What is Global Medical Thermistor Market?

The Global Medical Thermistor Market is a specialized segment within the broader medical device industry, focusing on thermistors used in various medical applications. Thermistors are temperature-sensitive resistors that change resistance with temperature changes, making them ideal for precise temperature monitoring and control. In the medical field, these devices are crucial for applications such as patient monitoring, diagnostic equipment, and therapeutic devices. The market is driven by the increasing demand for advanced healthcare solutions, the growing prevalence of chronic diseases, and the need for accurate temperature measurement in medical procedures. As healthcare technology advances, the demand for reliable and efficient thermistors continues to grow, contributing to the expansion of the global medical thermistor market. The market is characterized by continuous innovation and development, with manufacturers focusing on enhancing the accuracy, reliability, and miniaturization of thermistors to meet the evolving needs of the healthcare industry. Overall, the Global Medical Thermistor Market plays a vital role in ensuring the safety and effectiveness of medical devices, ultimately improving patient outcomes and advancing healthcare delivery worldwide.

NTC Thermistor, PTC Thermistor in the Global Medical Thermistor Market:

NTC (Negative Temperature Coefficient) and PTC (Positive Temperature Coefficient) thermistors are two primary types of thermistors used in the Global Medical Thermistor Market, each serving distinct purposes based on their unique properties. NTC thermistors decrease in resistance as temperature increases, making them highly sensitive and suitable for precise temperature measurements. They are commonly used in medical applications where accurate temperature monitoring is critical, such as in patient monitoring systems, incubators, and respiratory devices. The ability of NTC thermistors to provide rapid and accurate temperature readings makes them indispensable in situations where even slight temperature variations can have significant impacts on patient care and treatment outcomes. On the other hand, PTC thermistors increase in resistance with rising temperatures, which makes them ideal for applications requiring overcurrent protection and self-regulating heating elements. In the medical field, PTC thermistors are often used in devices that require controlled heating, such as blood warmers and dialysis machines. Their self-regulating properties ensure that the devices operate within safe temperature ranges, preventing overheating and ensuring patient safety. The choice between NTC and PTC thermistors in medical applications depends on the specific requirements of the device and the desired temperature control characteristics. Both types of thermistors are integral to the development of advanced medical devices, contributing to the overall growth and innovation within the Global Medical Thermistor Market. As the demand for more sophisticated and reliable medical devices continues to rise, the role of NTC and PTC thermistors becomes increasingly important, driving further research and development in this field. Manufacturers are constantly exploring new materials and technologies to enhance the performance and efficiency of thermistors, ensuring they meet the stringent standards and regulations of the healthcare industry. This ongoing innovation not only supports the growth of the Global Medical Thermistor Market but also plays a crucial role in advancing medical technology and improving patient care worldwide.

Medical Industry, Pharmaceutical Industry in the Global Medical Thermistor Market:

The Global Medical Thermistor Market finds extensive usage in both the medical and pharmaceutical industries, each benefiting from the unique properties of thermistors in different ways. In the medical industry, thermistors are primarily used for patient monitoring and diagnostic purposes. They are integral components in devices such as electronic thermometers, patient monitoring systems, and incubators, where accurate temperature measurement is crucial for patient safety and effective treatment. The ability of thermistors to provide precise and rapid temperature readings ensures that healthcare providers can monitor patients' vital signs accurately, enabling timely interventions and improving patient outcomes. Additionally, thermistors are used in therapeutic devices such as blood warmers and dialysis machines, where maintaining specific temperature ranges is essential for the safety and efficacy of treatments. In the pharmaceutical industry, thermistors play a critical role in ensuring the quality and safety of pharmaceutical products. They are used in temperature-controlled storage and transportation systems, where maintaining the integrity of temperature-sensitive drugs and vaccines is paramount. Thermistors help monitor and regulate the temperature within storage facilities and transport containers, ensuring that pharmaceutical products remain within specified temperature ranges throughout the supply chain. This is particularly important for vaccines and biologics, which can lose their efficacy if exposed to temperatures outside their recommended storage conditions. The use of thermistors in the pharmaceutical industry not only helps maintain product quality but also ensures compliance with regulatory standards, ultimately safeguarding public health. Overall, the Global Medical Thermistor Market is essential for both the medical and pharmaceutical industries, providing the necessary tools for accurate temperature monitoring and control, which are critical for patient safety, treatment efficacy, and product quality.

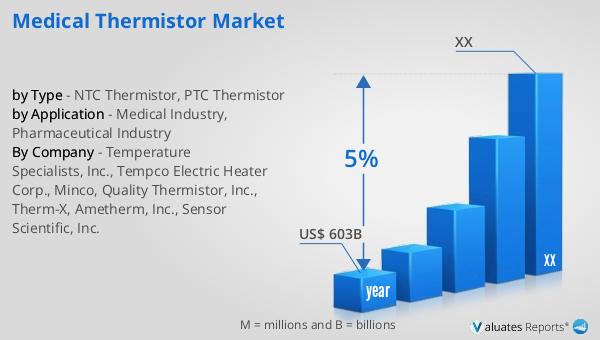

Global Medical Thermistor Market Outlook:

Based on our research, the global market for medical devices is projected to reach approximately $603 billion in 2023, with an anticipated growth rate of 5% annually over the next six years. This growth is indicative of the increasing demand for advanced medical technologies and the continuous innovation within the healthcare sector. The expansion of the medical device market is driven by several factors, including the rising prevalence of chronic diseases, an aging global population, and the growing emphasis on improving healthcare infrastructure worldwide. As healthcare systems strive to enhance patient care and outcomes, the demand for sophisticated medical devices, including thermistors, is expected to rise. Thermistors, with their critical role in temperature monitoring and control, are integral to the development and functionality of many medical devices. Their ability to provide precise and reliable temperature measurements ensures the safety and effectiveness of medical treatments, contributing to the overall growth of the medical device market. As the market continues to expand, manufacturers are focusing on developing innovative thermistor technologies to meet the evolving needs of the healthcare industry, ultimately driving further advancements in medical technology and improving patient care globally.

| Report Metric | Details |

| Report Name | Medical Thermistor Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Temperature Specialists, Inc., Tempco Electric Heater Corp., Minco, Quality Thermistor, Inc., Therm-X, Ametherm, Inc., Sensor Scientific, Inc. |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |