What is Global Wafer In-Process Containers Market?

The Global Wafer In-Process Containers Market is a specialized segment within the semiconductor industry that focuses on the storage and transportation of semiconductor wafers during the manufacturing process. These containers are crucial for maintaining the integrity and quality of wafers, which are thin slices of semiconductor material used in the fabrication of integrated circuits and other microdevices. The market for these containers is driven by the increasing demand for semiconductors across various industries, including electronics, automotive, and telecommunications. As technology advances, the need for more sophisticated and reliable wafer handling solutions grows, leading to innovations in container design and materials. The market is characterized by a range of products designed to accommodate different wafer sizes and types, ensuring that they are protected from contamination and physical damage during processing. This market is essential for the efficient and effective production of semiconductors, which are the building blocks of modern electronic devices. As the semiconductor industry continues to expand, the demand for high-quality wafer in-process containers is expected to rise, making this a dynamic and evolving market.

PC Resin Materials, PBT Resin Materials, Others in the Global Wafer In-Process Containers Market:

In the Global Wafer In-Process Containers Market, materials such as PC Resin, PBT Resin, and others play a significant role in the manufacturing of containers that ensure the safe handling and transportation of semiconductor wafers. PC Resin, or Polycarbonate Resin, is known for its excellent impact resistance and optical clarity, making it a popular choice for wafer containers. Its durability and ability to withstand high temperatures make it ideal for environments where wafers are processed. PC Resin containers are often used in applications where visibility of the wafer is important, allowing for easy inspection without opening the container. On the other hand, PBT Resin, or Polybutylene Terephthalate Resin, is valued for its high strength and resistance to chemicals and moisture. This makes PBT Resin containers suitable for environments where wafers are exposed to harsh chemicals or require a high degree of cleanliness. PBT Resin's dimensional stability ensures that the containers maintain their shape and integrity under various conditions, providing reliable protection for the wafers. Other materials used in wafer in-process containers include various polymers and composites that offer specific properties tailored to different stages of the semiconductor manufacturing process. These materials are selected based on their ability to provide the necessary protection and support for wafers, ensuring that they remain free from contamination and damage. The choice of material is crucial, as it impacts the overall performance and reliability of the container. Manufacturers in this market continuously explore new materials and technologies to enhance the functionality and efficiency of wafer in-process containers. This includes developing materials that offer improved thermal stability, chemical resistance, and mechanical strength. As the semiconductor industry evolves, the demand for advanced materials in wafer in-process containers is expected to grow, driving innovation and development in this sector. The use of PC Resin, PBT Resin, and other materials in wafer in-process containers highlights the importance of material selection in ensuring the safe and efficient handling of semiconductor wafers. Each material offers unique benefits that cater to specific requirements in the semiconductor manufacturing process, making them integral to the success of the Global Wafer In-Process Containers Market.

300 mm Wafer, 200 mm Wafer, Others in the Global Wafer In-Process Containers Market:

The Global Wafer In-Process Containers Market finds its application in various wafer sizes, including 300 mm wafers, 200 mm wafers, and others. The 300 mm wafer is the largest standard size used in the semiconductor industry, offering significant advantages in terms of cost efficiency and production volume. Containers designed for 300 mm wafers are engineered to accommodate the larger size while providing robust protection against contamination and physical damage. These containers are essential for maintaining the quality and integrity of the wafers throughout the manufacturing process, ensuring that they meet the stringent standards required for high-performance semiconductor devices. The use of 300 mm wafers is prevalent in advanced semiconductor manufacturing facilities, where the focus is on maximizing output and reducing costs. In contrast, 200 mm wafers are smaller and are often used in the production of less complex semiconductor devices. Containers for 200 mm wafers are designed to offer the same level of protection and reliability as those for larger wafers, ensuring that the wafers remain free from defects and contamination. The demand for 200 mm wafer containers is driven by the continued use of these wafers in various applications, including automotive electronics and consumer devices. Other wafer sizes, such as 150 mm and smaller, also require specialized containers to ensure their safe handling and transportation. These containers are designed to meet the specific needs of different wafer sizes, providing the necessary protection and support to maintain wafer quality. The Global Wafer In-Process Containers Market caters to a diverse range of wafer sizes, reflecting the varied requirements of the semiconductor industry. As technology advances and new applications for semiconductors emerge, the demand for wafer in-process containers across different wafer sizes is expected to grow. This growth is driven by the need for reliable and efficient solutions that ensure the safe handling of wafers, regardless of their size. The market's ability to adapt to the changing needs of the semiconductor industry is a testament to its importance and relevance in the production of modern electronic devices.

Global Wafer In-Process Containers Market Outlook:

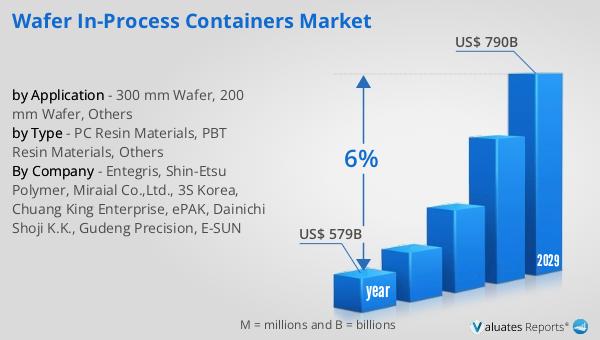

The global semiconductor market, valued at approximately $579 billion in 2022, is on a growth trajectory, with projections indicating it could reach around $790 billion by 2029. This anticipated growth represents a compound annual growth rate (CAGR) of 6% over the forecast period. This expansion is driven by the increasing demand for semiconductors across various sectors, including consumer electronics, automotive, telecommunications, and industrial applications. As technology continues to evolve, the need for more advanced and efficient semiconductor solutions is becoming increasingly critical. The rise in demand for smart devices, electric vehicles, and advanced communication technologies is fueling the growth of the semiconductor market. Additionally, the ongoing development of new technologies, such as artificial intelligence, the Internet of Things (IoT), and 5G networks, is further driving the demand for semiconductors. These advancements require more sophisticated and powerful semiconductor components, which in turn boosts the market's growth. The projected growth of the semiconductor market underscores the importance of continued innovation and investment in this sector. As the market expands, the need for reliable and efficient wafer in-process containers will also increase, highlighting the interconnected nature of the semiconductor industry and its supporting markets.

| Report Metric | Details |

| Report Name | Wafer In-Process Containers Market |

| Accounted market size in year | US$ 579 billion |

| Forecasted market size in 2029 | US$ 790 billion |

| CAGR | 6% |

| Base Year | year |

| Forecasted years | 2025 - 2029 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Entegris, Shin-Etsu Polymer, Miraial Co.,Ltd., 3S Korea, Chuang King Enterprise, ePAK, Dainichi Shoji K.K., Gudeng Precision, E-SUN |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |