What is Global Copper Pillars Market?

The Global Copper Pillars Market is a significant segment within the semiconductor industry, primarily driven by the increasing demand for advanced electronic devices. Copper pillars are tiny, cylindrical structures made of copper, used to connect different layers of semiconductor devices. These pillars are crucial in the manufacturing of integrated circuits, providing a reliable and efficient means of electrical connection. The market for copper pillars is expanding due to the growing need for miniaturization in electronic components, which requires more efficient and compact interconnect solutions. As technology advances, the demand for high-performance computing devices, smartphones, and other consumer electronics continues to rise, further propelling the growth of the copper pillars market. Additionally, the shift towards 5G technology and the Internet of Things (IoT) is expected to boost the demand for copper pillars, as these technologies require advanced semiconductor solutions. The market is characterized by continuous innovation and development, with manufacturers focusing on improving the performance and reliability of copper pillars to meet the evolving needs of the electronics industry. Overall, the Global Copper Pillars Market plays a crucial role in the advancement of modern technology, supporting the development of faster, smaller, and more efficient electronic devices.

Cu Bar Type, Standard Cu Pillar, Fine pitch Cu Pillar, Micro-bumps, Others in the Global Copper Pillars Market:

In the Global Copper Pillars Market, various types of copper pillars are utilized, each serving specific purposes and applications. The Cu Bar Type is one of the fundamental forms, characterized by its robust and straightforward design. These bars are typically used in applications where high mechanical strength is required, providing a stable and reliable connection between semiconductor layers. The Standard Cu Pillar, on the other hand, is more versatile and widely used across different electronic devices. It offers a balance between performance and cost, making it a popular choice for manufacturers looking to optimize their production processes. Fine pitch Cu Pillars are designed for applications requiring high-density interconnections. These pillars are smaller and more closely spaced, allowing for more connections in a limited space, which is essential for modern electronic devices that demand compact and efficient designs. Micro-bumps represent the next level of miniaturization in copper pillars. These are even smaller than fine pitch pillars and are used in advanced semiconductor applications where space is at a premium. Micro-bumps are crucial in the development of cutting-edge technologies such as 5G and IoT, where high-speed data transfer and compact design are paramount. Other types of copper pillars include those designed for specific applications, such as those with enhanced thermal or electrical properties. These specialized pillars are used in devices that require superior performance in challenging environments, such as automotive electronics or high-performance computing. The diversity in copper pillar types reflects the wide range of applications and the continuous innovation within the market. Manufacturers are constantly developing new designs and materials to meet the evolving demands of the electronics industry, ensuring that copper pillars remain a vital component in the advancement of technology.

12 Inches (300 mm), 8 Inches (200 mm), Others in the Global Copper Pillars Market:

The usage of copper pillars in the Global Copper Pillars Market varies significantly based on the size of the wafers used in semiconductor manufacturing. For 12 Inches (300 mm) wafers, copper pillars are essential in producing high-performance and high-density semiconductor devices. These larger wafers allow for more chips to be produced in a single batch, increasing efficiency and reducing costs. Copper pillars used in 300 mm wafers are typically designed to support advanced applications such as high-speed processors and memory chips, where performance and reliability are critical. The demand for copper pillars in this segment is driven by the need for faster and more efficient electronic devices, as well as the growing adoption of technologies like 5G and IoT. In contrast, 8 Inches (200 mm) wafers are used for a different set of applications, often focusing on cost-effective solutions for consumer electronics and other mass-market products. Copper pillars in this segment are designed to provide a balance between performance and affordability, making them suitable for a wide range of devices, from smartphones to household appliances. The versatility of copper pillars in 200 mm wafers allows manufacturers to produce a diverse array of products, catering to various consumer needs and preferences. Other wafer sizes, although less common, also utilize copper pillars for specific applications. These may include specialized devices that require unique interconnect solutions, such as automotive electronics or industrial sensors. The use of copper pillars in these applications highlights the adaptability and importance of this technology in the semiconductor industry. Overall, the usage of copper pillars across different wafer sizes underscores their critical role in the production of modern electronic devices. As the demand for advanced technology continues to grow, the need for efficient and reliable interconnect solutions like copper pillars will remain a key driver in the semiconductor market.

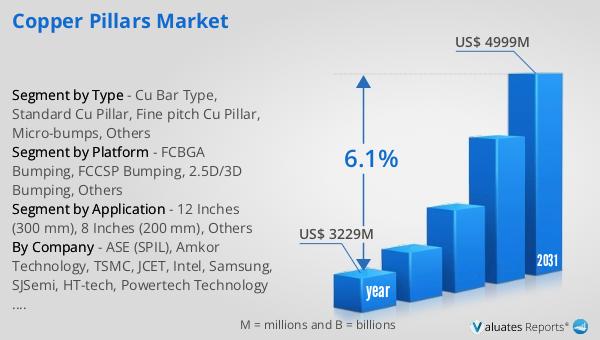

Global Copper Pillars Market Outlook:

The global market for Copper Pillars was valued at approximately $3.229 billion in 2024, with projections indicating a growth to around $4.999 billion by 2031. This growth represents a compound annual growth rate (CAGR) of 6.1% over the forecast period. Such a robust growth trajectory highlights the increasing importance and demand for copper pillars in the semiconductor industry. The market is dominated by the top ten players, who collectively hold over 83% of the global market share. This concentration of market power suggests that these leading companies are at the forefront of innovation and production in the copper pillars sector. Their dominance is likely due to their ability to invest in research and development, ensuring they remain competitive in a rapidly evolving market. The projected growth in the copper pillars market is driven by several factors, including the rising demand for advanced electronic devices, the shift towards 5G technology, and the increasing adoption of IoT applications. As these trends continue to shape the technology landscape, the need for efficient and reliable interconnect solutions like copper pillars will only grow. The market outlook for copper pillars is positive, with significant opportunities for growth and development in the coming years.

| Report Metric | Details |

| Report Name | Copper Pillars Market |

| Accounted market size in year | US$ 3229 million |

| Forecasted market size in 2031 | US$ 4999 million |

| CAGR | 6.1% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Platform |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | ASE (SPIL), Amkor Technology, TSMC, JCET, Intel, Samsung, SJSemi, HT-tech, Powertech Technology Inc. (PTI), Tongfu Microelectronics (TFME), Nepes, LB Semicon Inc, SFA Semicon, International Micro Industries, Inc. (IMI), Raytek Semiconductor, Winstek Semiconductor, Hana Micron, ChipMOS TECHNOLOGIES, Chipbond Technology Corporation, Hefei Chipmore Technology, Ningbo ChipEx Semiconductor Co., Ltd, UTAC |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |