What is Global Smart Payment Cards Market?

The Global Smart Payment Cards Market refers to the worldwide industry focused on the production, distribution, and utilization of smart payment cards. These cards are embedded with microprocessor chips that enhance security and functionality compared to traditional magnetic stripe cards. The market encompasses various types of smart cards, including contact-based and contactless cards, which are used for a wide range of applications such as banking, retail, transportation, and more. The growth of this market is driven by the increasing demand for secure and efficient payment methods, technological advancements, and the rising adoption of digital payment solutions across the globe. As consumers and businesses continue to seek more secure and convenient payment options, the smart payment cards market is expected to expand, offering innovative solutions to meet these needs. The market is characterized by a diverse range of players, including card manufacturers, technology providers, and financial institutions, all working together to enhance the capabilities and reach of smart payment cards. The ongoing evolution of payment technologies and the increasing emphasis on security and user experience are key factors shaping the future of the Global Smart Payment Cards Market.

Contact-based Smart Payment Cards, Contactless Smart Payment Cards in the Global Smart Payment Cards Market:

Contact-based Smart Payment Cards are a type of smart card that requires physical contact with a card reader to complete a transaction. These cards are equipped with a microprocessor chip that stores and processes data, providing enhanced security features compared to traditional magnetic stripe cards. When a contact-based smart card is inserted into a reader, the chip establishes a secure connection, allowing for the exchange of encrypted data. This process ensures that sensitive information, such as personal identification numbers (PINs) and account details, is protected from unauthorized access. Contact-based smart cards are widely used in various sectors, including banking, government, and healthcare, where security and data integrity are of utmost importance. They offer a reliable and secure method for conducting transactions, making them a popular choice for applications that require high levels of security and authentication. On the other hand, Contactless Smart Payment Cards offer a more convenient and faster way to make payments. These cards use radio-frequency identification (RFID) or near-field communication (NFC) technology to communicate with a card reader without the need for physical contact. Users simply need to tap or wave their card near a compatible reader to complete a transaction. This contactless feature significantly reduces transaction times and enhances the overall user experience, making it ideal for environments where speed and convenience are crucial, such as public transportation and retail. Contactless smart cards are becoming increasingly popular due to their ease of use and the growing acceptance of contactless payment systems worldwide. The Global Smart Payment Cards Market is witnessing a shift towards contactless solutions, driven by the demand for faster and more convenient payment methods. As consumers become more accustomed to the ease and speed of contactless transactions, businesses and financial institutions are investing in the necessary infrastructure to support this technology. This shift is further accelerated by the ongoing advancements in NFC and RFID technologies, which are making contactless payments more secure and reliable. Additionally, the COVID-19 pandemic has highlighted the importance of contactless solutions, as they minimize physical contact and reduce the risk of virus transmission. Despite the growing popularity of contactless smart cards, contact-based cards continue to play a significant role in the market. They are particularly favored in sectors where security is paramount, such as banking and government. The dual presence of contact-based and contactless smart cards in the market reflects the diverse needs and preferences of consumers and businesses. While contactless cards offer convenience and speed, contact-based cards provide an added layer of security, making them suitable for high-value transactions and applications that require stringent authentication measures. In conclusion, the Global Smart Payment Cards Market is characterized by the coexistence of contact-based and contactless smart cards, each catering to different needs and preferences. As technology continues to evolve, the market is likely to see further innovations and improvements in both types of smart cards, enhancing their security, functionality, and user experience. The ongoing advancements in payment technologies and the increasing emphasis on security and convenience are key factors driving the growth and evolution of the smart payment cards market.

Banking, Financial Services, and Insurance, Government and Healthcare, Transportation, Retail, Others in the Global Smart Payment Cards Market:

The Global Smart Payment Cards Market finds extensive usage across various sectors, including Banking, Financial Services, and Insurance (BFSI), Government and Healthcare, Transportation, Retail, and others. In the BFSI sector, smart payment cards are widely used for secure and efficient transactions. They offer enhanced security features, such as encryption and authentication, which help protect sensitive financial information from fraud and unauthorized access. Smart cards also enable seamless integration with digital banking platforms, allowing users to manage their accounts and conduct transactions with ease. The adoption of smart payment cards in the BFSI sector is driven by the need for secure and convenient payment solutions that enhance customer experience and streamline financial operations. In the Government and Healthcare sectors, smart payment cards are used for identity verification, access control, and secure transactions. Governments around the world are increasingly adopting smart cards for national identification programs, social security, and public services. These cards provide a secure and efficient way to manage citizen data and deliver government services. In the healthcare sector, smart cards are used to store and manage patient information, ensuring secure access to medical records and facilitating seamless communication between healthcare providers. The use of smart payment cards in these sectors enhances security, improves operational efficiency, and ensures the integrity of sensitive data. The Transportation sector is another key area where smart payment cards are extensively used. Contactless smart cards are particularly popular in public transportation systems, where they offer a convenient and efficient way for passengers to pay for their journeys. These cards enable quick and seamless transactions, reducing waiting times and improving the overall passenger experience. Smart payment cards are also used in toll collection systems, parking facilities, and other transportation-related services, providing a secure and efficient payment solution that enhances operational efficiency and customer satisfaction. In the Retail sector, smart payment cards are used to facilitate secure and convenient transactions. Contactless smart cards, in particular, are gaining popularity among retailers due to their ability to speed up the checkout process and enhance the overall shopping experience. These cards enable quick and secure payments, reducing transaction times and minimizing the risk of fraud. Retailers are increasingly adopting smart payment cards to meet the growing demand for contactless payment solutions and improve customer satisfaction. Beyond these sectors, smart payment cards are also used in various other applications, such as access control, loyalty programs, and prepaid services. They offer a versatile and secure solution for managing transactions and data across different industries. The widespread adoption of smart payment cards in these areas is driven by the need for secure, efficient, and convenient payment solutions that enhance user experience and operational efficiency. In summary, the Global Smart Payment Cards Market plays a crucial role in various sectors, providing secure and efficient payment solutions that enhance user experience and operational efficiency. The adoption of smart payment cards is driven by the need for secure and convenient payment methods, technological advancements, and the growing acceptance of digital payment solutions across the globe. As the market continues to evolve, smart payment cards are expected to play an increasingly important role in shaping the future of payments and transactions across different industries.

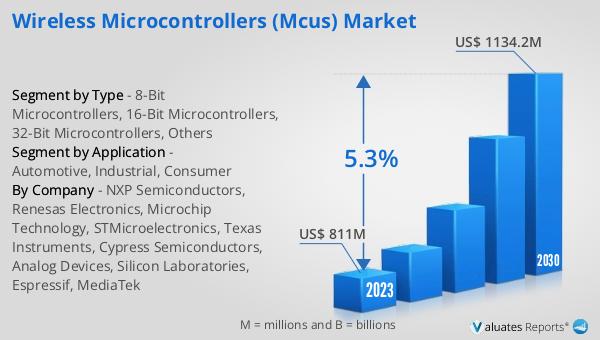

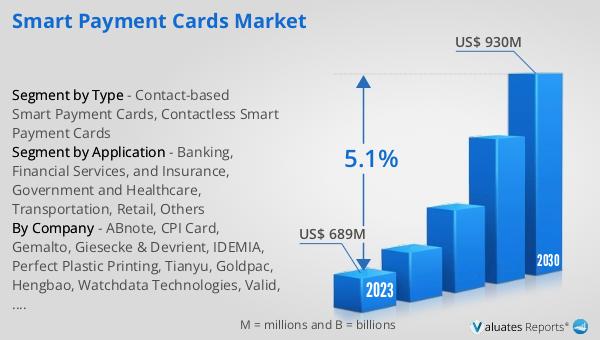

Global Smart Payment Cards Market Outlook:

The global market for Smart Payment Cards was valued at $722 million in 2024 and is anticipated to grow to a revised size of $1,017 million by 2031, reflecting a compound annual growth rate (CAGR) of 5.1% over the forecast period. This growth trajectory underscores the increasing demand for secure and efficient payment solutions worldwide. The market's expansion is driven by several factors, including the rising adoption of digital payment methods, technological advancements in payment card technology, and the growing emphasis on security and user experience. As consumers and businesses continue to seek more secure and convenient payment options, the smart payment cards market is poised for significant growth. The market's evolution is characterized by the development of innovative solutions that cater to the diverse needs of consumers and businesses, enhancing the capabilities and reach of smart payment cards. The ongoing advancements in payment technologies and the increasing emphasis on security and convenience are key factors shaping the future of the Global Smart Payment Cards Market. As the market continues to grow, smart payment cards are expected to play an increasingly important role in shaping the future of payments and transactions across different industries.

| Report Metric | Details |

| Report Name | Smart Payment Cards Market |

| Accounted market size in year | US$ 722 million |

| Forecasted market size in 2031 | US$ 1017 million |

| CAGR | 5.1% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | ABnote, CPI Card, Gemalto, Giesecke & Devrient, IDEMIA, Perfect Plastic Printing, Tianyu, Goldpac, Hengbao, Watchdata Technologies, Valid, Kona I, Wuhan Tianyu, Eastcompeace |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |