What is Global Electric Two-wheeler Insurance Market?

The Global Electric Two-wheeler Insurance Market is a specialized segment of the insurance industry that focuses on providing coverage for electric two-wheelers, such as electric motorcycles, scooters, and mopeds. As the popularity of electric vehicles continues to rise due to their environmental benefits and cost-effectiveness, the need for tailored insurance products has also increased. This market encompasses various types of insurance policies designed to protect electric two-wheeler owners from financial losses due to accidents, theft, or damage. Insurance providers in this market offer a range of coverage options, including liability coverage, collision coverage, and comprehensive coverage, among others. These policies are crucial for ensuring that owners of electric two-wheelers are financially protected against unforeseen events that could lead to significant expenses. The market is driven by factors such as the increasing adoption of electric two-wheelers, government incentives promoting electric vehicle usage, and growing awareness about the importance of insurance coverage. As the market evolves, insurers are continually developing innovative products to meet the unique needs of electric two-wheeler owners, ensuring that they have access to affordable and comprehensive insurance solutions.

Liability Coverage, Collision Coverage, Others in the Global Electric Two-wheeler Insurance Market:

Liability coverage is a fundamental component of the Global Electric Two-wheeler Insurance Market, designed to protect policyholders from financial liabilities arising from accidents where they are deemed at fault. This type of coverage typically includes bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses, lost wages, and legal fees of the other party involved in the accident, while property damage liability covers the repair or replacement costs of the other party's vehicle or property. Liability coverage is essential for electric two-wheeler owners as it ensures they are not personally responsible for significant financial burdens resulting from accidents. Collision coverage, on the other hand, is designed to cover the repair or replacement costs of the policyholder's electric two-wheeler in the event of an accident, regardless of who is at fault. This type of coverage is particularly important for electric two-wheelers, as the cost of repairing or replacing these vehicles can be substantial due to their advanced technology and specialized components. Collision coverage provides peace of mind to electric two-wheeler owners, knowing that they are protected against financial losses resulting from accidents. In addition to liability and collision coverage, the Global Electric Two-wheeler Insurance Market also offers other types of coverage to address the unique needs of electric two-wheeler owners. Comprehensive coverage, for example, provides protection against non-collision-related incidents such as theft, vandalism, natural disasters, and fire. This type of coverage is particularly important for electric two-wheelers, which are often targeted by thieves due to their high value and demand. Comprehensive coverage ensures that policyholders are financially protected against a wide range of risks, providing them with peace of mind and security. Another important type of coverage offered in the Global Electric Two-wheeler Insurance Market is personal injury protection (PIP), which covers the medical expenses and lost wages of the policyholder and their passengers in the event of an accident, regardless of who is at fault. PIP is especially beneficial for electric two-wheeler owners, as it ensures that they have access to necessary medical care and financial support in the aftermath of an accident. Additionally, uninsured/underinsured motorist coverage is available to protect electric two-wheeler owners from financial losses resulting from accidents involving drivers who do not have sufficient insurance coverage. This type of coverage is crucial in regions where a significant number of drivers are uninsured or underinsured, providing electric two-wheeler owners with an added layer of protection. Overall, the Global Electric Two-wheeler Insurance Market offers a comprehensive range of coverage options to meet the diverse needs of electric two-wheeler owners, ensuring that they are financially protected against a wide range of risks.

Electric Motorcycles, Scooters, Mopeds, Others in the Global Electric Two-wheeler Insurance Market:

The Global Electric Two-wheeler Insurance Market plays a crucial role in providing financial protection for various types of electric two-wheelers, including electric motorcycles, scooters, mopeds, and others. Electric motorcycles, known for their speed and performance, are becoming increasingly popular among consumers seeking an eco-friendly alternative to traditional gasoline-powered motorcycles. Insurance coverage for electric motorcycles typically includes liability, collision, and comprehensive coverage, ensuring that owners are protected against financial losses resulting from accidents, theft, or damage. Scooters, another popular category of electric two-wheelers, are favored for their convenience and ease of use, particularly in urban areas. Insurance policies for electric scooters often include similar coverage options as those for electric motorcycles, providing owners with financial protection against a range of risks. Mopeds, which are smaller and less powerful than motorcycles and scooters, are also covered under the Global Electric Two-wheeler Insurance Market. Insurance coverage for electric mopeds typically includes liability, collision, and comprehensive coverage, ensuring that owners are protected against financial losses resulting from accidents, theft, or damage. In addition to these common types of electric two-wheelers, the market also provides insurance coverage for other types of electric vehicles, such as electric bicycles and electric trikes. These vehicles, while less common than motorcycles, scooters, and mopeds, still require insurance coverage to protect owners from financial losses resulting from accidents or theft. The Global Electric Two-wheeler Insurance Market offers a range of coverage options for these vehicles, ensuring that owners have access to affordable and comprehensive insurance solutions. Overall, the Global Electric Two-wheeler Insurance Market plays a vital role in providing financial protection for a wide range of electric two-wheelers, ensuring that owners are protected against a variety of risks and can enjoy the benefits of their vehicles with peace of mind.

Global Electric Two-wheeler Insurance Market Outlook:

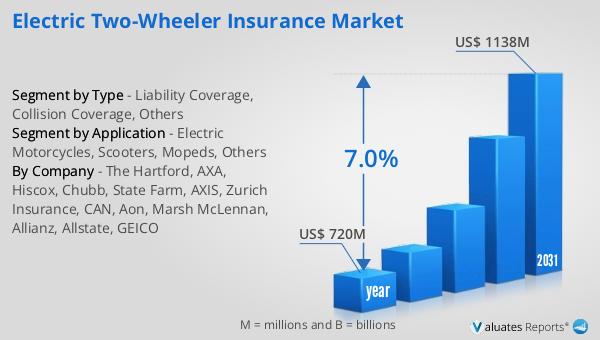

In 2024, the global market for Electric Two-wheeler Insurance was valued at approximately $720 million. This market is anticipated to experience significant growth over the coming years, with projections indicating that it will reach an estimated value of $1,138 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 7.0% during the forecast period. The increasing adoption of electric two-wheelers, driven by environmental concerns and government incentives, is a key factor contributing to the expansion of this market. As more consumers opt for electric motorcycles, scooters, and mopeds, the demand for specialized insurance products tailored to these vehicles is expected to rise. Insurance providers are likely to continue developing innovative products to meet the evolving needs of electric two-wheeler owners, ensuring that they have access to comprehensive and affordable insurance solutions. The projected growth of the Global Electric Two-wheeler Insurance Market reflects the increasing importance of insurance coverage for electric vehicles, as well as the growing awareness among consumers about the need for financial protection against potential risks. As the market continues to expand, it is expected to play a crucial role in supporting the widespread adoption of electric two-wheelers and promoting sustainable transportation solutions.

| Report Metric | Details |

| Report Name | Electric Two-wheeler Insurance Market |

| Accounted market size in year | US$ 720 million |

| Forecasted market size in 2031 | US$ 1138 million |

| CAGR | 7.0% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | The Hartford, AXA, Hiscox, Chubb, State Farm, AXIS, Zurich Insurance, CAN, Aon, Marsh McLennan, Allianz, Allstate, GEICO |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |