What is Global Automotive Chip Packaging Market?

The Global Automotive Chip Packaging Market refers to the industry that focuses on the design, production, and distribution of packaging solutions for semiconductor chips used in automotive applications. These chips are essential components in modern vehicles, enabling various functionalities such as engine control, infotainment systems, safety features, and advanced driver-assistance systems (ADAS). The packaging of these chips is crucial as it protects the semiconductor devices from physical damage, environmental factors, and electrical interference, ensuring their reliability and performance. The market encompasses a wide range of packaging technologies and materials, each tailored to meet the specific requirements of automotive applications. As the automotive industry continues to evolve with advancements in electric vehicles (EVs), autonomous driving, and connectivity, the demand for sophisticated chip packaging solutions is expected to grow. This market is characterized by continuous innovation, driven by the need for higher performance, miniaturization, and cost-effectiveness in automotive electronics.

Ceramic Substrate, WB BGA, Lead Frame, FC BGA, Power Module, Others in the Global Automotive Chip Packaging Market:

In the Global Automotive Chip Packaging Market, various packaging technologies are employed to meet the diverse needs of automotive applications. Ceramic substrates are one such technology, known for their excellent thermal conductivity and mechanical strength. They are often used in high-power and high-temperature environments, making them ideal for power modules and other critical automotive components. WB BGA (Wire Bond Ball Grid Array) is another packaging method that involves connecting the semiconductor die to the substrate using fine wires. This technique is widely used due to its cost-effectiveness and reliability, particularly in applications where space is a constraint. Lead Frame packaging, on the other hand, uses a metal frame to support the semiconductor die and provide electrical connections. This method is known for its robustness and is commonly used in power devices and sensors. FC BGA (Flip Chip Ball Grid Array) is a more advanced packaging technology where the semiconductor die is flipped and directly attached to the substrate using solder bumps. This method offers superior electrical performance and is used in high-speed and high-frequency applications. Power Modules are specialized packaging solutions designed to handle high power levels and are used in applications such as electric vehicle powertrains and charging systems. These modules often incorporate multiple semiconductor devices and advanced thermal management features to ensure reliable operation under demanding conditions. Other packaging technologies in the market include System-in-Package (SiP) and Multi-Chip Modules (MCM), which integrate multiple semiconductor devices into a single package to enhance functionality and reduce space. Each of these packaging technologies plays a crucial role in the automotive industry, enabling the development of advanced electronic systems that enhance vehicle performance, safety, and efficiency.

Automotive OSAT, Automotive IDM in the Global Automotive Chip Packaging Market:

The Global Automotive Chip Packaging Market finds extensive usage in two primary areas: Automotive OSAT (Outsourced Semiconductor Assembly and Test) and Automotive IDM (Integrated Device Manufacturer). Automotive OSAT companies specialize in providing assembly and testing services for semiconductor devices used in automotive applications. These companies offer a range of packaging solutions, from traditional lead frame packages to advanced flip-chip and wafer-level packages. By outsourcing these services, automotive OEMs (Original Equipment Manufacturers) and Tier 1 suppliers can focus on their core competencies while leveraging the expertise and capabilities of OSAT providers. This approach helps in reducing time-to-market, optimizing production costs, and ensuring high-quality packaging solutions. On the other hand, Automotive IDM companies are vertically integrated manufacturers that design, fabricate, assemble, and test their semiconductor devices in-house. These companies have complete control over the entire production process, allowing them to tailor packaging solutions to meet specific automotive requirements. IDMs often invest heavily in research and development to innovate new packaging technologies that enhance the performance, reliability, and miniaturization of automotive chips. Both OSAT and IDM play a vital role in the automotive chip packaging market, catering to the increasing demand for advanced electronic systems in vehicles. As the automotive industry continues to evolve with trends such as electrification, autonomous driving, and connectivity, the collaboration between OSAT and IDM companies will be crucial in developing cutting-edge packaging solutions that meet the stringent requirements of automotive applications.

Global Automotive Chip Packaging Market Outlook:

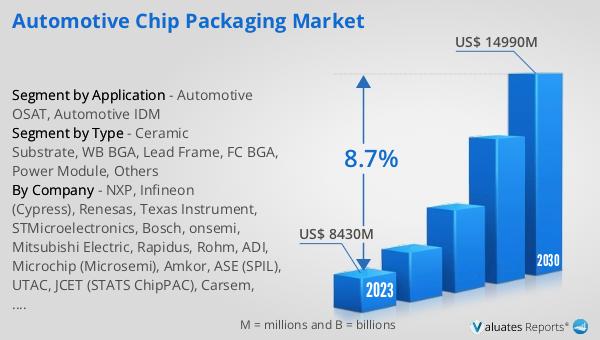

The global Automotive Chip Packaging market was valued at US$ 8430 million in 2023 and is anticipated to reach US$ 14990 million by 2030, witnessing a CAGR of 8.7% during the forecast period 2024-2030. This significant growth reflects the increasing demand for advanced packaging solutions in the automotive industry, driven by the rapid adoption of electric vehicles, autonomous driving technologies, and connected car systems. As vehicles become more sophisticated, the need for reliable, high-performance semiconductor chips and their packaging becomes paramount. The market's expansion is also fueled by continuous innovations in packaging technologies, which aim to enhance the performance, miniaturization, and cost-effectiveness of automotive electronics. Companies operating in this market are investing heavily in research and development to stay ahead of the competition and meet the evolving needs of the automotive sector. The projected growth of the Automotive Chip Packaging market underscores the critical role that packaging solutions play in the development of next-generation vehicles, ensuring their safety, efficiency, and overall performance.

| Report Metric | Details |

| Report Name | Automotive Chip Packaging Market |

| Accounted market size in 2023 | US$ 8430 million |

| Forecasted market size in 2030 | US$ 14990 million |

| CAGR | 8.7% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | NXP, Infineon (Cypress), Renesas, Texas Instrument, STMicroelectronics, Bosch, onsemi, Mitsubishi Electric, Rapidus, Rohm, ADI, Microchip (Microsemi), Amkor, ASE (SPIL), UTAC, JCET (STATS ChipPAC), Carsem, King Yuan Electronics Corp. (KYEC), KINGPAK Technology Inc, Powertech Technology Inc. (PTI), SFA Semicon, Unisem Group, Chipbond Technology Corporation, ChipMOS TECHNOLOGIES, OSE CORP., Sigurd Microelectronics, Natronix Semiconductor Technology, Nepes, KESM Industries Berhad, Forehope Electronic (Ningbo) Co.,Ltd., Union Semiconductor(Hefei)Co., Ltd., Tongfu Microelectronics (TFME), Hefei Chipmore Technology Co.,Ltd., HT-tech, China Wafer Level CSP Co., Ltd, Ningbo ChipEx Semiconductor Co., Ltd, Guangdong Leadyo IC Testing, Unimos Microelectronics (Shanghai), Sino Technology, Taiji Semiconductor (Suzhou) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |