What is Global DUV Lithography Machine Market?

The Global DUV (Deep Ultraviolet) Lithography Machine Market is a crucial segment within the semiconductor manufacturing industry, focusing on the production of advanced lithography equipment used in the fabrication of semiconductor devices. DUV lithography machines are essential for creating the intricate patterns on silicon wafers that form the basis of integrated circuits. These machines utilize deep ultraviolet light to achieve high precision and resolution, enabling the production of smaller and more powerful semiconductor components. The market for DUV lithography machines is driven by the increasing demand for advanced electronic devices, such as smartphones, tablets, and computers, which require highly sophisticated semiconductor chips. As technology continues to evolve, the need for more efficient and capable lithography machines grows, pushing the market forward. The DUV lithography machine market is characterized by rapid technological advancements and significant investments in research and development to enhance machine capabilities and reduce production costs. Key players in this market are constantly innovating to maintain a competitive edge and meet the ever-growing demands of the semiconductor industry. The market's growth is also influenced by the expansion of semiconductor manufacturing facilities worldwide, particularly in regions like Asia-Pacific, where there is a high concentration of electronics production.

ArF Dry Lithography Equipment, ArF immersion Lithography Equipment, KrF Lithography Equipment in the Global DUV Lithography Machine Market:

ArF Dry Lithography Equipment, ArF Immersion Lithography Equipment, and KrF Lithography Equipment are three significant types of lithography machines within the Global DUV Lithography Machine Market. ArF Dry Lithography Equipment uses argon fluoride (ArF) lasers to produce deep ultraviolet light with a wavelength of 193 nanometers. This type of equipment is primarily used for patterning semiconductor wafers with feature sizes down to 65 nanometers. ArF dry lithography is known for its high precision and is often employed in the production of microprocessors and memory chips. However, as the demand for even smaller feature sizes increases, the limitations of ArF dry lithography become more apparent, leading to the development of more advanced techniques. ArF Immersion Lithography Equipment represents a significant advancement over dry lithography. By immersing the wafer and lens in a liquid medium, typically water, the effective wavelength of the light is reduced, allowing for even smaller feature sizes, down to 45 nanometers or less. This technique enhances the resolution and depth of focus, making it ideal for producing cutting-edge semiconductor devices. ArF immersion lithography is widely used in the manufacturing of high-performance chips for applications such as artificial intelligence, 5G technology, and advanced computing. The complexity and cost of immersion lithography equipment are higher than dry lithography, but the benefits in terms of performance and capability justify the investment for many semiconductor manufacturers. KrF Lithography Equipment, on the other hand, utilizes krypton fluoride (KrF) lasers with a wavelength of 248 nanometers. This type of equipment is typically used for less demanding applications where feature sizes of 130 nanometers or larger are sufficient. KrF lithography is often employed in the production of less advanced semiconductor devices, such as those used in consumer electronics and automotive applications. Despite being an older technology compared to ArF lithography, KrF equipment remains relevant due to its cost-effectiveness and reliability for certain manufacturing processes. The choice between ArF dry, ArF immersion, and KrF lithography equipment depends on several factors, including the desired feature size, production volume, and cost considerations. Semiconductor manufacturers must carefully evaluate their specific needs and capabilities to select the most appropriate lithography technology for their production lines. As the semiconductor industry continues to push the boundaries of miniaturization and performance, the demand for advanced lithography equipment will remain strong, driving further innovation and development in the Global DUV Lithography Machine Market.

IDM, Foundry in the Global DUV Lithography Machine Market:

The usage of Global DUV Lithography Machine Market in areas such as Integrated Device Manufacturers (IDM) and Foundries is pivotal to the semiconductor industry. IDMs are companies that design, manufacture, and sell integrated circuit products. They rely heavily on DUV lithography machines to produce high-quality semiconductor chips that meet the stringent demands of modern electronic devices. DUV lithography allows IDMs to achieve the precision and resolution necessary for creating complex chip architectures, enabling them to produce cutting-edge products that power everything from smartphones to data centers. The ability to manufacture chips with smaller feature sizes and higher performance is a key competitive advantage for IDMs, making DUV lithography an essential component of their production processes. Foundries, on the other hand, are companies that specialize in manufacturing semiconductor wafers for other companies. They provide fabrication services to fabless semiconductor companies, which design chips but do not have their own manufacturing facilities. Foundries play a critical role in the semiconductor supply chain, and their success depends on their ability to offer advanced manufacturing capabilities to their clients. DUV lithography machines are integral to foundries' operations, enabling them to produce a wide range of semiconductor products with varying levels of complexity and performance. The flexibility and scalability of DUV lithography make it an ideal choice for foundries looking to meet the diverse needs of their customers. In both IDMs and foundries, the adoption of DUV lithography machines is driven by the need to stay competitive in a rapidly evolving market. As semiconductor technology continues to advance, the demand for smaller, faster, and more efficient chips increases, necessitating the use of state-of-the-art lithography equipment. DUV lithography machines provide the precision and capability required to meet these demands, making them indispensable tools for semiconductor manufacturers. The ongoing investment in DUV lithography technology by both IDMs and foundries underscores its importance in the semiconductor industry and its role in driving innovation and growth.

Global DUV Lithography Machine Market Outlook:

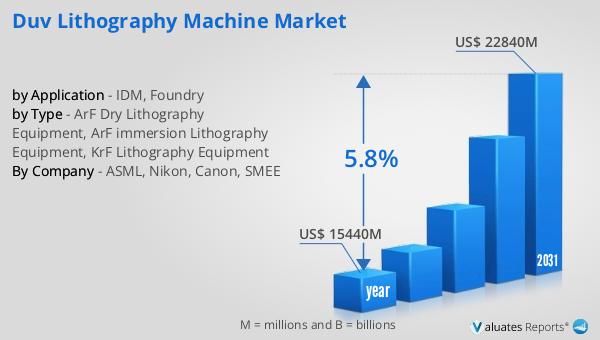

The global market for DUV Lithography Machines was valued at approximately $15.44 billion in 2024 and is anticipated to expand to around $22.84 billion by 2031, reflecting a compound annual growth rate (CAGR) of 5.8% over the forecast period. ASML, a leading player in this market, dominates with over 90% market share, while Nikon and Canon each hold about 5% of the market. In parallel, the global semiconductor market was estimated at $526.8 billion in 2023 and is projected to grow to $780.7 billion by 2030. Our research indicates that the global semiconductor manufacturing wafer fabrication market is expected to increase from $251.7 billion in 2023 to $506.5 billion by 2030, with a remarkable CAGR of 40.49% during the forecast period. These figures highlight the significant growth potential within the semiconductor industry and the critical role that DUV lithography machines play in supporting this expansion. As the demand for advanced semiconductor devices continues to rise, driven by technological advancements and increasing consumer electronics usage, the importance of DUV lithography machines in the manufacturing process becomes even more pronounced. The market dynamics underscore the need for continuous innovation and investment in DUV lithography technology to meet the evolving demands of the semiconductor industry.

| Report Metric | Details |

| Report Name | DUV Lithography Machine Market |

| Accounted market size in year | US$ 15440 million |

| Forecasted market size in 2031 | US$ 22840 million |

| CAGR | 5.8% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | ASML, Nikon, Canon, SMEE |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |