What is Global Ruled Diffraction Gratings Market?

The Global Ruled Diffraction Gratings Market is a specialized segment within the broader optics and photonics industry. Diffraction gratings are optical components with a series of parallel lines or grooves that disperse light into its component wavelengths. Ruled diffraction gratings are specifically manufactured using a mechanical ruling process, where a diamond-tipped tool engraves lines onto a reflective surface. These gratings are essential in various scientific and industrial applications due to their ability to precisely separate light into its spectral components. The global market for ruled diffraction gratings is driven by advancements in technology and increasing demand in sectors such as telecommunications, laser manufacturing, and scientific research. As industries continue to innovate and require more precise optical components, the demand for high-quality diffraction gratings is expected to grow. The market is characterized by a mix of established players and emerging companies, all striving to offer products with superior performance and reliability. With ongoing research and development, the capabilities of ruled diffraction gratings are continually being enhanced, making them indispensable tools in modern optical systems. The market's growth is further supported by the increasing adoption of optical technologies across various sectors, highlighting the critical role of diffraction gratings in enabling these advancements.

12.5 x 12.5 mm, 25 x 25 mm, 12.5 x 25 mm, 12.7 x 12.7 mm, 30 x 30 mm, Others in the Global Ruled Diffraction Gratings Market:

In the Global Ruled Diffraction Gratings Market, various sizes of gratings are available to cater to different application needs. The dimensions such as 12.5 x 12.5 mm, 25 x 25 mm, 12.5 x 25 mm, 12.7 x 12.7 mm, and 30 x 30 mm represent the physical size of the grating, which can influence its performance and suitability for specific uses. Smaller gratings, like the 12.5 x 12.5 mm and 12.7 x 12.7 mm, are often used in compact optical systems where space is limited but precision is crucial. These sizes are ideal for portable spectrometers and small-scale laser systems, where maintaining a compact form factor is essential without compromising on performance. On the other hand, larger gratings such as the 25 x 25 mm and 30 x 30 mm are preferred in applications requiring higher light throughput and resolution, such as in large-scale spectrometers and astronomical instruments. The choice of grating size also depends on the specific wavelength range and resolution required by the application. For instance, in telecommunications, where precise wavelength separation is critical, the grating size must be chosen to optimize performance for the specific optical bandwidth. Additionally, the material and coating of the grating play a significant role in its efficiency and durability. Different coatings can enhance the grating's reflectivity and resistance to environmental factors, making them suitable for various operational conditions. The "Others" category in grating sizes includes custom dimensions tailored to specific industrial or research needs, offering flexibility for unique applications. As technology advances, the demand for customized solutions is increasing, prompting manufacturers to offer a wider range of sizes and configurations. This diversity in grating sizes and specifications allows for a broad spectrum of applications, from basic educational tools to sophisticated research instruments. The ability to tailor diffraction gratings to specific requirements ensures that they remain a vital component in the development of cutting-edge optical technologies. As industries continue to evolve, the need for precise and reliable optical components like ruled diffraction gratings will only grow, driving further innovation and expansion in this market segment.

Laser, Astronomy, Optical Telecom, Monochromator and Spectrometer, Others in the Global Ruled Diffraction Gratings Market:

The usage of Global Ruled Diffraction Gratings Market spans several key areas, each benefiting from the unique properties of these optical components. In the field of lasers, ruled diffraction gratings are crucial for beam shaping and wavelength separation. They enable precise control over the laser's spectral output, which is essential for applications ranging from industrial cutting and welding to medical procedures and scientific research. In astronomy, diffraction gratings are used in spectrometers to analyze the light from stars and other celestial bodies. This analysis helps astronomers determine the composition, temperature, and movement of these objects, providing valuable insights into the universe's structure and evolution. Optical telecommunications rely heavily on diffraction gratings for wavelength division multiplexing (WDM), a technology that increases the capacity of fiber optic networks by allowing multiple signals to be transmitted simultaneously over a single fiber. This capability is vital for meeting the growing demand for high-speed internet and data services. In monochromators and spectrometers, ruled diffraction gratings are used to isolate specific wavelengths of light for detailed analysis. This is important in various scientific and industrial applications, including chemical analysis, environmental monitoring, and quality control in manufacturing. The "Others" category encompasses a wide range of additional applications, such as in educational tools, where diffraction gratings are used to demonstrate the principles of light and optics. They are also employed in artistic installations and displays, where their ability to create stunning visual effects is leveraged for creative purposes. The versatility of ruled diffraction gratings makes them indispensable in both traditional and emerging fields, driving continuous innovation and development in optical technologies. As industries continue to push the boundaries of what is possible with light, the demand for high-quality diffraction gratings is expected to grow, further solidifying their role as a cornerstone of modern optical systems.

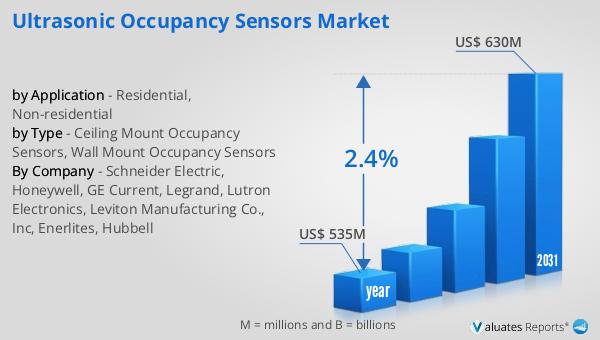

Global Ruled Diffraction Gratings Market Outlook:

The outlook for the Global Ruled Diffraction Gratings Market indicates a promising trajectory. In 2024, the market was valued at approximately US$ 153 million. Looking ahead, it is anticipated to expand significantly, reaching an estimated size of US$ 206 million by 2031. This growth reflects a compound annual growth rate (CAGR) of 4.4% over the forecast period. This upward trend is driven by several factors, including the increasing adoption of optical technologies across various industries and the continuous advancements in diffraction grating manufacturing techniques. As the demand for high-precision optical components rises, particularly in sectors such as telecommunications, laser technology, and scientific research, the market for ruled diffraction gratings is poised for substantial growth. The ability of these gratings to precisely separate light into its component wavelengths makes them essential for a wide range of applications, from enhancing the performance of fiber optic networks to enabling detailed spectroscopic analysis in research laboratories. As industries continue to innovate and seek more efficient and reliable optical solutions, the demand for high-quality ruled diffraction gratings is expected to increase, driving further expansion in this market segment. The market's growth is further supported by the increasing adoption of optical technologies across various sectors, highlighting the critical role of diffraction gratings in enabling these advancements.

| Report Metric | Details |

| Report Name | Ruled Diffraction Gratings Market |

| Accounted market size in year | US$ 153 million |

| Forecasted market size in 2031 | US$ 206 million |

| CAGR | 4.4% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | HORIBA, Newport Corporation, Edmund Optics, Shimadzu Corporation, Zeiss, Dynasil Corporation, Kaiser Optical Systems, Spectrogon AB, Headwall Photonics, Thorlabs, Photop Technologies, Spectrum Scientific, Wasatch Photonics, GratingWorks, Shenyang Yibeite Optics |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |