What is Global OBN Seismic Receivers Market?

The Global Ocean Bottom Node (OBN) Seismic Receivers Market is a specialized segment within the broader seismic technology industry. OBN seismic receivers are devices used to collect seismic data from the ocean floor, providing valuable insights into subsurface geological formations. These receivers are crucial for various applications, including oil and gas exploration, carbon capture and storage (CCS), renewable energy projects, and earthquake and tsunami monitoring. The technology involves deploying nodes on the seabed, which capture seismic waves generated by controlled sources or natural seismic events. The data collected is then used to create detailed images of the subsurface, aiding in resource exploration and environmental monitoring. The market for OBN seismic receivers is driven by the increasing demand for accurate and high-resolution subsurface data, particularly in challenging offshore environments. As industries seek to optimize resource extraction and ensure environmental safety, the adoption of OBN technology is expected to grow. The market is characterized by advancements in technology, such as improved data acquisition and processing capabilities, which enhance the efficiency and accuracy of seismic surveys. Overall, the Global OBN Seismic Receivers Market plays a vital role in supporting various industries by providing critical data for decision-making and operational planning.

Shallow-water Nodes (<500 m), Midwater Nodes (500–2000 m), Deepwater Nodes (>2000 m) in the Global OBN Seismic Receivers Market:

In the Global OBN Seismic Receivers Market, the classification of nodes based on water depth is crucial for understanding their application and functionality. Shallow-water nodes, operating at depths of less than 500 meters, are primarily used in coastal and nearshore environments. These nodes are essential for projects that require high-resolution imaging of the subsurface in areas where traditional seismic methods may be less effective due to shallow water conditions. Shallow-water nodes are often deployed in oil and gas exploration, where they help identify potential hydrocarbon reserves close to shore. Additionally, they are used in environmental monitoring and research projects that focus on coastal ecosystems and geological formations. Midwater nodes, designed for depths ranging from 500 to 2000 meters, serve a broader range of applications. These nodes are versatile and can be used in both exploration and monitoring activities. In the oil and gas sector, midwater nodes are deployed in offshore fields to gather data that aids in the identification and evaluation of deepwater reserves. They are also used in carbon capture and storage (CCS) projects, where understanding the subsurface is critical for assessing the feasibility and safety of storing carbon dioxide in geological formations. Furthermore, midwater nodes play a role in renewable energy projects, such as offshore wind farms, where they help assess the seabed conditions and ensure the stability of installations. Deepwater nodes, operating at depths greater than 2000 meters, are designed for the most challenging offshore environments. These nodes are essential for exploring and monitoring areas that are beyond the reach of conventional seismic methods. In the oil and gas industry, deepwater nodes are used to explore ultra-deepwater reserves, which are often located in remote and harsh environments. The data collected by these nodes is crucial for making informed decisions about drilling and production activities. In addition to oil and gas exploration, deepwater nodes are used in earthquake and tsunami monitoring, where they provide valuable data on seismic activity and help improve early warning systems. Overall, the classification of nodes based on water depth highlights the diverse applications and capabilities of OBN seismic receivers in the Global Market.

Oil & Gas, CCS and Renewables, Earthquake and Tsunami Monitoring, Others in the Global OBN Seismic Receivers Market:

The Global OBN Seismic Receivers Market finds extensive usage across various sectors, each benefiting from the detailed subsurface data these devices provide. In the oil and gas industry, OBN seismic receivers are indispensable tools for exploration and production activities. They enable companies to obtain high-resolution images of the subsurface, which are crucial for identifying potential hydrocarbon reserves and optimizing drilling operations. The ability to gather accurate data in challenging offshore environments makes OBN technology a preferred choice for oil and gas companies seeking to maximize resource extraction while minimizing environmental impact. In the realm of carbon capture and storage (CCS) and renewables, OBN seismic receivers play a vital role in assessing the feasibility and safety of storing carbon dioxide in geological formations. The detailed subsurface imaging provided by these devices helps identify suitable storage sites and monitor the integrity of storage reservoirs over time. Additionally, in renewable energy projects, such as offshore wind farms, OBN technology aids in evaluating seabed conditions, ensuring the stability and safety of installations. Earthquake and tsunami monitoring is another critical area where OBN seismic receivers are utilized. These devices provide valuable data on seismic activity, helping improve early warning systems and enhance disaster preparedness. By capturing detailed information about seismic events, OBN technology contributes to a better understanding of earthquake dynamics and tsunami generation, ultimately aiding in the development of more effective mitigation strategies. Beyond these primary applications, OBN seismic receivers are also used in various other sectors, including environmental monitoring, marine research, and infrastructure development. The versatility and accuracy of OBN technology make it a valuable tool for projects that require detailed subsurface data, regardless of the specific industry or application. Overall, the Global OBN Seismic Receivers Market supports a wide range of activities by providing critical insights into the subsurface, enabling informed decision-making and enhancing operational efficiency across multiple sectors.

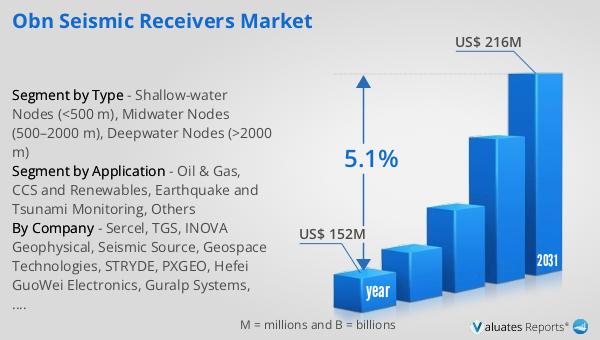

Global OBN Seismic Receivers Market Outlook:

The global market for OBN Seismic Receivers was valued at $152 million in 2024, and it is anticipated to grow significantly over the coming years. By 2031, the market is expected to reach a revised size of $216 million, reflecting a compound annual growth rate (CAGR) of 5.1% during the forecast period. This growth trajectory underscores the increasing demand for high-resolution subsurface data across various industries, including oil and gas, CCS, renewables, and seismic monitoring. The expansion of the market is driven by advancements in technology, which enhance the efficiency and accuracy of seismic surveys, as well as the growing need for detailed geological insights in challenging offshore environments. As industries continue to prioritize resource optimization and environmental safety, the adoption of OBN seismic receivers is likely to rise, further fueling market growth. The projected increase in market size highlights the critical role that OBN technology plays in supporting exploration, monitoring, and research activities across multiple sectors. Overall, the Global OBN Seismic Receivers Market is poised for substantial growth, driven by the ongoing demand for precise and reliable subsurface data.

| Report Metric | Details |

| Report Name | OBN Seismic Receivers Market |

| Accounted market size in year | US$ 152 million |

| Forecasted market size in 2031 | US$ 216 million |

| CAGR | 5.1% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Sercel, TGS, INOVA Geophysical, Seismic Source, Geospace Technologies, STRYDE, PXGEO, Hefei GuoWei Electronics, Guralp Systems, Shearwater GeoServices, Kinemetrics, Viridien, BGP China National Petroleum, inApril, SmartSolo |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |