What is Global Electronic Grade Phosphine (PH3) Market?

The Global Electronic Grade Phosphine (PH3) Market is a specialized segment within the broader chemical industry, focusing on the production and distribution of high-purity phosphine gas. This gas is primarily used in the electronics sector, where its purity is crucial for applications in semiconductor manufacturing and photovoltaic cells. The demand for electronic grade phosphine is driven by the rapid growth of the electronics industry, particularly in regions like Asia-Pacific, where technological advancements and increased production capacities are prevalent. The market is characterized by a few key players who dominate the production and supply chain, ensuring that the quality and consistency of the product meet the stringent requirements of electronic applications. As technology continues to evolve, the need for high-purity materials like electronic grade phosphine is expected to grow, supporting innovations in electronics and renewable energy sectors. The market's growth is also influenced by regulatory standards and environmental considerations, which necessitate the development of cleaner and more efficient production processes. Overall, the Global Electronic Grade Phosphine Market plays a critical role in supporting the technological advancements that drive modern economies.

6N, Others in the Global Electronic Grade Phosphine (PH3) Market:

In the Global Electronic Grade Phosphine (PH3) Market, the term "6N" refers to the purity level of phosphine gas, which is 99.9999% pure. This high level of purity is essential for applications in the semiconductor industry, where even the slightest impurities can significantly affect the performance and reliability of electronic components. The production of 6N phosphine involves advanced purification processes that remove contaminants to achieve the desired purity level. This makes 6N phosphine a critical component in the manufacturing of semiconductors, where it is used as a dopant gas to modify the electrical properties of silicon wafers. The demand for 6N phosphine is closely tied to the growth of the semiconductor industry, which is driven by the increasing demand for electronic devices such as smartphones, computers, and other consumer electronics. In addition to 6N phosphine, the market also includes other grades of phosphine that are used in various applications. These other grades may have lower purity levels and are used in less demanding applications where the stringent purity requirements of the semiconductor industry are not necessary. The production and distribution of these different grades of phosphine are managed by a few key players in the market, who have the expertise and infrastructure to ensure the quality and consistency of the product. The market for electronic grade phosphine is highly competitive, with manufacturers constantly seeking to improve their production processes and reduce costs to maintain their market position. This has led to significant investments in research and development, as companies strive to develop new technologies and processes that can enhance the purity and performance of phosphine gas. The market is also influenced by regulatory standards, which require manufacturers to adhere to strict environmental and safety guidelines in the production and handling of phosphine gas. This has led to the development of more sustainable and environmentally friendly production processes, which are becoming increasingly important as the industry seeks to reduce its environmental impact. Overall, the Global Electronic Grade Phosphine Market is a dynamic and rapidly evolving industry that plays a crucial role in supporting the growth and development of the electronics sector. As technology continues to advance, the demand for high-purity phosphine gas is expected to increase, driving further innovation and investment in the market.

Semiconductor, Photovoltaic (PV) in the Global Electronic Grade Phosphine (PH3) Market:

The usage of Global Electronic Grade Phosphine (PH3) Market in the semiconductor and photovoltaic (PV) sectors is pivotal to the advancement of modern technology. In the semiconductor industry, phosphine is primarily used as a dopant gas. Doping is a process where impurities are intentionally introduced to a semiconductor to change its electrical properties. Phosphine, with its high purity levels, is ideal for this purpose as it ensures the precise control needed in the manufacturing of semiconductor devices. The demand for semiconductors is ever-increasing, driven by the proliferation of electronic devices such as smartphones, tablets, and computers. This, in turn, fuels the demand for electronic grade phosphine, as manufacturers strive to produce smaller, faster, and more efficient chips. The role of phosphine in this industry cannot be overstated, as it directly impacts the performance and reliability of the final products. In the photovoltaic sector, phosphine is used in the production of thin-film solar cells. These cells are a type of photovoltaic technology that converts sunlight into electricity. The use of phosphine in this process is crucial as it helps in the deposition of thin layers of materials that are essential for the efficient functioning of solar cells. As the world moves towards renewable energy sources, the demand for photovoltaic technology is on the rise, further boosting the need for electronic grade phosphine. The ability of phosphine to facilitate the production of high-efficiency solar cells makes it an indispensable component in the quest for sustainable energy solutions. The intersection of these two industries with the Global Electronic Grade Phosphine Market highlights the importance of this chemical in driving technological innovation. As both the semiconductor and photovoltaic sectors continue to grow, the demand for high-purity phosphine is expected to rise, underscoring its critical role in the advancement of modern technology. The market dynamics are shaped by the need for continuous improvement in production processes and the development of new applications for phosphine, ensuring that it remains a key player in the global push towards technological progress and sustainability.

Global Electronic Grade Phosphine (PH3) Market Outlook:

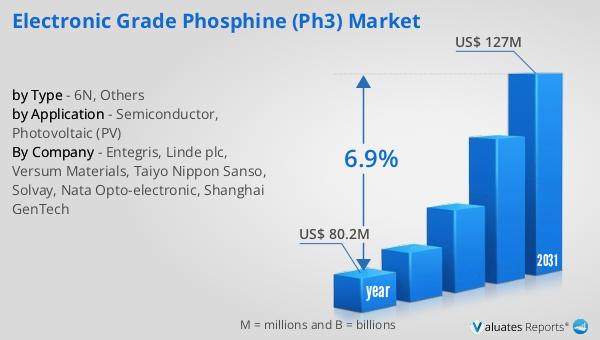

The worldwide market for Electronic Grade Phosphine (PH3) was valued at $80.2 million in 2024 and is anticipated to expand to a revised size of $127 million by 2031, reflecting a compound annual growth rate (CAGR) of 6.9% over the forecast period. The market is dominated by the top four manufacturers, who collectively hold a share exceeding 80%. China emerges as the largest producer of Electronic Grade Phosphine, accounting for over 50% of the market share, followed by the USA with a 40% share. Within the product segment, the semiconductor industry holds a significant portion, with an 80% share. This data underscores the concentrated nature of the market, with a few key players driving the majority of production and distribution. The dominance of China and the USA in production highlights the strategic importance of these regions in the global supply chain. The semiconductor industry's substantial share further emphasizes the critical role of electronic grade phosphine in supporting technological advancements and the production of electronic devices. As the market continues to evolve, the focus remains on maintaining high purity levels and meeting the stringent requirements of the semiconductor and photovoltaic sectors.

| Report Metric | Details |

| Report Name | Electronic Grade Phosphine (PH3) Market |

| Accounted market size in year | US$ 80.2 million |

| Forecasted market size in 2031 | US$ 127 million |

| CAGR | 6.9% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Entegris, Linde plc, Versum Materials, Taiyo Nippon Sanso, Solvay, Nata Opto-electronic, Shanghai GenTech |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |