What is Global Transaction Monitoring for Insurance Market?

Global Transaction Monitoring for Insurance Market is a comprehensive system that scrutinizes transactions in real-time or retrospectively to ensure that they are in compliance with regulatory and internal policies. This system is designed to detect and prevent fraudulent transactions, money laundering, and other financial crimes in the insurance sector. It involves the continuous monitoring of customer transactions to identify unusual patterns that could indicate fraudulent activity. This system is crucial for insurance companies as it helps them to maintain regulatory compliance, protect their reputation, and avoid hefty fines. It also provides a detailed analysis of customer behavior, which can be used to improve customer service and develop more effective marketing strategies.

Cloud-based Platform, Web-based Platform in the Global Transaction Monitoring for Insurance Market:

The Global Transaction Monitoring for Insurance Market is primarily divided into two platforms: Cloud-based and Web-based. The Cloud-based platform offers a flexible, scalable, and cost-effective solution for monitoring transactions. It allows insurance companies to store and analyze large volumes of transaction data in real-time. On the other hand, the Web-based platform provides a user-friendly interface for monitoring transactions. It allows users to access the system from any device with an internet connection, making it a convenient option for insurance companies with multiple locations. Both platforms provide robust security features to protect sensitive data from cyber threats. They also offer advanced analytics tools to identify trends and patterns in transaction data, which can be used to enhance decision-making and risk management strategies.

AML, FDP, Compliance Management, Customer Identity Management in the Global Transaction Monitoring for Insurance Market:

The Global Transaction Monitoring for Insurance Market is widely used in various areas such as Anti-Money Laundering (AML), Fraud Detection and Prevention (FDP), Compliance Management, and Customer Identity Management. In AML, it helps insurance companies to detect and report suspicious transactions to the relevant authorities. In FDP, it helps to identify fraudulent activities and take immediate action to prevent financial losses. In Compliance Management, it ensures that all transactions are in line with regulatory requirements and internal policies. In Customer Identity Management, it verifies the identity of customers and monitors their transactions to prevent identity theft and other forms of fraud. These applications of transaction monitoring help insurance companies to enhance their operational efficiency, improve customer trust, and maintain a competitive edge in the market.

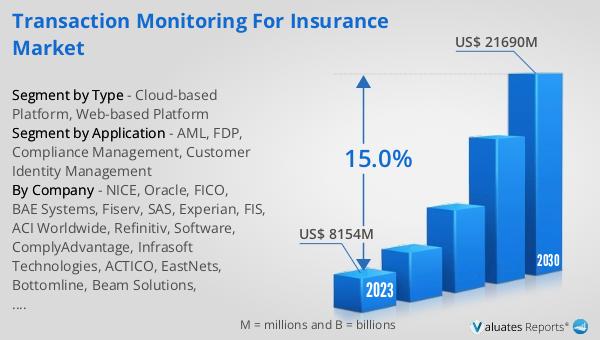

Global Transaction Monitoring for Insurance Market Outlook:

The future of the Global Transaction Monitoring for Insurance Market looks promising. In 2023, the market was valued at US$ 8154 million. It is expected to grow significantly over the next few years, reaching a value of US$ 21690 million by 2030. This represents a Compound Annual Growth Rate (CAGR) of 15.0% during the forecast period from 2024 to 2030. This growth can be attributed to the increasing need for insurance companies to comply with stringent regulatory requirements, prevent financial crimes, and enhance customer service. The adoption of advanced technologies such as artificial intelligence and machine learning is also expected to drive the growth of this market.

| Report Metric | Details |

| Report Name | Transaction Monitoring for Insurance Market |

| Accounted market size in 2023 | US$ 8154 million |

| Forecasted market size in 2030 | US$ 21690 million |

| CAGR | 15.0% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | NICE, Oracle, FICO, BAE Systems, Fiserv, SAS, Experian, FIS, ACI Worldwide, Refinitiv, Software, ComplyAdvantage, Infrasoft Technologies, ACTICO, EastNets, Bottomline, Beam Solutions, IdentityMind, CaseWare |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |