What is Global Biopolyol Market?

The Global Biopolyol Market is a rapidly evolving sector within the broader chemical industry, focusing on the production and application of biopolyols. These are polyols derived from renewable resources such as vegetable oils, corn, and soybeans, which serve as key components in the manufacturing of polyurethanes. The shift towards biopolyols is driven by the increasing demand for sustainable and eco-friendly materials, as they offer a reduced carbon footprint compared to traditional petroleum-based polyols. Biopolyols are used in various applications, including the production of flexible and rigid foams, coatings, adhesives, sealants, and elastomers. The market is witnessing significant growth due to the rising awareness of environmental issues and the push for greener alternatives in industrial processes. Additionally, advancements in technology and the development of new production methods are enhancing the efficiency and cost-effectiveness of biopolyols, further propelling their adoption across different industries. As companies and consumers alike become more environmentally conscious, the Global Biopolyol Market is poised to play a crucial role in the transition towards more sustainable industrial practices.

Polyether Polyol, Polyester Polyol in the Global Biopolyol Market:

Polyether polyols and polyester polyols are two primary types of biopolyols that have distinct characteristics and applications within the Global Biopolyol Market. Polyether polyols are typically produced through the polymerization of ethylene oxide or propylene oxide, often using a starter molecule like glycerin. These polyols are known for their excellent flexibility, hydrolytic stability, and low viscosity, making them ideal for applications requiring soft and resilient materials. They are predominantly used in the production of flexible polyurethane foams, which are widely utilized in furniture, bedding, and automotive seating. The inherent properties of polyether polyols, such as their ability to provide comfort and durability, make them a preferred choice in these sectors. On the other hand, polyester polyols are synthesized through the polycondensation of diols and dicarboxylic acids or their derivatives. These polyols are characterized by their superior mechanical strength, abrasion resistance, and thermal stability. As a result, polyester polyols are commonly used in the production of rigid polyurethane foams, which are essential for insulation applications in the construction industry. The robust nature of polyester polyols also makes them suitable for use in coatings, adhesives, and elastomers, where durability and resistance to environmental factors are crucial. The choice between polyether and polyester polyols often depends on the specific requirements of the application, with each type offering unique advantages. In the context of the Global Biopolyol Market, both polyether and polyester polyols are gaining traction due to their renewable origins and the growing emphasis on sustainability. Manufacturers are increasingly investing in research and development to enhance the performance characteristics of these biopolyols, aiming to expand their applicability across various industries. The development of bio-based polyether and polyester polyols is particularly noteworthy, as it aligns with the global trend towards reducing reliance on fossil fuels and minimizing environmental impact. As the market continues to evolve, the interplay between polyether and polyester polyols will likely shape the future landscape of the biopolyol industry, with innovations in production techniques and material properties driving further growth and diversification.

Furniture and Bedding, Construction/Insulation, Automotive, Packaging, Carpet Backing, Others in the Global Biopolyol Market:

The Global Biopolyol Market finds extensive usage across a variety of sectors, each benefiting from the unique properties of biopolyols. In the furniture and bedding industry, biopolyols are primarily used in the production of flexible polyurethane foams. These foams provide the necessary comfort and support in mattresses, cushions, and upholstered furniture, offering a sustainable alternative to traditional materials. The demand for eco-friendly furniture is on the rise, driven by consumer awareness and regulatory pressures, making biopolyols an attractive option for manufacturers. In the construction and insulation sector, biopolyols are utilized in the creation of rigid polyurethane foams, which serve as effective insulators. These foams help in reducing energy consumption in buildings by providing superior thermal insulation, thereby contributing to energy efficiency and sustainability goals. The automotive industry is another significant consumer of biopolyols, where they are used in the production of seat cushions, headrests, and interior panels. The lightweight nature of biopolyol-based materials helps in improving fuel efficiency and reducing emissions, aligning with the industry's shift towards greener technologies. In the packaging sector, biopolyols are employed in the development of biodegradable and recyclable packaging materials, addressing the growing concern over plastic waste. The versatility of biopolyols allows for the creation of packaging solutions that are not only environmentally friendly but also meet the functional requirements of protection and durability. Carpet backing is another area where biopolyols are making inroads, offering an eco-friendly alternative to traditional backing materials. The use of biopolyols in carpet backing enhances the sustainability of the product while maintaining performance standards. Beyond these specific applications, biopolyols are also finding use in other areas such as adhesives, sealants, and elastomers, where their renewable nature and performance characteristics are highly valued. As industries continue to prioritize sustainability, the Global Biopolyol Market is expected to expand its reach, offering innovative solutions that cater to the evolving needs of various sectors.

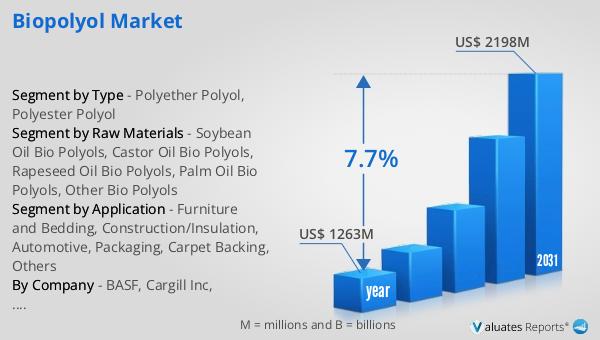

Global Biopolyol Market Outlook:

The global market for biopolyols was valued at $1,263 million in 2024 and is anticipated to grow to a revised size of $2,198 million by 2031, reflecting a compound annual growth rate (CAGR) of 7.7% during the forecast period. The automotive sector emerges as the largest application market, projected to capture 27% of the global share by 2024. This growth underscores the strong demand for environmentally friendly and high-performance materials in vehicle manufacturing. The automotive industry's focus on sustainability and efficiency is driving the adoption of biopolyols, which offer the dual benefits of reducing environmental impact and enhancing vehicle performance. Geographically, North America stands out as the largest consumer market, holding 42% of the global share. This dominance is attributed to the region's advanced technology development and supportive policies that encourage the use of sustainable materials. The combination of technological innovation and regulatory support is fostering the growth of the biopolyol market in North America, setting a benchmark for other regions to follow. As the market continues to evolve, the emphasis on sustainability and innovation will likely drive further growth and diversification, positioning biopolyols as a key component in the transition towards more sustainable industrial practices.

| Report Metric | Details |

| Report Name | Biopolyol Market |

| Accounted market size in year | US$ 1263 million |

| Forecasted market size in 2031 | US$ 2198 million |

| CAGR | 7.7% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Raw Materials |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | BASF, Cargill Inc, MCNS, Emery Oleochemicals, Croda, Alberdingk Boley, Jayant Agro-Organics Limited, Maskimi, Hairma, Stahl, Polylabs, Xuchuan Chemical, Vertellus, NivaPol, MCPU Polymer, Global Bio-Chem Technology Group, EDB Poliois Vegetais |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |