What is Global Non-residential Occupancy Sensors Market?

The Global Non-residential Occupancy Sensors Market refers to the industry focused on the development, production, and distribution of sensors used to detect the presence of people in non-residential spaces. These sensors are crucial for energy management and automation in commercial buildings, such as offices, retail stores, and hospitality venues. By detecting human presence, these sensors can control lighting, heating, ventilation, and air conditioning systems, thereby optimizing energy consumption and reducing operational costs. The market is driven by the increasing demand for energy-efficient solutions and the growing adoption of smart building technologies. As businesses and organizations strive to reduce their carbon footprint and comply with stringent energy regulations, the adoption of occupancy sensors is expected to rise. These sensors not only contribute to energy savings but also enhance the comfort and convenience of building occupants by ensuring that environmental conditions are adjusted according to occupancy levels. The market encompasses various types of sensors, including Passive Infrared (PIR), Ultrasonic, and Dual-technology sensors, each offering unique advantages and applications. As technology advances, the integration of IoT and AI in occupancy sensors is anticipated to further propel market growth, offering more sophisticated and intelligent solutions for building management.

PIR (Passive Infrared) Sensors, Ultrasonic Sensors, Dual-technology Occupancy Sensors, Others in the Global Non-residential Occupancy Sensors Market:

In the realm of the Global Non-residential Occupancy Sensors Market, several types of sensors play pivotal roles, each with distinct functionalities and applications. Passive Infrared (PIR) Sensors are among the most commonly used in this market. They detect motion by sensing the infrared radiation emitted by humans. When a person enters a room, the sensor detects the change in infrared radiation and triggers the connected systems, such as lighting or HVAC. PIR sensors are highly effective in environments where there is a clear line of sight and minimal obstructions. They are energy-efficient and cost-effective, making them a popular choice for many commercial applications. However, they may not perform well in areas with partitions or where movement is subtle. Ultrasonic Sensors, on the other hand, operate by emitting ultrasonic sound waves and measuring the time it takes for the waves to return after bouncing off objects, including people. These sensors are highly sensitive and can detect even the slightest movements, making them ideal for spaces with obstructions or where occupants may remain relatively still, such as in offices or conference rooms. Ultrasonic sensors can cover a larger area compared to PIR sensors and are less affected by temperature changes. However, they may consume more energy and can be more expensive. Dual-technology Occupancy Sensors combine the features of both PIR and Ultrasonic sensors to enhance accuracy and reliability. By using both infrared and ultrasonic technologies, these sensors can reduce false triggers and ensure that the connected systems are only activated when necessary. This combination is particularly useful in complex environments where a single technology might not suffice. Dual-technology sensors are often used in high-traffic areas or spaces with varying occupancy patterns, such as open-plan offices or retail stores. Apart from these, there are other types of sensors used in the market, such as microwave sensors and camera-based sensors. Microwave sensors emit microwave signals and detect changes in the reflected signals to determine occupancy. They can penetrate through walls and are effective in detecting movement in large areas. Camera-based sensors use image processing to detect occupancy and can provide additional data, such as the number of occupants and their locations. These sensors are often used in advanced building management systems where detailed occupancy data is required. Each type of sensor has its own set of advantages and limitations, and the choice of sensor depends on the specific requirements of the application. Factors such as the size and layout of the space, the level of occupancy, and the desired level of automation all play a role in determining the most suitable sensor technology. As the demand for smart building solutions continues to grow, the development of more advanced and integrated sensor technologies is expected to drive the evolution of the Global Non-residential Occupancy Sensors Market.

Office, Shop, Hospitality, Others in the Global Non-residential Occupancy Sensors Market:

The usage of Global Non-residential Occupancy Sensors Market spans across various sectors, each benefiting from the unique capabilities of these sensors. In office environments, occupancy sensors are primarily used to manage lighting and HVAC systems. By detecting when a room is occupied, these sensors can automatically adjust lighting levels and temperature settings, ensuring that energy is not wasted in unoccupied spaces. This not only reduces energy costs but also enhances the comfort of employees by maintaining optimal working conditions. In open-plan offices, sensors can be used to monitor occupancy levels and adjust ventilation systems accordingly, improving air quality and reducing the risk of airborne illnesses. In retail settings, such as shops and malls, occupancy sensors play a crucial role in creating an inviting and energy-efficient environment. By adjusting lighting and temperature based on the number of customers present, retailers can enhance the shopping experience while minimizing energy consumption. Sensors can also be used to gather data on customer traffic patterns, helping retailers optimize store layouts and improve customer service. In addition, occupancy sensors can be integrated with security systems to enhance surveillance and prevent theft. The hospitality industry also benefits significantly from the use of occupancy sensors. In hotels, sensors can be used to control lighting, heating, and cooling in guest rooms, ensuring that energy is only used when rooms are occupied. This not only reduces operational costs but also aligns with the growing demand for sustainable and eco-friendly accommodations. In conference and banquet facilities, sensors can be used to manage lighting and climate control, ensuring that these spaces are comfortable and energy-efficient during events. Beyond these sectors, occupancy sensors are used in a variety of other non-residential applications. In educational institutions, sensors can be used to manage lighting and HVAC systems in classrooms and lecture halls, ensuring that energy is not wasted in unoccupied spaces. In healthcare facilities, sensors can help maintain optimal environmental conditions in patient rooms and common areas, enhancing patient comfort and safety. In industrial settings, sensors can be used to monitor occupancy in warehouses and production areas, optimizing lighting and ventilation systems to improve energy efficiency and worker safety. Overall, the Global Non-residential Occupancy Sensors Market offers a wide range of applications across different sectors, each benefiting from the energy savings, enhanced comfort, and improved operational efficiency that these sensors provide. As the demand for smart building solutions continues to grow, the adoption of occupancy sensors is expected to increase, driving further innovation and development in this dynamic market.

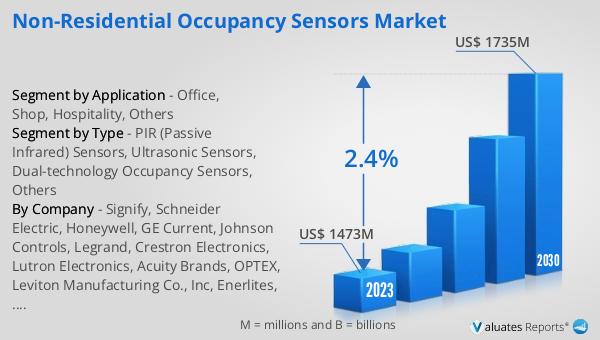

Global Non-residential Occupancy Sensors Market Outlook:

The worldwide market for Non-residential Occupancy Sensors was valued at $1,537 million in 2024 and is anticipated to expand to a revised size of $1,811 million by 2031, reflecting a compound annual growth rate (CAGR) of 2.4% over the forecast period. This growth trajectory underscores the increasing demand for energy-efficient solutions in commercial spaces, driven by the need to reduce operational costs and comply with environmental regulations. As businesses and organizations continue to prioritize sustainability and energy conservation, the adoption of occupancy sensors is expected to rise. These sensors play a crucial role in optimizing energy consumption by ensuring that lighting, heating, and cooling systems are only activated when spaces are occupied. This not only reduces energy costs but also contributes to a more sustainable and environmentally friendly building operation. The market's growth is further supported by advancements in sensor technology, including the integration of IoT and AI, which offer more sophisticated and intelligent solutions for building management. As the market evolves, the focus on developing more advanced and integrated sensor technologies is expected to drive further growth and innovation in the Global Non-residential Occupancy Sensors Market.

| Report Metric | Details |

| Report Name | Non-residential Occupancy Sensors Market |

| Accounted market size in year | US$ 1537 million |

| Forecasted market size in 2031 | US$ 1811 million |

| CAGR | 2.4% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Signify, Schneider Electric, Honeywell, GE Current, Johnson Controls, Legrand, Crestron Electronics, Lutron Electronics, Acuity Brands, OPTEX, Leviton Manufacturing Co., Inc, Enerlites, Hubbell |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |