What is Global Feed Grade Astaxanthin Market?

The Global Feed Grade Astaxanthin Market is a specialized segment within the broader astaxanthin industry, focusing on the production and distribution of astaxanthin specifically for animal feed applications. Astaxanthin is a naturally occurring carotenoid pigment, renowned for its vibrant red-orange color, and is primarily used to enhance the pigmentation of farmed animals such as fish and poultry. This market is driven by the increasing demand for high-quality animal products, as consumers become more health-conscious and seek out foods rich in nutrients and antioxidants. Feed grade astaxanthin is particularly valued for its ability to improve the coloration of fish like salmon and trout, making them more appealing to consumers. Additionally, it is believed to offer health benefits to animals, such as boosting immune function and improving growth rates. The market is characterized by a mix of natural and synthetic astaxanthin products, with ongoing research and development efforts aimed at improving production efficiency and reducing costs. As the aquaculture and poultry industries continue to expand globally, the demand for feed grade astaxanthin is expected to grow, driven by the need for sustainable and efficient feed solutions.

Natural Astaxanthin, Synthetic Astaxanthin in the Global Feed Grade Astaxanthin Market:

Natural astaxanthin is derived from sources such as the microalgae Haematococcus pluvialis, which is known for its high astaxanthin content. This natural form is highly sought after due to its perceived health benefits and sustainability. The production process involves cultivating the algae in controlled environments, where they are exposed to stress conditions that trigger astaxanthin accumulation. Once harvested, the algae are processed to extract the astaxanthin, which is then formulated into feed products. Natural astaxanthin is often preferred in the market due to its antioxidant properties, which are believed to be superior to those of synthetic alternatives. It is also considered more environmentally friendly, as it is derived from renewable sources. On the other hand, synthetic astaxanthin is produced through chemical synthesis, offering a more cost-effective solution for large-scale production. This form is chemically identical to natural astaxanthin, but its production involves petrochemical processes, which can raise environmental and sustainability concerns. Despite these concerns, synthetic astaxanthin remains popular due to its lower cost and consistent quality. In the Global Feed Grade Astaxanthin Market, both natural and synthetic forms play crucial roles, catering to different segments of the industry. Natural astaxanthin is often used in premium products, where sustainability and natural sourcing are key selling points. Meanwhile, synthetic astaxanthin is favored in more cost-sensitive applications, where price and availability are the primary considerations. The choice between natural and synthetic astaxanthin often depends on factors such as cost, availability, and consumer preferences. As the market evolves, there is a growing interest in developing more sustainable and efficient production methods for both forms of astaxanthin. This includes exploring alternative natural sources, improving algae cultivation techniques, and optimizing chemical synthesis processes. Additionally, regulatory considerations play a significant role in shaping the market, as different regions have varying standards and requirements for feed additives. Companies operating in this space must navigate these regulatory landscapes to ensure compliance and market access. Overall, the Global Feed Grade Astaxanthin Market is a dynamic and evolving sector, driven by the interplay between natural and synthetic astaxanthin, consumer preferences, and industry trends.

Poultry, Fish, Others in the Global Feed Grade Astaxanthin Market:

The usage of Global Feed Grade Astaxanthin Market in poultry, fish, and other areas highlights its versatility and importance in animal nutrition. In the poultry industry, astaxanthin is primarily used to enhance the coloration of egg yolks and broiler skin, which are important quality attributes for consumers. The vibrant yellow-orange color of egg yolks is often associated with freshness and nutritional value, making astaxanthin a valuable additive for poultry feed. Additionally, astaxanthin is believed to offer health benefits to poultry, such as improved immune function and reduced oxidative stress, which can lead to better growth rates and overall health. In the aquaculture sector, astaxanthin is essential for the pigmentation of fish species like salmon and trout. These fish naturally accumulate astaxanthin in the wild, giving them their characteristic pink-red color. In farmed fish, astaxanthin is added to the feed to replicate this natural coloration, which is a key factor in consumer acceptance and marketability. Beyond its role in pigmentation, astaxanthin is also valued for its potential health benefits in fish, including enhanced growth, improved stress resistance, and better reproductive performance. The use of astaxanthin in aquaculture is driven by the need to produce high-quality, visually appealing fish that meet consumer expectations. In addition to poultry and fish, astaxanthin is also used in other areas of animal nutrition, such as pet food and livestock feed. In pet food, astaxanthin is added for its antioxidant properties, which can support the health and well-being of pets. It is believed to contribute to improved skin and coat condition, enhanced immune function, and overall vitality. In livestock feed, astaxanthin is used to improve the health and productivity of animals, although its use is less common compared to poultry and aquaculture. The versatility of astaxanthin in animal nutrition underscores its importance as a feed additive, with applications across a wide range of species and production systems. As the demand for high-quality animal products continues to grow, the use of astaxanthin in feed is expected to increase, driven by its benefits in pigmentation, health, and performance.

Global Feed Grade Astaxanthin Market Outlook:

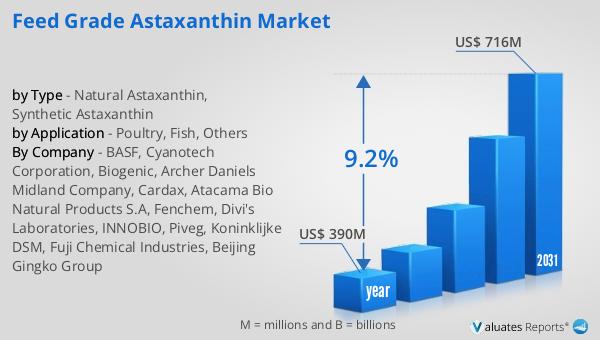

In 2024, the global market for Feed Grade Astaxanthin was valued at approximately $390 million. Looking ahead, this market is anticipated to expand significantly, reaching an estimated size of $716 million by the year 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 9.2% over the forecast period. This robust growth can be attributed to several factors, including the increasing demand for high-quality animal products and the rising awareness of the benefits of astaxanthin in animal nutrition. As consumers become more health-conscious, there is a growing preference for foods that are rich in nutrients and antioxidants, driving the demand for astaxanthin-enriched animal products. Additionally, the expansion of the aquaculture and poultry industries globally is contributing to the increased demand for feed grade astaxanthin. As these industries continue to grow, the need for sustainable and efficient feed solutions becomes more pressing, further fueling the market's expansion. The market's growth is also supported by ongoing research and development efforts aimed at improving production efficiency and reducing costs, making astaxanthin more accessible to a wider range of applications. Overall, the Global Feed Grade Astaxanthin Market is poised for significant growth, driven by the interplay of consumer preferences, industry trends, and technological advancements.

| Report Metric | Details |

| Report Name | Feed Grade Astaxanthin Market |

| Accounted market size in year | US$ 390 million |

| Forecasted market size in 2031 | US$ 716 million |

| CAGR | 9.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | BASF, Cyanotech Corporation, Biogenic, Archer Daniels Midland Company, Cardax, Atacama Bio Natural Products S.A, Fenchem, Divi's Laboratories, INNOBIO, Piveg, Koninklijke DSM, Fuji Chemical Industries, Beijing Gingko Group |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |