What is Global Wafer Bump Plating Market?

The Global Wafer Bump Plating Market is a specialized segment within the semiconductor industry, focusing on the process of applying tiny bumps of solder onto the surface of semiconductor wafers. These bumps serve as connection points for the semiconductor chips, allowing them to be mounted onto circuit boards or other substrates. This process is crucial for the production of advanced electronic devices, as it ensures reliable electrical connections and enhances the performance of the chips. The market for wafer bump plating is driven by the increasing demand for miniaturized and high-performance electronic devices, such as smartphones, tablets, and wearable technology. As technology continues to evolve, the need for more efficient and compact semiconductor solutions grows, further propelling the demand for wafer bump plating. The market is characterized by continuous innovation and the adoption of new materials and techniques to improve the efficiency and reliability of the bumping process. Companies operating in this market are investing heavily in research and development to stay ahead of the competition and meet the ever-changing demands of the electronics industry.

in the Global Wafer Bump Plating Market:

The Global Wafer Bump Plating Market encompasses a variety of types that cater to the diverse needs of its customers. One of the primary types is the solder bump, which is the most commonly used method in the industry. Solder bumps are made from a combination of tin, lead, and other metals, and they provide a reliable and cost-effective solution for creating electrical connections on semiconductor wafers. However, with the increasing push towards lead-free solutions due to environmental concerns, many companies are now adopting lead-free solder bumps, which use alternative materials such as tin-silver-copper alloys. Another type is the gold bump, which is used in applications that require high reliability and performance. Gold bumps offer excellent conductivity and resistance to corrosion, making them ideal for use in harsh environments or in devices that require long-term reliability. However, the high cost of gold can be a limiting factor for its widespread adoption. Copper pillar bumps are another type gaining popularity in the market. These bumps use a copper core with a solder cap, providing a robust and reliable connection. Copper pillar bumps are particularly suited for high-density applications, as they allow for finer pitch and higher input/output counts. This makes them an attractive option for advanced packaging solutions, such as 3D stacking and system-in-package (SiP) technologies. Additionally, there are also hybrid bumping solutions that combine different materials and techniques to achieve specific performance characteristics. For example, some companies are experimenting with using a combination of copper and gold to create bumps that offer the benefits of both materials. This approach allows for greater flexibility in meeting the unique requirements of different applications. The choice of bump type often depends on the specific needs of the customer, including factors such as cost, performance, and environmental considerations. As the demand for more advanced and miniaturized electronic devices continues to grow, the wafer bump plating market is expected to see further diversification in the types of bumps available, with companies continually innovating to meet the evolving needs of their customers.

in the Global Wafer Bump Plating Market:

The applications of the Global Wafer Bump Plating Market are vast and varied, reflecting the diverse needs of the electronics industry. One of the primary applications is in the production of semiconductor devices, where wafer bump plating is used to create the electrical connections necessary for mounting chips onto circuit boards. This is a critical step in the manufacturing process, as it ensures the reliable performance of the final product. Wafer bump plating is also used in the production of advanced packaging solutions, such as flip-chip technology. Flip-chip technology involves mounting the semiconductor chip upside down on the substrate, allowing for a more compact and efficient design. This approach is particularly popular in applications that require high performance and miniaturization, such as smartphones, tablets, and other portable electronic devices. Another important application of wafer bump plating is in the automotive industry, where it is used in the production of electronic control units (ECUs) and other critical components. As vehicles become more advanced and reliant on electronic systems, the demand for reliable and high-performance semiconductor solutions continues to grow. Wafer bump plating plays a crucial role in ensuring the performance and reliability of these components, which are essential for the safe and efficient operation of modern vehicles. In addition to these applications, wafer bump plating is also used in the production of consumer electronics, such as televisions, gaming consoles, and home appliances. As consumers continue to demand more advanced and feature-rich products, the need for high-performance semiconductor solutions becomes increasingly important. Wafer bump plating helps to meet this demand by providing the necessary connections for advanced electronic components. Furthermore, the telecommunications industry also relies heavily on wafer bump plating for the production of network infrastructure equipment, such as routers, switches, and base stations. As the demand for faster and more reliable communication networks continues to grow, the need for advanced semiconductor solutions becomes increasingly important. Wafer bump plating plays a critical role in ensuring the performance and reliability of these components, which are essential for the efficient operation of modern communication networks. Overall, the applications of the Global Wafer Bump Plating Market are diverse and continue to expand as technology advances and new opportunities emerge.

Global Wafer Bump Plating Market Outlook:

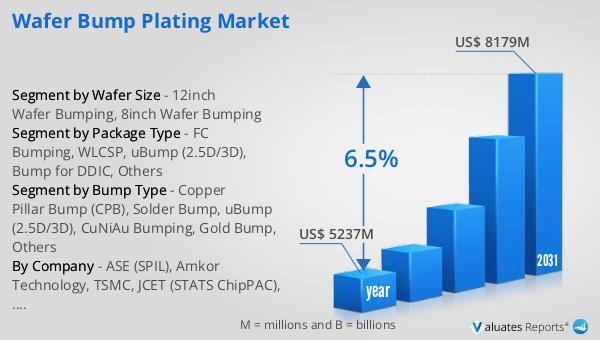

In 2024, the Global Wafer Bump Plating Market was valued at approximately USD 5,237 million. By 2031, it is anticipated to grow to a revised size of USD 8,179 million, reflecting a compound annual growth rate (CAGR) of 6.5% over the forecast period. This growth is indicative of the increasing demand for advanced semiconductor solutions driven by technological advancements and the proliferation of electronic devices. Notably, the top ten players in the market hold a significant share, accounting for over 85% of the global market. This concentration highlights the competitive nature of the industry and the importance of innovation and strategic partnerships in maintaining market leadership. Furthermore, the global advanced packaging market, which includes wafer bump plating, is expected to surpass USD 79.1 billion by 2031. This growth is fueled by the adoption of heterogeneous integration and chiplet-based systems, which offer enhanced performance and efficiency for electronic devices. As the industry continues to evolve, companies are investing in research and development to stay ahead of the competition and meet the ever-changing demands of the market. The outlook for the Global Wafer Bump Plating Market is positive, with significant opportunities for growth and innovation in the coming years.

| Report Metric | Details |

| Report Name | Wafer Bump Plating Market |

| Accounted market size in year | US$ 5237 million |

| Forecasted market size in 2031 | US$ 8179 million |

| CAGR | 6.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Package Type |

|

| Segment by Bump Type |

|

| Segment by Wafer Size |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | ASE (SPIL), Amkor Technology, TSMC, JCET (STATS ChipPAC), Intel, Samsung, SJSemi, ChipMOS TECHNOLOGIES, Chipbond Technology Corporation, Hefei Chipmore Technology, Union Semiconductor (Hefei) Co., Ltd., HT-tech, Powertech Technology Inc. (PTI), Tongfu Microelectronics (TFME), Nepes, LB Semicon Inc, SFA Semicon, International Micro Industries, Inc. (IMI), Raytek Semiconductor, Winstek Semiconductor, Hana Micron, Ningbo ChipEx Semiconductor Co., Ltd, UTAC, Shenzhen TXD Technology, Jiangsu CAS Microelectronics Integration, Jiangsu Yidu Technology |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |