What is Global LED Packaging Material Market?

The Global LED Packaging Material Market refers to the industry that supplies materials used in the packaging of LED (Light Emitting Diode) components. These materials are crucial for protecting the LED chips and ensuring their optimal performance and longevity. The packaging process involves encasing the LED chip in a protective shell, which not only safeguards it from environmental factors like moisture and dust but also enhances its light output and efficiency. The materials used in this process include substrates, encapsulants, phosphors, and others, each playing a vital role in the overall functionality of the LED. The market for these materials is driven by the increasing demand for LEDs in various applications such as lighting, displays, and automotive sectors. As technology advances, the need for more efficient and durable packaging materials grows, pushing manufacturers to innovate and improve their offerings. This market is characterized by rapid technological advancements and a constant push towards more sustainable and cost-effective solutions. The global LED packaging material market is a dynamic and evolving sector, reflecting the broader trends in the LED industry and the increasing emphasis on energy-efficient lighting solutions.

Epoxy Resin, Silicone in the Global LED Packaging Material Market:

Epoxy resin and silicone are two critical materials used in the Global LED Packaging Material Market, each offering unique properties that make them suitable for different applications. Epoxy resin is a thermosetting polymer known for its excellent adhesive properties, chemical resistance, and mechanical strength. In the context of LED packaging, epoxy resin is primarily used as an encapsulant, providing a protective layer over the LED chip. This layer not only shields the chip from environmental factors such as moisture and dust but also enhances its mechanical stability. Epoxy resins are favored for their cost-effectiveness and ease of processing, making them a popular choice for mass production of LEDs. However, they have limitations, such as a tendency to yellow over time, which can affect the light quality of the LED. On the other hand, silicone is a versatile material known for its flexibility, thermal stability, and optical clarity. Silicone encapsulants are used in LED packaging to provide a protective layer that maintains its clarity and performance over a wide temperature range. Unlike epoxy, silicone does not yellow over time, making it ideal for applications where long-term optical clarity is essential. Silicone's flexibility also allows it to absorb mechanical stresses, reducing the risk of damage to the LED chip. This makes silicone a preferred choice for high-performance and high-reliability LED applications, such as automotive lighting and outdoor displays. The choice between epoxy resin and silicone in LED packaging depends on various factors, including the specific application requirements, cost considerations, and desired performance characteristics. While epoxy resins offer a cost-effective solution for general-purpose LEDs, silicone provides superior performance for demanding applications where long-term reliability and optical clarity are critical. As the LED industry continues to evolve, the demand for advanced packaging materials like epoxy resin and silicone is expected to grow, driven by the need for more efficient, durable, and versatile LED solutions. Manufacturers are continually exploring new formulations and processing techniques to enhance the properties of these materials, ensuring they meet the ever-changing demands of the LED market. The ongoing research and development efforts in this field are focused on improving the thermal management, optical performance, and environmental resistance of LED packaging materials, paving the way for the next generation of LED technologies.

LED Display, LED Backlight in the Global LED Packaging Material Market:

The Global LED Packaging Material Market plays a crucial role in the development and performance of LED displays and LED backlights, two key areas where LEDs are extensively used. In LED displays, packaging materials are essential for protecting the LED chips and ensuring optimal light output and color quality. The encapsulants used in LED packaging, such as epoxy resin and silicone, help maintain the integrity of the LED chips by shielding them from environmental factors like moisture and dust. This protection is vital for maintaining the brightness and color consistency of LED displays, which are used in a wide range of applications, from televisions and computer monitors to digital signage and billboards. The choice of packaging material can significantly impact the performance and longevity of LED displays, with silicone being a preferred option for high-end applications due to its superior optical clarity and thermal stability. In the context of LED backlights, packaging materials are equally important. LED backlights are used in various devices, including smartphones, tablets, and televisions, to provide uniform illumination behind the display panel. The packaging materials used in LED backlights must ensure efficient light transmission and thermal management to maintain the performance and reliability of the LEDs. Silicone encapsulants are often used in LED backlights due to their excellent optical properties and ability to withstand high temperatures. The flexibility of silicone also allows it to absorb mechanical stresses, reducing the risk of damage to the LED chips during operation. As the demand for high-quality displays and backlighting solutions continues to grow, the need for advanced LED packaging materials is expected to increase. Manufacturers are continually exploring new materials and technologies to enhance the performance and efficiency of LED displays and backlights, ensuring they meet the evolving needs of consumers and industries. The Global LED Packaging Material Market is a dynamic and rapidly evolving sector, driven by the increasing demand for energy-efficient and high-performance LED solutions in various applications.

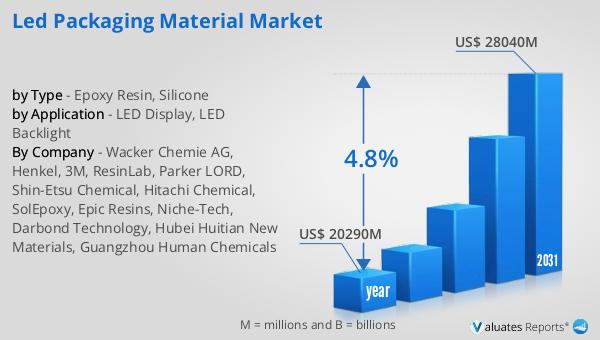

Global LED Packaging Material Market Outlook:

The global market for LED Packaging Material was valued at approximately $20,290 million in 2024, and it is anticipated to expand to a revised size of around $28,040 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 4.8% over the forecast period. This upward trend in the market is indicative of the increasing demand for LED technologies across various sectors, including consumer electronics, automotive, and general lighting. The growth is driven by the rising adoption of energy-efficient lighting solutions and the continuous advancements in LED technology, which require high-quality packaging materials to ensure optimal performance and longevity. The market's expansion is also fueled by the growing emphasis on sustainability and the need for environmentally friendly lighting solutions. As the LED industry continues to evolve, the demand for advanced packaging materials that offer superior thermal management, optical performance, and environmental resistance is expected to rise. This growth presents significant opportunities for manufacturers and suppliers in the LED packaging material market to innovate and develop new solutions that meet the changing needs of the industry. The market's positive outlook reflects the broader trends in the LED industry and the increasing focus on energy efficiency and sustainability in lighting solutions.

| Report Metric | Details |

| Report Name | LED Packaging Material Market |

| Accounted market size in year | US$ 20290 million |

| Forecasted market size in 2031 | US$ 28040 million |

| CAGR | 4.8% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Wacker Chemie AG, Henkel, 3M, ResinLab, Parker LORD, Shin-Etsu Chemical, Hitachi Chemical, SolEpoxy, Epic Resins, Niche-Tech, Darbond Technology, Hubei Huitian New Materials, Guangzhou Human Chemicals |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |