. The versatility and high performance of MOPP films make them a preferred choice for manufacturers looking to enhance the quality and functionality of their products. As industries continue to seek sustainable and efficient packaging solutions, the demand for MOPP films is expected to grow, further solidifying their position in the global market.

Thickness Below 50 µm, Thickness Between 51 to 100 µm, Thickness Above 100 µm in the Global Mono-oriented Polypropylene (MOPP) Film Market:

When it comes to the thickness of Mono-oriented Polypropylene (MOPP) films, they are generally categorized into three main segments: Thickness Below 50 µm, Thickness Between 51 to 100 µm, and Thickness Above 100 µm. Each thickness category serves different purposes and applications. Films with a thickness below 50 µm are typically used in applications where flexibility and lightweight properties are crucial. These films are often employed in the packaging of lightweight products, such as snacks and small consumer goods, where the primary requirement is to provide a barrier against moisture and contaminants without adding significant weight. On the other hand, films with a thickness between 51 to 100 µm offer a balance between strength and flexibility. This category is widely used in the packaging of medium-weight products, including various food items, pharmaceuticals, and cosmetics. The increased thickness provides better durability and resistance to tearing, making it suitable for products that require a more robust packaging solution. Lastly, films with a thickness above 100 µm are used in heavy-duty applications where maximum strength and protection are needed. These films are commonly used in industrial packaging, heavy machinery, and large consumer goods. The added thickness ensures that the packaging can withstand rough handling and provide superior protection against environmental factors. Each thickness category of MOPP films plays a vital role in meeting the diverse needs of different industries, ensuring that products are safely and efficiently packaged.

Pharmaceuticals, Food and Beverage, Cosmetic Industry, Others in the Global Mono-oriented Polypropylene (MOPP) Film Market:

The usage of Global Mono-oriented Polypropylene (MOPP) Film Market spans across various industries, including Pharmaceuticals, Food and Beverage, Cosmetic Industry, and others. In the pharmaceutical sector, MOPP films are extensively used for packaging medicines and medical devices. The films provide an excellent barrier against moisture, oxygen, and other contaminants, ensuring the integrity and shelf life of pharmaceutical products. Additionally, the high tensile strength of MOPP films makes them ideal for tamper-evident packaging, which is crucial for maintaining the safety and efficacy of medicines. In the Food and Beverage industry, MOPP films are used for packaging a wide range of products, from snacks and confectioneries to beverages and frozen foods. The films' ability to provide a strong barrier against moisture and oxygen helps in preserving the freshness and quality of food products. Moreover, the excellent printability of MOPP films allows manufacturers to create attractive and informative packaging that can enhance brand visibility and consumer appeal. In the Cosmetic Industry, MOPP films are used for packaging various beauty and personal care products. The films' clarity and glossiness make them an attractive choice for packaging high-end cosmetic products, while their durability ensures that the packaging can withstand the rigors of transportation and handling. Other industries that utilize MOPP films include electronics, where the films are used for protective packaging of electronic components, and the automotive industry, where they are used for labeling and protective applications. The versatility and high performance of MOPP films make them a valuable asset in ensuring the safe and efficient packaging of products across various sectors.

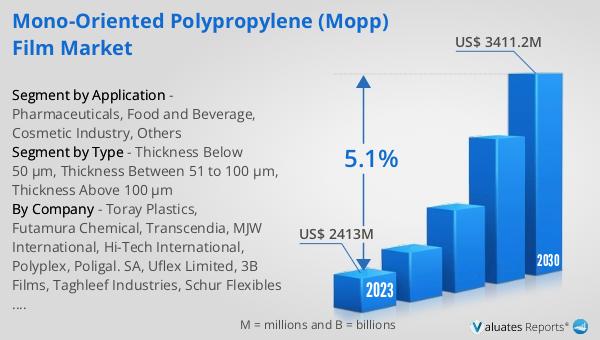

Global Mono-oriented Polypropylene (MOPP) Film Market Outlook:

The global Mono-oriented Polypropylene (MOPP) Film market was valued at US$ 2413 million in 2023 and is anticipated to reach US$ 3411.2 million by 2030, witnessing a CAGR of 5.1% during the forecast period from 2024 to 2030. This growth is driven by the increasing demand for high-performance packaging solutions across various industries. The unique properties of MOPP films, such as their high tensile strength, excellent printability, and resistance to moisture and contaminants, make them a preferred choice for manufacturers. As industries continue to seek sustainable and efficient packaging solutions, the demand for MOPP films is expected to grow, further solidifying their position in the global market. The versatility and high performance of MOPP films make them a valuable asset in ensuring the safe and efficient packaging of products across various sectors.

| Report Metric | Details |

| Report Name | Mono-oriented Polypropylene (MOPP) Film Market |

| Accounted market size in 2023 | US$ 2413 million |

| Forecasted market size in 2030 | US$ 3411.2 million |

| CAGR | 5.1% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | Toray Plastics, Futamura Chemical, Transcendia, MJW International, Hi-Tech International, Polyplex, Poligal. SA, Uflex Limited, 3B Films, Taghleef Industries, Schur Flexibles Holding GesmbH, Oben Holding Group S.A.C., Thai Film Industries Public Company, PT. Bhineka Tatamulya, Jindal Poly Films, Profol GmbH, PT Panverta Cakrakencana, M Stretch S.p.A, Mitsui Chemicals, Polibak Plastik, Copol International, TriPack Films, LC Packaging |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |