What is Global Telematics Insurance Service Market?

The Global Telematics Insurance Service Market is a rapidly evolving sector that combines telecommunications and informatics to offer innovative insurance solutions. This market leverages telematics technology, which involves the use of devices installed in vehicles to collect and transmit data about driving behavior, vehicle usage, and other relevant metrics. Insurers use this data to tailor insurance policies more accurately to individual drivers, offering personalized premiums based on actual driving habits rather than generalized risk assessments. This approach not only benefits insurers by reducing risk and improving customer satisfaction but also encourages safer driving practices among policyholders. The market is driven by advancements in technology, increasing demand for personalized insurance products, and the growing adoption of connected vehicles. As more consumers and businesses recognize the advantages of telematics-based insurance, the market is expected to expand significantly, offering new opportunities for innovation and growth in the insurance industry.

PAYD, PHYD in the Global Telematics Insurance Service Market:

PAYD (Pay-As-You-Drive) and PHYD (Pay-How-You-Drive) are two prominent models within the Global Telematics Insurance Service Market that have revolutionized the way insurance premiums are calculated. PAYD insurance is based on the distance a vehicle is driven. This model is particularly appealing to drivers who use their vehicles infrequently, as it allows them to pay lower premiums compared to traditional insurance policies. By using telematics devices to track mileage, insurers can offer more equitable pricing, ensuring that low-mileage drivers are not subsidizing the costs for high-mileage drivers. This model not only promotes fairness but also encourages reduced vehicle usage, which can have positive environmental impacts by lowering emissions and reducing traffic congestion.

Private Car, Operating Vehicle, Other in the Global Telematics Insurance Service Market:

On the other hand, PHYD insurance takes a more comprehensive approach by assessing how a vehicle is driven. This model uses telematics data to evaluate driving behavior, including factors such as speed, acceleration, braking patterns, and cornering. Drivers who exhibit safe driving habits are rewarded with lower premiums, while those who engage in risky behaviors may face higher costs. PHYD insurance incentivizes safer driving, potentially reducing the number of accidents and claims, which benefits both insurers and policyholders. This model is particularly attractive to young or inexperienced drivers, who may face higher premiums under traditional insurance due to perceived risk. By demonstrating responsible driving behavior, these drivers can earn discounts and build a positive driving record.

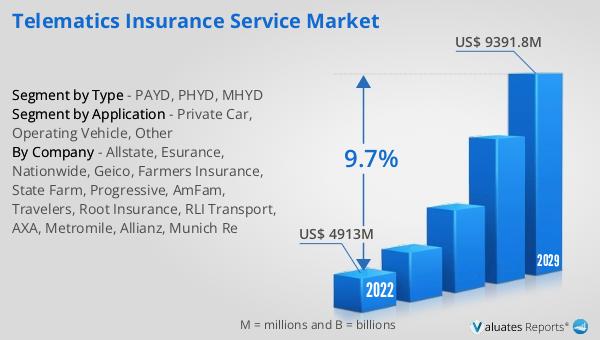

Global Telematics Insurance Service Market Outlook:

The integration of PAYD and PHYD models into the Global Telematics Insurance Service Market has been facilitated by advancements in telematics technology, including GPS, onboard diagnostics, and mobile applications. These technologies enable real-time data collection and analysis, providing insurers with accurate and up-to-date information about each policyholder's driving habits. As a result, insurers can offer more personalized and competitive pricing, enhancing customer satisfaction and loyalty. Moreover, the data collected through telematics can be used to develop new products and services, such as usage-based insurance for specific vehicle types or tailored coverage for different driving conditions.

| Report Metric | Details |

| Report Name | Telematics Insurance Service Market |

| Accounted market size in year | US$ 5859 million |

| Forecasted market size in 2031 | US$ 11100 million |

| CAGR | 9.7% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allstate, Geico, Farmers Insurance, State Farm, Progressive, AmFam, Travelers, RLI Transport, AXA, Metromile, Allianz, Munich Re |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |