What is Global Transaction Monitoring for Government and Defense Market?

The Global Transaction Monitoring for Government and Defense Market is a crucial aspect of the modern financial landscape. It involves the tracking and analysis of transactions conducted by government and defense entities on a global scale. This process is essential for detecting and preventing fraudulent activities, ensuring regulatory compliance, and maintaining the integrity of financial systems. Transaction monitoring systems are designed to identify unusual or suspicious activities that may indicate potential fraud or money laundering. They use advanced algorithms and machine learning techniques to analyze transaction data and identify patterns that may indicate illegal activities. These systems are also used to ensure compliance with various regulations and standards, such as the Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Cloud-based Platform, Web-based Platform in the Global Transaction Monitoring for Government and Defense Market:

The Global Transaction Monitoring for Government and Defense Market is increasingly adopting cloud-based and web-based platforms. These platforms offer numerous benefits, including scalability, flexibility, and cost-effectiveness. Cloud-based platforms allow for the storage and analysis of large volumes of transaction data in a secure and efficient manner. They also provide real-time monitoring capabilities, enabling government and defense entities to detect and respond to suspicious activities promptly. On the other hand, web-based platforms offer easy access to transaction monitoring systems from any location, making them ideal for organizations with a global presence. These platforms also support integration with other systems, enhancing their functionality and efficiency.

AML, FDP, Compliance Management, Customer Identity Management in the Global Transaction Monitoring for Government and Defense Market:

The Global Transaction Monitoring for Government and Defense Market is widely used in various areas, including Anti-Money Laundering (AML), Fraud Detection and Prevention (FDP), Compliance Management, and Customer Identity Management. In AML, transaction monitoring systems are used to detect and report suspicious activities that may indicate money laundering. In FDP, these systems are used to identify and prevent fraudulent transactions, thereby protecting the financial assets of government and defense entities. In Compliance Management, transaction monitoring systems are used to ensure adherence to various regulations and standards. Lastly, in Customer Identity Management, these systems are used to verify the identity of customers and prevent identity theft.

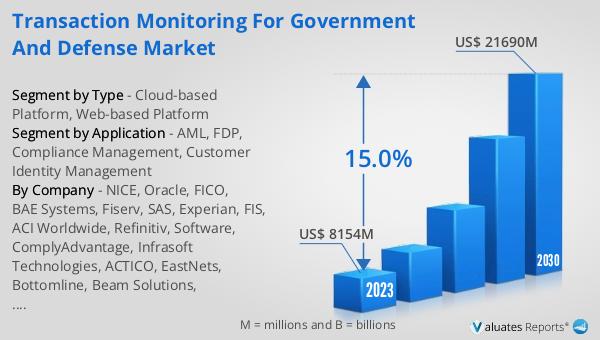

Global Transaction Monitoring for Government and Defense Market Outlook:

The Global Transaction Monitoring for Government and Defense Market has shown significant growth in recent years. In 2023, the market was valued at US$ 8154 million. However, it is expected to reach a staggering value of US$ 21690 million by 2030. This represents a Compound Annual Growth Rate (CAGR) of 15.0% during the forecast period from 2024 to 2030. This growth can be attributed to the increasing need for effective transaction monitoring systems to combat financial fraud and ensure regulatory compliance in the government and defense sectors.

| Report Metric | Details |

| Report Name | Transaction Monitoring for Government and Defense Market |

| Accounted market size in 2023 | US$ 8154 million |

| Forecasted market size in 2030 | US$ 21690 million |

| CAGR | 15.0% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | NICE, Oracle, FICO, BAE Systems, Fiserv, SAS, Experian, FIS, ACI Worldwide, Refinitiv, Software, ComplyAdvantage, Infrasoft Technologies, ACTICO, EastNets, Bottomline, Beam Solutions, IdentityMind, CaseWare |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |