What is Global Automotive Packaging Market?

The Global Automotive Packaging Market refers to the industry that provides packaging solutions specifically designed for automotive components and parts. This market encompasses a wide range of packaging materials and products, including boxes, crates, pallets, and protective packaging, which are used to ensure the safe transportation and storage of automotive parts. The primary goal of automotive packaging is to protect components from damage, contamination, and environmental factors during transit and storage. This market is driven by the increasing demand for automobiles, advancements in automotive technology, and the need for efficient supply chain management. As the automotive industry continues to grow and evolve, the demand for innovative and sustainable packaging solutions is also on the rise. Companies in this market are focusing on developing packaging that is not only durable and protective but also environmentally friendly and cost-effective. The global automotive packaging market plays a crucial role in ensuring the smooth operation of the automotive supply chain, from manufacturers to end-users.

Advanced Packaging for Automotive, Traditional Packaging for Automotive in the Global Automotive Packaging Market:

Advanced packaging for automotive refers to the use of innovative and high-tech packaging solutions that go beyond traditional methods to meet the specific needs of modern automotive components. These advanced packaging solutions often incorporate materials and technologies that provide enhanced protection, durability, and efficiency. For example, advanced packaging may include the use of specialized foams, anti-static materials, and custom-designed containers that are tailored to the unique shapes and sizes of automotive parts. These solutions are particularly important for protecting sensitive electronic components, such as sensors and control units, which are increasingly used in modern vehicles. Advanced packaging also focuses on sustainability, with many companies developing eco-friendly materials and designs that reduce waste and environmental impact. On the other hand, traditional packaging for automotive typically involves the use of standard materials and methods, such as cardboard boxes, wooden crates, and plastic pallets. While these traditional solutions are still widely used, they may not always provide the level of protection and efficiency required for modern automotive components. Traditional packaging is often more cost-effective and easier to implement, but it may not offer the same level of customization and protection as advanced packaging solutions. In the global automotive packaging market, both advanced and traditional packaging solutions play important roles. Advanced packaging is essential for protecting high-value and sensitive components, while traditional packaging is often used for more robust and less sensitive parts. As the automotive industry continues to evolve, the demand for both types of packaging is expected to grow, with a particular emphasis on developing innovative and sustainable solutions that meet the changing needs of the market. Companies in this market are constantly exploring new materials, technologies, and designs to improve the performance and sustainability of their packaging solutions. This ongoing innovation is crucial for ensuring the safe and efficient transportation and storage of automotive components, ultimately supporting the growth and success of the global automotive industry.

Automotive OSAT, Automotive IDM in the Global Automotive Packaging Market:

The usage of the Global Automotive Packaging Market in areas such as Automotive OSAT (Outsourced Semiconductor Assembly and Test) and Automotive IDM (Integrated Device Manufacturer) is crucial for ensuring the safe and efficient handling of semiconductor components used in vehicles. Automotive OSAT companies specialize in providing assembly and testing services for semiconductor devices, which are essential for various automotive applications, including engine control units, infotainment systems, and advanced driver-assistance systems (ADAS). These companies rely heavily on specialized packaging solutions to protect sensitive semiconductor components from damage, contamination, and electrostatic discharge during transportation and storage. Advanced packaging materials, such as anti-static bags, custom-designed trays, and protective foams, are commonly used to ensure the integrity and performance of these components. On the other hand, Automotive IDM companies are involved in the design, manufacturing, and testing of semiconductor devices in-house. These companies also require robust packaging solutions to safeguard their products throughout the supply chain. The packaging needs of Automotive IDM companies are similar to those of OSAT companies, with a focus on protecting sensitive semiconductor components from physical damage and environmental factors. In addition to advanced packaging materials, IDM companies may also use specialized containers and handling equipment to ensure the safe transportation and storage of their products. The global automotive packaging market plays a vital role in supporting the operations of both OSAT and IDM companies by providing innovative and reliable packaging solutions. As the demand for advanced semiconductor components in vehicles continues to grow, the need for effective packaging solutions becomes increasingly important. Companies in the automotive packaging market are constantly developing new materials and designs to meet the evolving needs of the semiconductor industry, ensuring the safe and efficient handling of these critical components. This ongoing innovation is essential for supporting the growth and success of the automotive industry, as well as the development of new and advanced vehicle technologies.

Global Automotive Packaging Market Outlook:

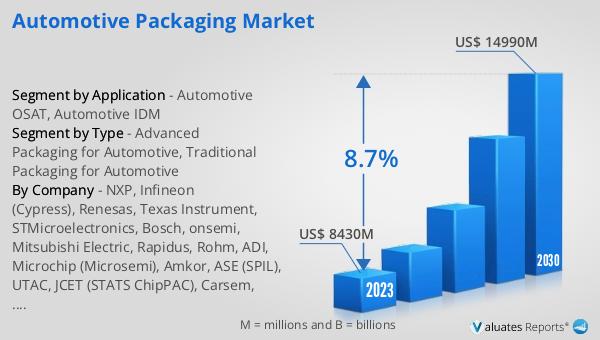

The global Automotive Packaging market was valued at US$ 8430 million in 2023 and is anticipated to reach US$ 14990 million by 2030, witnessing a CAGR of 8.7% during the forecast period 2024-2030. This significant growth reflects the increasing demand for efficient and sustainable packaging solutions in the automotive industry. As the industry continues to evolve, the need for innovative packaging that can protect sensitive components, reduce environmental impact, and improve supply chain efficiency is becoming more critical. Companies in the automotive packaging market are focusing on developing advanced materials and designs that meet these requirements, ensuring the safe and efficient transportation and storage of automotive parts. The projected growth of the market also highlights the importance of packaging in supporting the overall operations of the automotive industry, from manufacturers to end-users. With the ongoing advancements in automotive technology and the increasing complexity of vehicle components, the demand for specialized packaging solutions is expected to rise. This growth presents significant opportunities for companies in the automotive packaging market to innovate and expand their product offerings, ultimately contributing to the success and sustainability of the global automotive industry.

| Report Metric | Details |

| Report Name | Automotive Packaging Market |

| Accounted market size in 2023 | US$ 8430 million |

| Forecasted market size in 2030 | US$ 14990 million |

| CAGR | 8.7% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | NXP, Infineon (Cypress), Renesas, Texas Instrument, STMicroelectronics, Bosch, onsemi, Mitsubishi Electric, Rapidus, Rohm, ADI, Microchip (Microsemi), Amkor, ASE (SPIL), UTAC, JCET (STATS ChipPAC), Carsem, King Yuan Electronics Corp. (KYEC), KINGPAK Technology Inc, Powertech Technology Inc. (PTI), SFA Semicon, Unisem Group, Chipbond Technology Corporation, ChipMOS TECHNOLOGIES, OSE CORP., Sigurd Microelectronics, Natronix Semiconductor Technology, Nepes, KESM Industries Berhad, Forehope Electronic (Ningbo) Co.,Ltd., Union Semiconductor(Hefei)Co., Ltd., Tongfu Microelectronics (TFME), Hefei Chipmore Technology Co.,Ltd., HT-tech, China Wafer Level CSP Co., Ltd, Ningbo ChipEx Semiconductor Co., Ltd, Guangdong Leadyo IC Testing, Unimos Microelectronics (Shanghai), Sino Technology, Taiji Semiconductor (Suzhou) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |