What is Needle Coke for EV Batteries - Global Market?

Needle coke is a specialized form of carbon material that plays a crucial role in the production of electric vehicle (EV) batteries. It is a key component in the manufacturing of graphite electrodes, which are essential for the anodes of lithium-ion batteries. These batteries are widely used in EVs due to their high energy density and long cycle life. Needle coke is characterized by its needle-like structure, which provides excellent electrical conductivity and thermal stability, making it ideal for use in high-performance batteries. The global market for needle coke is driven by the increasing demand for EVs, as countries worldwide push for cleaner and more sustainable transportation solutions. As the automotive industry shifts towards electrification, the need for high-quality needle coke is expected to rise significantly. This demand is further fueled by advancements in battery technology, which require materials that can enhance battery performance and efficiency. Consequently, the needle coke market is poised for substantial growth, with manufacturers focusing on improving production processes to meet the rising demand from the EV sector.

Sulfur Content <0.5%, Sulfur Content <1%, Other in the Needle Coke for EV Batteries - Global Market:

In the global market for needle coke used in EV batteries, sulfur content is a critical factor that influences the quality and performance of the final product. Needle coke is categorized based on its sulfur content, with the primary classifications being sulfur content less than 0.5%, sulfur content less than 1%, and other variations. Needle coke with sulfur content less than 0.5% is highly sought after due to its superior quality and performance characteristics. Low sulfur content ensures minimal impurities, which is crucial for maintaining the integrity and efficiency of lithium-ion batteries. This type of needle coke is preferred for high-performance applications, where battery longevity and reliability are paramount. On the other hand, needle coke with sulfur content less than 1% is also widely used, offering a balance between cost and performance. While it may not match the purity levels of the <0.5% category, it still provides adequate performance for many standard applications. The "other" category includes needle coke with varying sulfur levels, which may be used in less demanding applications or where cost considerations are a priority. The choice of needle coke based on sulfur content is influenced by several factors, including the specific requirements of the battery manufacturer, cost constraints, and the intended application of the EV batteries. As the demand for EVs continues to grow, manufacturers are increasingly focusing on optimizing the sulfur content in needle coke to enhance battery performance and meet stringent environmental regulations. This has led to innovations in production techniques and a greater emphasis on quality control to ensure that the needle coke used in EV batteries meets the highest standards of purity and performance. The global market for needle coke is thus characterized by a dynamic interplay between quality, cost, and technological advancements, as manufacturers strive to meet the evolving needs of the EV industry.

Petroleum Based, Coal Based in the Needle Coke for EV Batteries - Global Market:

Needle coke is primarily derived from two sources: petroleum-based and coal-based. Each type has its own unique properties and applications in the global market for EV batteries. Petroleum-based needle coke is produced from decant oil, a byproduct of the oil refining process. It is known for its high purity and low sulfur content, making it ideal for use in high-performance lithium-ion batteries. The production process involves a series of complex steps, including coking, calcination, and graphitization, to achieve the desired properties. Petroleum-based needle coke is favored for its superior electrical conductivity and thermal stability, which are essential for the efficient functioning of EV batteries. On the other hand, coal-based needle coke is derived from coal tar pitch, a byproduct of coal processing. While it generally has higher sulfur content compared to petroleum-based needle coke, advancements in production techniques have enabled manufacturers to produce high-quality coal-based needle coke with improved performance characteristics. Coal-based needle coke is often used in applications where cost considerations are a priority, as it is typically less expensive to produce than its petroleum-based counterpart. However, the choice between petroleum-based and coal-based needle coke ultimately depends on the specific requirements of the battery manufacturer, including performance, cost, and environmental considerations. As the demand for EVs continues to rise, manufacturers are exploring ways to optimize the production and use of both types of needle coke to meet the diverse needs of the market. This includes investing in research and development to improve the quality and performance of coal-based needle coke, as well as enhancing the efficiency of petroleum-based needle coke production processes. The global market for needle coke is thus characterized by a dynamic interplay between these two sources, as manufacturers strive to balance quality, cost, and sustainability in the production of EV batteries.

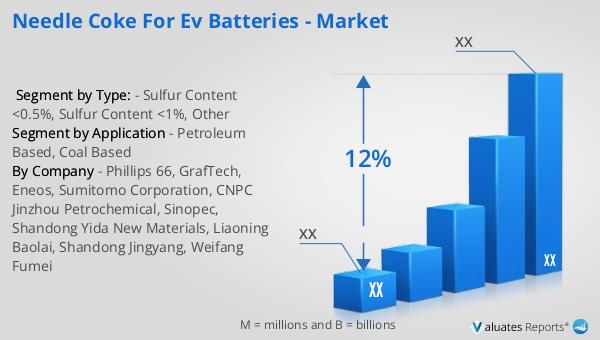

Needle Coke for EV Batteries - Global Market Outlook:

Industry estimates suggest that the demand for needle coke, a critical component in lithium-ion batteries, is projected to grow at a compound annual growth rate (CAGR) of over 12% from 2021 to 2028. This growth is largely driven by the increasing adoption of electric vehicles (EVs) worldwide. In 2022, China emerged as a leader in the new energy vehicle market, with sales reaching 6.8 million units, accounting for a global market share of 63.6%. This significant growth in China is supported by government initiatives and policies aimed at promoting sustainable transportation solutions. In contrast, Europe saw a penetration rate of 19%, while North America lagged behind with a penetration rate of only 6%. The disparity in market penetration rates highlights the varying levels of adoption and infrastructure development across different regions. According to the Ministry of Industry and Information Technology, China's lithium-ion battery production reached an impressive 750 gigawatt-hours (GWh) in 2022, marking a year-on-year increase of over 130%. This surge in production capacity underscores China's commitment to becoming a global leader in the EV industry. As the demand for EVs continues to rise, the needle coke market is expected to experience significant growth, driven by the need for high-quality materials that can enhance battery performance and efficiency.

| Report Metric | Details |

| Report Name | Needle Coke for EV Batteries - Market |

| CAGR | 12% |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Phillips 66, GrafTech, Eneos, Sumitomo Corporation, CNPC Jinzhou Petrochemical, Sinopec, Shandong Yida New Materials, Liaoning Baolai, Shandong Jingyang, Weifang Fumei |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |