What is Global New Energy Vehicle Accident Insurance Market?

The Global New Energy Vehicle Accident Insurance Market is a specialized segment of the insurance industry that focuses on providing coverage for accidents involving new energy vehicles (NEVs). These vehicles, which include electric cars, plug-in hybrids, and hydrogen fuel cell vehicles, are becoming increasingly popular as the world shifts towards more sustainable and environmentally friendly transportation options. The insurance market for these vehicles is evolving to address the unique risks and challenges associated with their use. This includes considerations such as the high cost of battery replacement, the potential for electrical fires, and the need for specialized repair services. As more consumers and businesses adopt NEVs, the demand for tailored insurance products is expected to grow. Insurers are developing policies that not only cover traditional accident-related damages but also address the specific needs of NEV owners, such as coverage for charging equipment and protection against cyber threats. This market is poised for significant growth as the adoption of new energy vehicles continues to rise globally, driven by technological advancements and supportive government policies.

Compulsory Insurance, Optional Insurance in the Global New Energy Vehicle Accident Insurance Market:

In the realm of the Global New Energy Vehicle Accident Insurance Market, insurance offerings are typically divided into two main categories: compulsory insurance and optional insurance. Compulsory insurance is mandated by law and is designed to ensure that all vehicle owners have a basic level of coverage to protect against liabilities arising from accidents. This type of insurance is crucial for new energy vehicles, as it provides a safety net for both the vehicle owner and other parties involved in an accident. It typically covers third-party liabilities, which include bodily injury and property damage caused to others. This ensures that victims of accidents are compensated for their losses, regardless of the financial situation of the at-fault driver. On the other hand, optional insurance offers additional coverage that vehicle owners can choose to purchase based on their individual needs and preferences. For new energy vehicles, optional insurance can include coverage for damage to the vehicle itself, protection against theft, and coverage for natural disasters. Given the high cost of new energy vehicles and their components, such as batteries, many owners opt for comprehensive coverage to safeguard their investment. Optional insurance can also include coverage for specialized repair services, which are often required for the advanced technology used in new energy vehicles. Additionally, as these vehicles become more connected and reliant on software, there is a growing need for cyber insurance to protect against hacking and other digital threats. Insurers are increasingly offering policies that cover the costs associated with data breaches and cyberattacks, which can be particularly damaging for new energy vehicles that rely on sophisticated electronic systems. Another important aspect of optional insurance for new energy vehicles is coverage for charging equipment. As more consumers install home charging stations, there is a need for insurance products that protect against damage or theft of this equipment. Some insurers are also offering coverage for the costs associated with charging, such as reimbursement for electricity used to charge the vehicle. This is particularly relevant for commercial fleet operators who may have significant charging expenses. The Global New Energy Vehicle Accident Insurance Market is also influenced by government policies and incentives. In many regions, governments are offering subsidies and tax breaks to encourage the adoption of new energy vehicles. These incentives can also extend to insurance, with some governments providing discounts or rebates on insurance premiums for NEV owners. This can make optional insurance more affordable and attractive to consumers. As the market for new energy vehicles continues to grow, insurers are likely to develop more innovative and tailored products to meet the evolving needs of consumers. This could include usage-based insurance, where premiums are determined by the actual usage of the vehicle, or pay-as-you-drive policies that offer flexibility for drivers who use their vehicles infrequently. Overall, the Global New Energy Vehicle Accident Insurance Market is a dynamic and rapidly evolving sector that is adapting to the unique challenges and opportunities presented by the rise of new energy vehicles.

Commercial Vehicle, Passenger Vehicle in the Global New Energy Vehicle Accident Insurance Market:

The Global New Energy Vehicle Accident Insurance Market plays a crucial role in the commercial and passenger vehicle sectors by providing tailored insurance solutions that address the specific needs and risks associated with these types of vehicles. In the commercial vehicle sector, new energy vehicles are increasingly being adopted by businesses looking to reduce their carbon footprint and operating costs. These vehicles, which include electric trucks, vans, and buses, offer significant environmental benefits and can lead to substantial savings on fuel and maintenance. However, they also present unique challenges that require specialized insurance coverage. For instance, the high cost of batteries and the need for specialized repair services can result in higher repair costs in the event of an accident. Commercial vehicle operators often opt for comprehensive insurance policies that cover these potential expenses, ensuring that their investment is protected. Additionally, commercial fleet operators may require coverage for charging infrastructure, as well as protection against potential cyber threats that could disrupt their operations. In the passenger vehicle sector, new energy vehicles are becoming increasingly popular among consumers who are looking for environmentally friendly and cost-effective transportation options. The insurance market for these vehicles is evolving to meet the needs of individual consumers, offering a range of coverage options that address the unique risks associated with new energy vehicles. For example, many insurers offer policies that cover the cost of battery replacement, which can be a significant expense for electric vehicle owners. Additionally, as new energy vehicles become more connected and reliant on software, there is a growing need for cyber insurance to protect against hacking and other digital threats. Insurers are increasingly offering policies that cover the costs associated with data breaches and cyberattacks, which can be particularly damaging for new energy vehicles that rely on sophisticated electronic systems. Another important aspect of the Global New Energy Vehicle Accident Insurance Market is the coverage for charging equipment. As more consumers install home charging stations, there is a need for insurance products that protect against damage or theft of this equipment. Some insurers are also offering coverage for the costs associated with charging, such as reimbursement for electricity used to charge the vehicle. This is particularly relevant for commercial fleet operators who may have significant charging expenses. Overall, the Global New Energy Vehicle Accident Insurance Market is playing a vital role in supporting the adoption of new energy vehicles in both the commercial and passenger vehicle sectors. By providing tailored insurance solutions that address the unique risks and challenges associated with these vehicles, insurers are helping to facilitate the transition to a more sustainable and environmentally friendly transportation system.

Global New Energy Vehicle Accident Insurance Market Outlook:

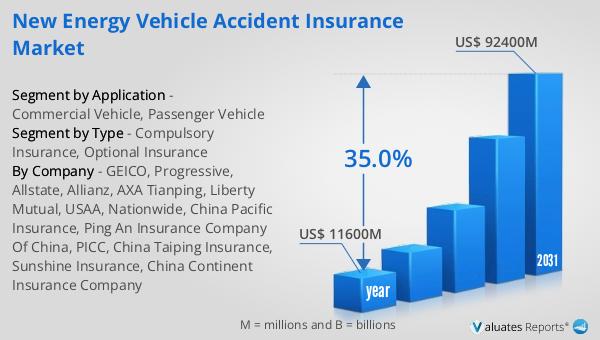

The global market for New Energy Vehicle Accident Insurance was valued at $11.6 billion in 2024 and is anticipated to expand significantly, reaching an estimated $92.4 billion by 2031. This impressive growth trajectory reflects a compound annual growth rate (CAGR) of 35.0% over the forecast period. Such robust expansion is indicative of the increasing adoption of new energy vehicles worldwide, driven by technological advancements and supportive government policies. In Europe, for instance, the sales of pure electric vehicles saw a remarkable increase of 29% year-on-year in 2022, totaling 1.58 million units. This surge in electric vehicle sales underscores the growing consumer preference for environmentally friendly transportation options and the corresponding demand for specialized insurance products. As more consumers and businesses transition to new energy vehicles, the need for tailored insurance solutions that address the unique risks and challenges associated with these vehicles is expected to rise. Insurers are responding to this demand by developing innovative products that provide comprehensive coverage for new energy vehicles, including protection against accidents, theft, and cyber threats. This dynamic market is poised for continued growth as the adoption of new energy vehicles accelerates globally.

| Report Metric | Details |

| Report Name | New Energy Vehicle Accident Insurance Market |

| Accounted market size in year | US$ 11600 million |

| Forecasted market size in 2031 | US$ 92400 million |

| CAGR | 35.0% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | GEICO, Progressive, Allstate, Allianz, AXA Tianping, Liberty Mutual, USAA, Nationwide, China Pacific Insurance, Ping An Insurance Company Of China, PICC, China Taiping Insurance, Sunshine Insurance, China Continent Insurance Company |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |