What is Global Schottky Diode Market?

The Global Schottky Diode Market is a rapidly evolving sector within the semiconductor industry, characterized by its unique properties and diverse applications. Schottky diodes are semiconductor devices known for their low forward voltage drop and fast switching capabilities, making them highly efficient for various electronic applications. These diodes are primarily used in power rectification, voltage clamping, and radio frequency applications due to their ability to handle high frequencies and low power loss. The market is driven by the increasing demand for energy-efficient electronic devices and the growing adoption of renewable energy sources, which require efficient power conversion systems. Additionally, the rise in consumer electronics, automotive electronics, and telecommunications equipment further fuels the demand for Schottky diodes. As industries continue to innovate and seek more efficient solutions, the Global Schottky Diode Market is expected to witness significant growth, driven by technological advancements and the expanding application areas of these versatile components. The market's growth is also supported by the increasing investments in research and development to enhance the performance and efficiency of Schottky diodes, catering to the evolving needs of various industries.

Si SBD, SiC SBD, GaAs SBD in the Global Schottky Diode Market:

Silicon Schottky Barrier Diodes (Si SBD), Silicon Carbide Schottky Barrier Diodes (SiC SBD), and Gallium Arsenide Schottky Barrier Diodes (GaAs SBD) are pivotal components in the Global Schottky Diode Market, each offering distinct advantages and applications. Si SBDs are the most traditional type, widely used due to their cost-effectiveness and adequate performance in low to medium power applications. They are commonly found in consumer electronics, power supplies, and automotive systems, where efficiency and cost are critical. Si SBDs are known for their low forward voltage drop, which reduces power loss and enhances overall system efficiency. However, they have limitations in high-temperature and high-voltage applications, which is where SiC SBDs come into play. SiC SBDs are designed to operate in high-temperature and high-voltage environments, making them ideal for applications in electric vehicles, renewable energy systems, and industrial power supplies. They offer superior thermal performance and higher breakdown voltage compared to Si SBDs, enabling more efficient power conversion and reduced cooling requirements. This makes SiC SBDs a preferred choice for applications demanding high efficiency and reliability under extreme conditions. On the other hand, GaAs SBDs are known for their high-frequency performance, making them suitable for radio frequency and microwave applications. They are used in telecommunications, satellite communications, and radar systems, where high-speed switching and low noise are essential. GaAs SBDs offer excellent performance in terms of frequency response and noise figure, making them indispensable in high-frequency circuits. Despite their advantages, GaAs SBDs are more expensive than Si and SiC counterparts, limiting their use to specialized applications where performance outweighs cost considerations. The choice between Si, SiC, and GaAs SBDs depends on the specific requirements of the application, including factors such as operating temperature, voltage, frequency, and cost constraints. As technology advances and the demand for more efficient and reliable electronic components grows, the Global Schottky Diode Market is expected to see a shift towards more advanced materials like SiC and GaAs, driven by their superior performance characteristics and expanding application areas.

Automotive & Transportation, Energy & Power Grid, Consumer, Industrial Applications, Telecommunications, Avionics, Military and Medical, Others in the Global Schottky Diode Market:

The Global Schottky Diode Market finds extensive usage across various sectors, each benefiting from the unique properties of Schottky diodes. In the automotive and transportation industry, Schottky diodes are crucial for power management and efficiency in electric and hybrid vehicles. They are used in battery charging systems, power inverters, and motor control units, where their low forward voltage drop and fast switching capabilities enhance energy efficiency and reduce power loss. In the energy and power grid sector, Schottky diodes play a vital role in renewable energy systems, such as solar inverters and wind turbines, where efficient power conversion is essential. Their ability to handle high frequencies and low power loss makes them ideal for maximizing energy output and reducing operational costs. In consumer electronics, Schottky diodes are used in power supplies, chargers, and voltage clamping circuits, where their efficiency and compact size contribute to the miniaturization and performance of electronic devices. Industrial applications benefit from Schottky diodes in motor drives, power supplies, and lighting systems, where their reliability and efficiency are critical for reducing energy consumption and enhancing system performance. In telecommunications, Schottky diodes are used in RF and microwave circuits, where their high-frequency performance and low noise characteristics are essential for signal integrity and communication efficiency. The avionics and military sectors rely on Schottky diodes for radar systems, communication equipment, and power management, where their robustness and reliability are crucial for mission-critical applications. In the medical field, Schottky diodes are used in imaging equipment, diagnostic devices, and power supplies, where their efficiency and low power loss contribute to the reliability and performance of medical equipment. Other applications include aerospace, where Schottky diodes are used in satellite communications and power systems, and the industrial automation sector, where they are used in control systems and robotics. The versatility and efficiency of Schottky diodes make them indispensable across these diverse sectors, driving the growth and innovation in the Global Schottky Diode Market.

Global Schottky Diode Market Outlook:

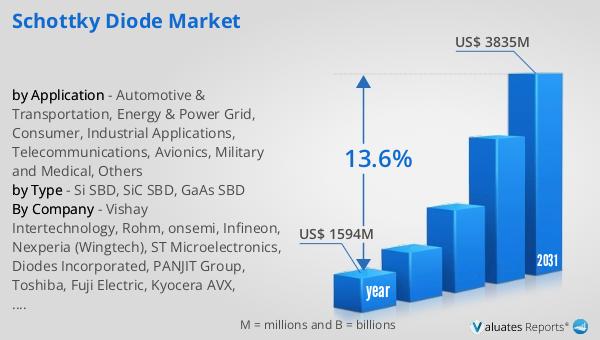

The worldwide market for Schottky Diodes was valued at approximately $1,594 million in 2024 and is anticipated to expand to a revised size of $3,835 million by 2031, reflecting a compound annual growth rate (CAGR) of 13.6% throughout the forecast period. A significant contributor to this growth is the burgeoning new energy vehicle market, particularly in China, where sales reached 9.495 million units, accounting for 64.8% of global sales. This surge in demand for energy-efficient vehicles is a key driver for the Schottky Diode Market, as these components are integral to the power management systems in electric and hybrid vehicles. In 2023, the United States and Europe also experienced notable growth in new energy vehicle sales, with figures reaching 2.94 million and 1.46 million units, respectively. The year-on-year growth rates for these regions were 18.3% and 48.0%, respectively, highlighting the increasing adoption of energy-efficient technologies. This trend underscores the growing importance of Schottky diodes in the automotive sector, as manufacturers seek to enhance the efficiency and performance of their vehicles. The expanding application areas and technological advancements in Schottky diodes are expected to further propel the market's growth, catering to the evolving needs of various industries.

| Report Metric | Details |

| Report Name | Schottky Diode Market |

| Accounted market size in year | US$ 1594 million |

| Forecasted market size in 2031 | US$ 3835 million |

| CAGR | 13.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Vishay Intertechnology, Rohm, onsemi, Infineon, Nexperia (Wingtech), ST Microelectronics, Diodes Incorporated, PANJIT Group, Toshiba, Fuji Electric, Kyocera AVX, Littelfuse (IXYS), Microchip (Microsemi), Sanken Electric, Texas Instruments, Bourns, Inc, Central Semiconductor Corp., Shindengen, MACOM, KEC Corporation, Wolfspeed, Unisonic Technologies (UTC), Hangzhou Silan Microelectronics, Yangzhou Yangjie Electronic Technology, China Resources Microelectronics Limited, Jilin Sino-Microelectronics, Jiangsu Jiejie Microelectronics, OmniVision Technologies, Suzhou Good-Ark Electronics, Changzhou Galaxy Century Microelectronics, Shandong Jingdao Microelectronics, Chongqing Pingwei Enterprise, Prisemi, Navitas (GeneSiC), Sanan IC, Mitsubishi Electric (Vincotech), GeneSiC Semiconductor Inc., Shenzhen BASiC Semiconductor, Renesas Electronics, Wayon Electronics, WeEn Semiconductors, SemiQ, Cissoid, Zhuzhou CRRC Times Electric, CETC 55 |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |