What is Global Binder for Lithium-Ion Batteries Market?

The Global Binder for Lithium-Ion Batteries Market is a crucial component in the production of lithium-ion batteries, which are widely used in various applications such as consumer electronics, electric vehicles, and energy storage systems. Binders are essential materials that hold the active material particles together within the electrode, ensuring structural integrity and enhancing the battery's overall performance. These binders are typically made from polymers and play a significant role in determining the battery's efficiency, lifespan, and safety. The market for these binders is expanding rapidly due to the increasing demand for lithium-ion batteries, driven by the growing adoption of electric vehicles and renewable energy storage solutions. As technology advances, the development of more efficient and environmentally friendly binders is becoming a focal point for manufacturers, aiming to improve battery performance while reducing costs and environmental impact. The global market is characterized by intense competition among key players, with a strong emphasis on research and development to innovate and meet the evolving needs of the battery industry. This dynamic market is poised for significant growth as the world continues to transition towards cleaner energy solutions and sustainable technologies.

Anode Binder, Cathode Binder in the Global Binder for Lithium-Ion Batteries Market:

Anode and cathode binders are integral components of the lithium-ion battery manufacturing process, each serving distinct roles in the battery's functionality. Anode binders are used in the negative electrode of the battery, where they help to hold the active material, typically graphite, together. This ensures that the anode maintains its structural integrity during the charge and discharge cycles, which is crucial for the battery's longevity and performance. Anode binders must possess excellent adhesion properties, flexibility, and chemical stability to withstand the battery's operational conditions. They are often made from materials such as polyvinylidene fluoride (PVDF) or carboxymethyl cellulose (CMC), which provide the necessary binding strength and resilience. On the other hand, cathode binders are used in the positive electrode, where they bind the active material, usually lithium metal oxides, to the current collector. The cathode binder's role is to ensure that the active material remains in place during the battery's operation, preventing any loss of contact that could lead to reduced efficiency or failure. Like anode binders, cathode binders must exhibit strong adhesion, chemical resistance, and thermal stability. The choice of binder material can significantly impact the battery's performance, with PVDF being a popular choice due to its excellent chemical resistance and mechanical properties. However, there is a growing interest in developing alternative binder materials that are more environmentally friendly and cost-effective. The global market for anode and cathode binders is driven by the increasing demand for high-performance lithium-ion batteries, particularly in the electric vehicle and renewable energy sectors. Manufacturers are investing heavily in research and development to create binders that enhance battery performance, reduce costs, and minimize environmental impact. This includes exploring new materials and formulations that offer improved binding properties, greater thermal stability, and enhanced compatibility with various electrode materials. As the demand for lithium-ion batteries continues to rise, the market for anode and cathode binders is expected to grow significantly, with a focus on innovation and sustainability.

Digital Battery, Energy Storage Battery, Power Battery in the Global Binder for Lithium-Ion Batteries Market:

The usage of global binders for lithium-ion batteries spans across various applications, including digital batteries, energy storage batteries, and power batteries, each with specific requirements and challenges. In digital batteries, which are commonly used in consumer electronics such as smartphones, laptops, and tablets, binders play a crucial role in ensuring the battery's compact size, lightweight, and high energy density. The binders used in these applications must provide excellent adhesion and flexibility to accommodate the frequent charging and discharging cycles typical of consumer electronics. They also need to be compatible with the miniaturized design of digital devices, ensuring that the battery can deliver consistent performance over its lifespan. In energy storage batteries, which are used in renewable energy systems to store energy generated from sources like solar and wind, binders are essential for maintaining the battery's stability and efficiency over long periods. These batteries require binders that can withstand extended cycles and varying environmental conditions, ensuring reliable energy storage and delivery. The binders must also support the high capacity and long lifespan needed for effective energy storage solutions. In power batteries, which are primarily used in electric vehicles and other high-power applications, binders are critical for ensuring the battery's safety, performance, and durability. Power batteries demand binders that can handle high discharge rates and provide robust mechanical support to the electrode materials. The binders must also offer excellent thermal stability and chemical resistance to prevent degradation under the intense conditions experienced during high-power applications. As the demand for digital, energy storage, and power batteries continues to grow, the global binder market is evolving to meet the specific needs of each application. Manufacturers are focusing on developing advanced binder materials that enhance battery performance, extend lifespan, and reduce environmental impact. This includes exploring new polymer formulations, improving binder processing techniques, and optimizing binder-electrode interactions to achieve better battery performance across all applications.

Global Binder for Lithium-Ion Batteries Market Outlook:

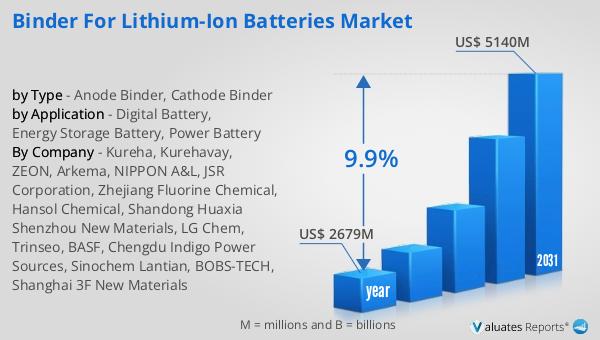

In 2024, the global market for binders used in lithium-ion batteries was valued at approximately $2,679 million. By 2031, this market is expected to grow significantly, reaching an estimated size of $5,140 million, with a compound annual growth rate (CAGR) of 9.9% during the forecast period. The market is dominated by the top three companies, which collectively hold about 31% of the market share. China stands out as the largest market for these binders, commanding a substantial 73% share, followed by Japan and Europe, with market shares of 15% and 5%, respectively. When examining product types, cathode binders emerge as the largest segment, accounting for approximately 51% of the market share. In terms of application, power batteries represent the largest downstream segment, making up about 72% of the market share. This growth is driven by the increasing demand for lithium-ion batteries across various sectors, including electric vehicles, consumer electronics, and renewable energy storage systems. As the market continues to expand, manufacturers are focusing on innovation and sustainability to meet the evolving needs of the industry and capitalize on the growing demand for high-performance, environmentally friendly battery solutions.

| Report Metric | Details |

| Report Name | Binder for Lithium-Ion Batteries Market |

| Accounted market size in year | US$ 2679 million |

| Forecasted market size in 2031 | US$ 5140 million |

| CAGR | 9.9% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Kureha, Kurehavay, ZEON, Arkema, NIPPON A&L, JSR Corporation, Zhejiang Fluorine Chemical, Hansol Chemical, Shandong Huaxia Shenzhou New Materials, LG Chem, Trinseo, BASF, Chengdu Indigo Power Sources, Sinochem Lantian, BOBS-TECH, Shanghai 3F New Materials |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |