What is Global Rapid Microwave Oven Market?

The Global Rapid Microwave Oven Market is a comprehensive study of the current trends, growth indicators, and market dynamics of the microwave oven industry on a global scale. This market is primarily focused on the rapid microwave ovens, which are designed to cook and heat food at a faster pace than traditional microwave ovens. These ovens are equipped with advanced technologies and features that enhance their efficiency and usability. The market encompasses various types of rapid microwave ovens, including those designed for commercial and residential use, and those that are built-in or countertop models. The market analysis includes the evaluation of market size, product types, applications, and regional analysis. The market is driven by factors such as the increasing demand for energy-efficient appliances, the growing popularity of smart appliances, and the rising trend of home cooking.

Build-in, Counter Top in the Global Rapid Microwave Oven Market:

The Global Rapid Microwave Oven Market is segmented based on the type of microwave oven, namely, built-in and countertop. Built-in microwave ovens are integrated into the kitchen cabinetry or wall, offering a seamless look to the kitchen decor. They are typically more expensive than their countertop counterparts, but they offer more convenience and save counter space. On the other hand, countertop microwave ovens are portable and can be placed anywhere in the kitchen. They are more affordable and easier to install than built-in models. Both types of ovens have their own set of advantages and disadvantages, and the choice between the two largely depends on the user's needs, preferences, and budget. The market for both built-in and countertop rapid microwave ovens is growing, driven by factors such as the increasing demand for convenience in cooking, the rising trend of home cooking, and the growing popularity of smart appliances.

Commercial Appliances, Home Appliances in the Global Rapid Microwave Oven Market:

The Global Rapid Microwave Oven Market finds its application in two major areas, namely, commercial appliances and home appliances. In the commercial sector, rapid microwave ovens are used in restaurants, cafes, and other foodservice establishments for quick and efficient cooking. They are particularly useful in commercial settings where time is of the essence and large volumes of food need to be cooked or heated quickly. In the residential sector, rapid microwave ovens are used for everyday cooking and heating tasks. They offer convenience and speed, making them a popular choice among homeowners. The market for rapid microwave ovens in both commercial and residential sectors is growing, driven by factors such as the increasing demand for convenience in cooking, the rising trend of home cooking, and the growing popularity of smart appliances.

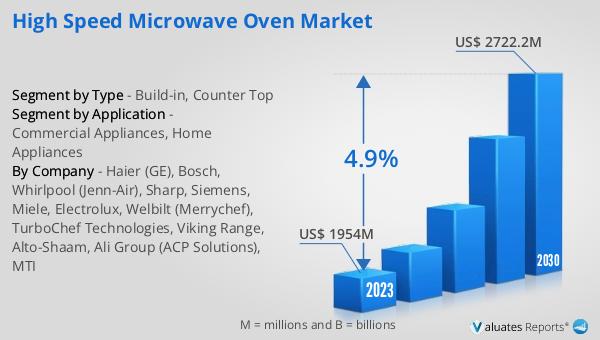

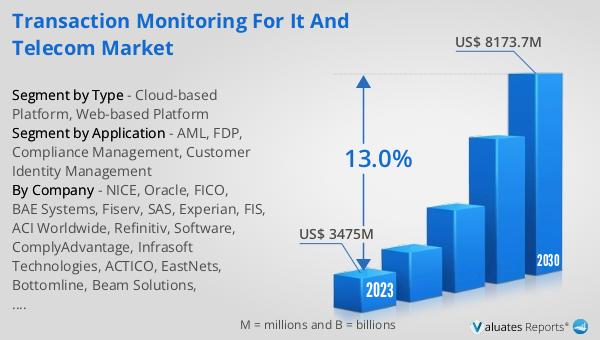

Global Rapid Microwave Oven Market Outlook:

The outlook for the Global Rapid Microwave Oven Market is promising. In 2023, the market was valued at US$ 1954 million. It is projected to reach a value of US$ 2722.2 million by 2030, growing at a Compound Annual Growth Rate (CAGR) of 4.9% during the forecast period from 2024 to 2030. This growth is driven by factors such as the increasing demand for energy-efficient appliances, the growing popularity of smart appliances, and the rising trend of home cooking. The market is also influenced by technological advancements and innovations in the microwave oven industry, which are expected to further drive the market growth in the coming years.

| Report Metric | Details |

| Report Name | Rapid Microwave Oven Market |

| Accounted market size in 2023 | US$ 1954 million |

| Forecasted market size in 2030 | US$ 2722.2 million |

| CAGR | 4.9% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | Haier (GE), Bosch, Whirlpool (Jenn-Air), Sharp, Siemens, Miele, Electrolux, Welbilt (Merrychef), TurboChef Technologies, Viking Range, Alto-Shaam, Ali Group (ACP Solutions), MTI |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |