What is Residue Hydrodemetalization Catalysts - Global Market?

Residue hydrodemetalization catalysts play a crucial role in the global market by facilitating the removal of metal impurities from heavy crude oil residues. These catalysts are essential in refining processes, particularly in the treatment of atmospheric and vacuum residues, which are the heavier fractions of crude oil. The primary function of these catalysts is to enhance the quality of the oil by reducing the metal content, which can otherwise poison downstream catalysts and affect the efficiency of refining processes. The global market for these catalysts is driven by the increasing demand for cleaner fuels and the need to process heavier crude oils, which are more abundant but also more challenging to refine. The market is characterized by the use of advanced materials and technologies to improve the efficiency and lifespan of the catalysts, making them more cost-effective for refineries. As environmental regulations become stricter, the demand for effective hydrodemetalization solutions is expected to grow, further driving innovation and development in this sector. The market outlook suggests a steady growth trajectory, reflecting the ongoing need for efficient refining solutions in the face of evolving energy demands and environmental considerations.

Ni, Mo-Ni in the Residue Hydrodemetalization Catalysts - Global Market:

Ni, Mo-Ni based residue hydrodemetalization catalysts are pivotal in the refining industry, particularly for processing heavy crude oils. These catalysts are composed of nickel (Ni) and molybdenum (Mo) or a combination of nickel and molybdenum (Mo-Ni), which are impregnated on a high-surface-area support material like alumina or silica. The choice of these metals is due to their ability to effectively remove metal impurities such as vanadium and nickel from crude oil residues. Nickel, in particular, is known for its hydrogenation properties, which help in breaking down complex hydrocarbons, while molybdenum enhances the catalyst's ability to withstand high temperatures and pressures, making it suitable for harsh refining environments. The combination of Ni and Mo provides a synergistic effect, improving the overall efficiency and lifespan of the catalyst. In the global market, these catalysts are in high demand due to their effectiveness in improving the quality of heavy crude oils, which are increasingly being used as feedstock in refineries. The use of Ni, Mo-Ni based catalysts is also driven by the need to comply with stringent environmental regulations that require the reduction of sulfur and metal content in fuels. As refineries continue to face challenges in processing heavier and more contaminated crude oils, the demand for advanced hydrodemetalization catalysts is expected to rise. Manufacturers are focusing on developing catalysts with enhanced activity and stability to meet the evolving needs of the industry. This includes innovations in catalyst design, such as the use of novel support materials and the optimization of metal loading and distribution. The global market for Ni, Mo-Ni based residue hydrodemetalization catalysts is characterized by a competitive landscape, with key players investing in research and development to gain a competitive edge. The market is also influenced by factors such as the availability of raw materials, technological advancements, and the economic viability of refining processes. As the industry continues to evolve, the role of Ni, Mo-Ni based catalysts in ensuring efficient and sustainable refining operations is expected to become increasingly important.

Atmospheric Residue, Vacuum Residue in the Residue Hydrodemetalization Catalysts - Global Market:

Residue hydrodemetalization catalysts are extensively used in the treatment of atmospheric and vacuum residues, which are the heavier fractions of crude oil. Atmospheric residue is the bottom fraction obtained after the atmospheric distillation of crude oil, while vacuum residue is the heaviest fraction obtained after further distillation under reduced pressure. These residues contain high levels of metal impurities, such as vanadium and nickel, which can adversely affect the performance of downstream refining processes. The use of hydrodemetalization catalysts in these areas is crucial for improving the quality of the residues and making them suitable for further processing. In the case of atmospheric residue, the catalysts help in reducing the metal content, thereby preventing the poisoning of downstream catalysts used in processes such as hydrocracking and catalytic reforming. This not only enhances the efficiency of the refining process but also extends the lifespan of the catalysts, reducing operational costs for refineries. Similarly, in the treatment of vacuum residue, hydrodemetalization catalysts play a vital role in removing metal impurities, which can otherwise lead to the formation of deposits and fouling in refining equipment. This is particularly important in processes such as fluid catalytic cracking (FCC) and delayed coking, where the presence of metal impurities can significantly impact product yields and quality. The use of these catalysts also helps in reducing the sulfur content of the residues, which is essential for meeting environmental regulations and producing cleaner fuels. As the demand for heavy crude oils continues to rise, the need for effective hydrodemetalization solutions in the treatment of atmospheric and vacuum residues is expected to grow. Refineries are increasingly investing in advanced catalyst technologies to enhance the efficiency and sustainability of their operations. This includes the development of catalysts with improved activity, selectivity, and stability, as well as the optimization of process conditions to maximize the removal of metal impurities. The global market for residue hydrodemetalization catalysts is poised for growth, driven by the increasing demand for cleaner fuels and the need to process heavier and more contaminated crude oils. As the industry continues to evolve, the role of these catalysts in ensuring efficient and sustainable refining operations is expected to become increasingly important.

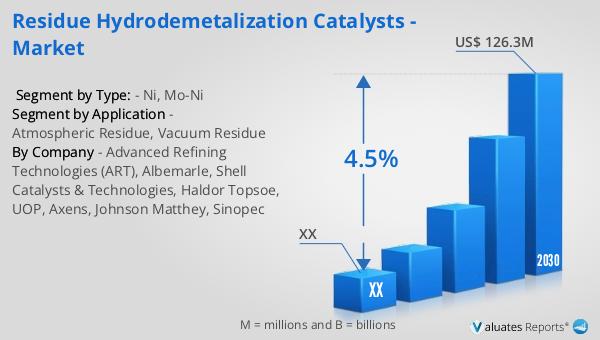

Residue Hydrodemetalization Catalysts - Global Market Outlook:

The global market for residue hydrodemetalization catalysts was valued at approximately US$ 93 million in 2023. It is projected to grow to a revised size of US$ 126.3 million by 2030, reflecting a compound annual growth rate (CAGR) of 4.5% during the forecast period from 2024 to 2030. These catalysts are typically composed of a high-surface-area support material, such as alumina or silica, which is impregnated with active metals like molybdenum or cobalt. The choice of support material and active metals is crucial for the performance of the catalysts, as they determine the efficiency and lifespan of the catalysts in removing metal impurities from crude oil residues. The market growth is driven by the increasing demand for cleaner fuels and the need to process heavier crude oils, which are more challenging to refine. As environmental regulations become stricter, the demand for effective hydrodemetalization solutions is expected to grow, further driving innovation and development in this sector. The market is characterized by a competitive landscape, with key players investing in research and development to gain a competitive edge. The availability of raw materials, technological advancements, and the economic viability of refining processes are some of the factors influencing the market dynamics. As the industry continues to evolve, the role of residue hydrodemetalization catalysts in ensuring efficient and sustainable refining operations is expected to become increasingly important.

| Report Metric | Details |

| Report Name | Residue Hydrodemetalization Catalysts - Market |

| Forecasted market size in 2030 | US$ 126.3 million |

| CAGR | 4.5% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Advanced Refining Technologies (ART), Albemarle, Shell Catalysts & Technologies, Haldor Topsoe, UOP, Axens, Johnson Matthey, Sinopec |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |