What is Global Metallurgical Grade Fluorite Fine Powder Market?

The Global Metallurgical Grade Fluorite Fine Powder Market is a specialized segment within the broader fluorite market, focusing on the production and distribution of fine powder fluorite used primarily in metallurgical applications. Fluorite, also known as fluorspar, is a mineral composed of calcium fluoride and is a critical raw material in various industrial processes. The metallurgical grade fluorite fine powder is particularly valued for its role as a flux in steelmaking and aluminum production, where it helps to lower the melting point of raw materials, remove impurities, and improve the fluidity of slag. This market is driven by the demand from industries that require high-quality fluxing agents to enhance the efficiency and quality of their metal production processes. The market's growth is influenced by factors such as the expansion of the steel and aluminum industries, technological advancements in metallurgy, and the availability of fluorite resources. Additionally, environmental regulations and sustainability concerns are shaping the market dynamics, as companies seek to optimize their processes and reduce their environmental footprint. Overall, the Global Metallurgical Grade Fluorite Fine Powder Market plays a crucial role in supporting the metallurgical industry's efforts to produce high-quality metals efficiently and sustainably.

Purity: Below 90%, Purity: 90%-85%, Purity: Above 95% in the Global Metallurgical Grade Fluorite Fine Powder Market:

In the Global Metallurgical Grade Fluorite Fine Powder Market, the purity of the fluorite fine powder is a critical factor that determines its suitability for various applications. The market is segmented based on the purity levels of the fluorite fine powder, which include Purity: Below 90%, Purity: 90%-95%, and Purity: Above 95%. Each of these purity levels serves different purposes and caters to specific industrial needs. Fluorite fine powder with Purity: Below 90% is typically used in applications where the presence of impurities does not significantly affect the end product's quality. This grade is often utilized in basic metallurgical processes where cost-effectiveness is a priority over high purity. It is suitable for use in industries where the primary goal is to achieve a basic level of fluxing without incurring high costs. On the other hand, fluorite fine powder with Purity: 90%-95% is more refined and is used in applications that require a higher degree of purity to ensure the quality of the final product. This grade is commonly used in the production of steel and aluminum, where the presence of impurities can adversely affect the metal's properties. The higher purity level helps in achieving better control over the metallurgical processes, resulting in improved product quality and performance. Finally, fluorite fine powder with Purity: Above 95% is the highest grade available in the market and is used in applications that demand the utmost purity. This grade is essential for high-precision metallurgical processes where even trace amounts of impurities can lead to significant defects in the final product. Industries such as electronics and high-performance alloys rely on this high-purity fluorite to ensure the integrity and performance of their products. The demand for high-purity fluorite fine powder is driven by the need for advanced materials and technologies that require precise control over the composition and properties of the metals used. In summary, the Global Metallurgical Grade Fluorite Fine Powder Market offers a range of products with varying purity levels to meet the diverse needs of different industries. Each purity level has its own set of applications and benefits, allowing companies to choose the most suitable product for their specific requirements. As industries continue to evolve and demand higher quality materials, the importance of purity in fluorite fine powder is expected to grow, driving further innovation and development in this market.

Metallurgy, Industrial, Others in the Global Metallurgical Grade Fluorite Fine Powder Market:

The Global Metallurgical Grade Fluorite Fine Powder Market finds its usage across various sectors, including metallurgy, industrial applications, and other niche areas. In metallurgy, fluorite fine powder is primarily used as a fluxing agent in the production of steel and aluminum. It helps in reducing the melting point of raw materials, facilitating the removal of impurities, and improving the fluidity of slag. This results in enhanced efficiency and quality of the metal production process. The use of fluorite fine powder in metallurgy is crucial for achieving the desired properties in the final metal products, such as strength, durability, and resistance to corrosion. In industrial applications, fluorite fine powder is used in the manufacturing of glass, ceramics, and cement. It acts as a fluxing agent in glass production, helping to lower the melting temperature and improve the clarity and quality of the glass. In ceramics, fluorite fine powder is used to enhance the thermal and mechanical properties of the final products. In the cement industry, it is used as a mineralizer to improve the efficiency of the clinkerization process and reduce energy consumption. Beyond these traditional applications, fluorite fine powder is also used in other niche areas such as the production of hydrofluoric acid, which is a key raw material for the chemical industry. Hydrofluoric acid is used in the production of various fluorine-containing compounds, including refrigerants, pharmaceuticals, and agrochemicals. The versatility of fluorite fine powder makes it an essential component in a wide range of industrial processes, contributing to the development of advanced materials and technologies. Overall, the Global Metallurgical Grade Fluorite Fine Powder Market plays a vital role in supporting various industries by providing a reliable and efficient fluxing agent that enhances the quality and performance of their products.

Global Metallurgical Grade Fluorite Fine Powder Market Outlook:

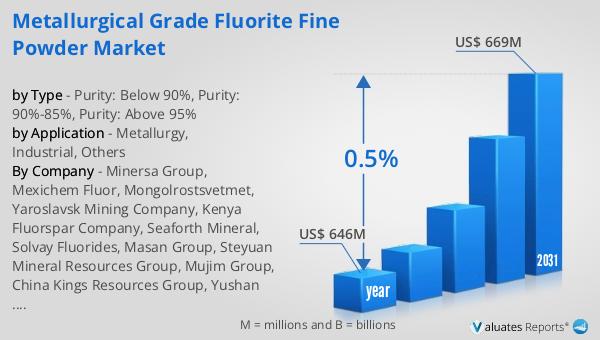

The global market for Metallurgical Grade Fluorite Fine Powder was valued at approximately $646 million in 2024, with projections indicating a growth to around $669 million by 2031. This growth represents a compound annual growth rate (CAGR) of 0.5% over the forecast period. The market's steady growth can be attributed to the consistent demand from industries such as steel and aluminum production, where fluorite fine powder is used as a fluxing agent to improve the efficiency and quality of metal production processes. Despite the relatively modest growth rate, the market remains an essential component of the metallurgical industry, providing critical raw materials that support the production of high-quality metals. The market's outlook is influenced by factors such as technological advancements in metallurgy, environmental regulations, and the availability of fluorite resources. As industries continue to seek ways to optimize their processes and reduce their environmental impact, the demand for high-quality fluxing agents like metallurgical grade fluorite fine powder is expected to remain strong. Overall, the Global Metallurgical Grade Fluorite Fine Powder Market is poised for steady growth, driven by the ongoing need for efficient and sustainable metal production solutions.

| Report Metric | Details |

| Report Name | Metallurgical Grade Fluorite Fine Powder Market |

| Accounted market size in year | US$ 646 million |

| Forecasted market size in 2031 | US$ 669 million |

| CAGR | 0.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Minersa Group, Mexichem Fluor, Mongolrostsvetmet, Yaroslavsk Mining Company, Kenya Fluorspar Company, Seaforth Mineral, Solvay Fluorides, Masan Group, Steyuan Mineral Resources Group, Mujim Group, China Kings Resources Group, Yushan Fengyuan Fluoride Chemical, Wuyi Shenlong Flotation, Inner Mongolia Xiang Zhen Mining, Hunan Nonferrous Chenzhou Fluoride |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |