What is Global Insurance for Livestock Farms Market?

Global insurance for livestock farms is a specialized segment of the insurance industry that provides coverage tailored to the unique needs of livestock farmers. This type of insurance is designed to protect farmers from financial losses associated with their livestock, which can be a significant investment. Livestock insurance covers a range of risks, including mortality, theft, and veterinary expenses, among others. The global market for this insurance is driven by the increasing demand for livestock products, the rising awareness of risk management among farmers, and the growing need for financial security in the agricultural sector. As the livestock industry continues to expand, so does the need for comprehensive insurance solutions that can safeguard farmers' investments against unforeseen events. This market is characterized by a variety of insurance products that cater to different types of livestock, including cattle, sheep, goats, pigs, and poultry. Insurance providers in this market offer policies that are tailored to the specific risks associated with each type of livestock, ensuring that farmers have the coverage they need to protect their livelihoods. Overall, global insurance for livestock farms plays a crucial role in supporting the agricultural industry by providing financial stability and peace of mind to farmers worldwide.

Mortality Insurance, Theft Insurance, Veterinary Expenses Insurance, Others in the Global Insurance for Livestock Farms Market:

Mortality insurance is a fundamental component of livestock insurance, providing coverage for the death of animals due to accidents, diseases, or natural causes. This type of insurance is crucial for farmers as it helps mitigate the financial impact of losing valuable livestock. Mortality insurance policies typically cover the market value of the animal at the time of death, ensuring that farmers can recover some of their investment. This coverage is particularly important for high-value animals, such as breeding stock or show animals, where the financial loss can be substantial. Theft insurance, on the other hand, protects farmers against the loss of livestock due to theft. Livestock theft can be a significant issue in some regions, leading to considerable financial losses for farmers. Theft insurance provides compensation for stolen animals, helping farmers recover from such incidents and continue their operations without severe financial strain. Veterinary expenses insurance covers the costs associated with veterinary care for livestock. This includes routine check-ups, vaccinations, and treatment for illnesses or injuries. Veterinary expenses can be a significant burden for farmers, especially when dealing with large herds or flocks. By covering these costs, veterinary expenses insurance helps farmers maintain the health and productivity of their livestock without incurring prohibitive expenses. Other types of insurance in the global livestock market may include coverage for loss of income due to business interruption, liability insurance to protect against claims of injury or damage caused by livestock, and insurance for equipment and facilities used in livestock farming. Each of these insurance types addresses specific risks faced by livestock farmers, providing a comprehensive safety net that supports the sustainability and profitability of their operations. By offering a range of insurance products, providers in the global livestock insurance market can cater to the diverse needs of farmers, ensuring that they have the protection they need to manage risks effectively.

Large Enterprises, SMEs, Personal in the Global Insurance for Livestock Farms Market:

The usage of global insurance for livestock farms varies across different types of enterprises, including large enterprises, small and medium-sized enterprises (SMEs), and personal or family-owned farms. Large enterprises, which often operate on a commercial scale, require comprehensive insurance coverage to protect their significant investments in livestock. These enterprises typically have large herds or flocks and are exposed to a wide range of risks, including disease outbreaks, natural disasters, and market fluctuations. Insurance for large enterprises often includes extensive coverage options, such as mortality insurance, theft insurance, and veterinary expenses insurance, as well as additional coverage for business interruption and liability. By securing comprehensive insurance, large enterprises can safeguard their operations against potential losses and ensure business continuity. SMEs, which may have more limited resources compared to large enterprises, also benefit from livestock insurance. For these businesses, insurance provides a crucial safety net that helps manage risks and protect their investments. SMEs may opt for tailored insurance packages that address their specific needs and budget constraints. This could include basic mortality and theft insurance, along with optional coverage for veterinary expenses or equipment. By investing in insurance, SMEs can enhance their resilience to unforeseen events and maintain their financial stability. Personal or family-owned farms, which often operate on a smaller scale, also utilize livestock insurance to protect their livelihoods. For these farmers, livestock may represent a significant portion of their income and assets. Insurance provides peace of mind by covering potential losses due to animal mortality, theft, or illness. Personal farms may choose insurance policies that align with their specific needs, such as coverage for high-value breeding stock or specialized veterinary care. By securing insurance, personal farms can ensure the sustainability of their operations and protect their financial well-being. Overall, the usage of global insurance for livestock farms is essential for enterprises of all sizes, providing a vital layer of protection that supports the agricultural industry and promotes financial security for farmers.

Global Insurance for Livestock Farms Market Outlook:

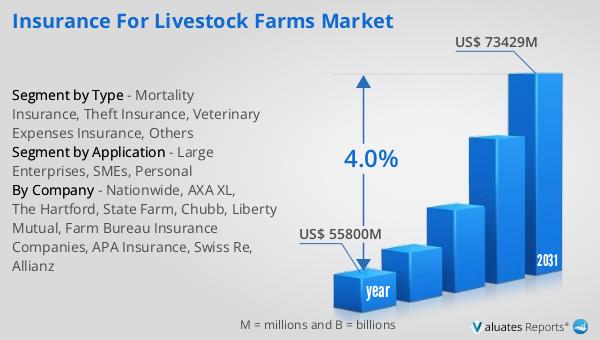

In 2024, the global market for insurance tailored to livestock farms was valued at approximately 55.8 billion US dollars. This market is anticipated to grow steadily, reaching an estimated size of 73.4 billion US dollars by the year 2031. This growth reflects a compound annual growth rate (CAGR) of 4.0% over the forecast period. The expansion of this market is driven by several factors, including the increasing demand for livestock products, the rising awareness of risk management among farmers, and the growing need for financial security in the agricultural sector. As the livestock industry continues to evolve, the demand for comprehensive insurance solutions that can protect farmers' investments against unforeseen events is expected to rise. This market outlook highlights the importance of livestock insurance in supporting the agricultural industry by providing financial stability and peace of mind to farmers worldwide. By offering a range of insurance products that cater to the diverse needs of farmers, providers in the global livestock insurance market can ensure that farmers have the protection they need to manage risks effectively and sustain their operations in the face of challenges.

| Report Metric | Details |

| Report Name | Insurance for Livestock Farms Market |

| Accounted market size in year | US$ 55800 million |

| Forecasted market size in 2031 | US$ 73429 million |

| CAGR | 4.0% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Nationwide, AXA XL, The Hartford, State Farm, Chubb, Liberty Mutual, Farm Bureau Insurance Companies, APA Insurance, Swiss Re, Allianz |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |