What is Global EDA for Semiconductor Front End Design Market?

The Global EDA for Semiconductor Front End Design Market is a crucial segment within the semiconductor industry, focusing on Electronic Design Automation (EDA) tools used in the initial stages of semiconductor design. These tools are essential for designing and verifying the functionality of semiconductor devices before they are manufactured. The front-end design process involves creating the architecture, logic design, and verification of the semiconductor chip. EDA tools help engineers simulate and test the design to ensure it meets the required specifications and performance criteria. This market is driven by the increasing complexity of semiconductor devices, which require advanced design tools to manage the intricate processes involved. As technology evolves, the demand for more efficient and powerful EDA tools continues to grow, making this market a vital component of the semiconductor industry. The global reach of this market is significant, as it supports the development of cutting-edge technologies across various sectors, including consumer electronics, automotive, and telecommunications. The continuous advancements in EDA tools are essential for maintaining the pace of innovation in the semiconductor industry, ensuring that new devices can be developed quickly and efficiently to meet the ever-growing demands of the digital world.

Analog Type EDA, Digital Type EDA in the Global EDA for Semiconductor Front End Design Market:

Analog Type EDA and Digital Type EDA are two fundamental categories within the Global EDA for Semiconductor Front End Design Market, each serving distinct purposes in the design and development of semiconductor devices. Analog Type EDA tools are primarily used for designing analog circuits, which are essential for processing real-world signals such as sound, light, and temperature. These tools help engineers create and simulate analog components like amplifiers, oscillators, and filters, ensuring they function correctly within the overall semiconductor design. Analog circuits are crucial for applications that require precise signal processing, such as audio equipment, sensors, and communication devices. The complexity of analog design lies in its continuous nature, requiring sophisticated EDA tools to model and verify the behavior of analog components accurately. On the other hand, Digital Type EDA tools focus on designing digital circuits, which operate using discrete signals represented by binary code. These tools are used to create and verify digital components like processors, memory units, and logic gates, which form the backbone of modern computing and electronic devices. Digital circuits are essential for applications that require high-speed data processing and storage, such as computers, smartphones, and data centers. The design process for digital circuits involves creating a logical representation of the circuit, simulating its behavior, and verifying its functionality through various testing methods. Digital EDA tools provide engineers with the ability to optimize the design for performance, power consumption, and area, ensuring the final product meets the desired specifications. Both Analog and Digital Type EDA tools are integral to the semiconductor design process, enabling engineers to create complex and efficient semiconductor devices that power the technology we rely on every day. The advancements in EDA tools have significantly reduced the time and cost associated with semiconductor design, allowing companies to bring innovative products to market faster. As the demand for more sophisticated electronic devices continues to rise, the role of EDA tools in the semiconductor industry becomes increasingly important, driving further innovation and development in this field.

Signal Communication, Consumer Electronics, Automotive, Industry, Medical Care, Aviation, Other in the Global EDA for Semiconductor Front End Design Market:

The Global EDA for Semiconductor Front End Design Market plays a pivotal role in various industries, providing essential tools for designing and developing semiconductor devices used in a wide range of applications. In the field of Signal Communication, EDA tools are used to design and verify the components that enable data transmission and reception, such as transceivers, modulators, and demodulators. These components are critical for maintaining reliable and efficient communication networks, supporting technologies like 5G, Wi-Fi, and satellite communications. In Consumer Electronics, EDA tools are employed to create the semiconductor chips that power devices like smartphones, tablets, and smart home appliances. These tools help engineers design chips that offer high performance, low power consumption, and compact size, meeting the demands of modern consumers for faster and more efficient electronic devices. In the Automotive industry, EDA tools are used to develop the semiconductor components that enable advanced driver-assistance systems (ADAS), infotainment systems, and electric vehicle powertrains. These components are essential for enhancing vehicle safety, connectivity, and energy efficiency, driving the evolution of the automotive sector towards smarter and more sustainable transportation solutions. In the Industrial sector, EDA tools support the design of semiconductor devices used in automation, robotics, and industrial control systems. These devices are crucial for improving operational efficiency, productivity, and safety in manufacturing and other industrial processes. In the Medical Care industry, EDA tools are used to design the semiconductor components that power medical devices and equipment, such as imaging systems, diagnostic tools, and wearable health monitors. These components are vital for delivering accurate and reliable healthcare solutions, improving patient outcomes and quality of life. In Aviation, EDA tools are employed to develop the semiconductor devices used in avionics systems, communication equipment, and navigation systems. These devices are essential for ensuring the safety, reliability, and efficiency of aircraft operations, supporting the growth of the aviation industry. The versatility and adaptability of EDA tools make them indispensable across these diverse sectors, enabling the development of innovative semiconductor solutions that drive technological progress and improve our daily lives.

Global EDA for Semiconductor Front End Design Market Outlook:

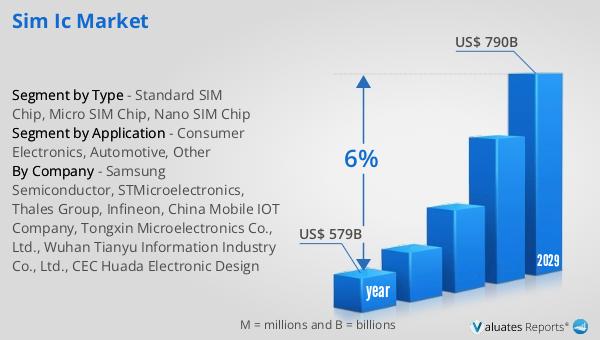

The outlook for the Global EDA for Semiconductor Front End Design Market is closely tied to the broader semiconductor industry, which was valued at approximately $579 billion in 2022. This market is expected to grow significantly, reaching around $790 billion by 2029, with a compound annual growth rate (CAGR) of 6% during the forecast period. This growth is driven by the increasing demand for advanced semiconductor devices across various sectors, including consumer electronics, automotive, telecommunications, and healthcare. As the complexity of semiconductor designs continues to rise, the need for sophisticated EDA tools becomes more critical, enabling engineers to manage the intricate processes involved in creating cutting-edge semiconductor solutions. The expansion of the semiconductor market is also fueled by the rapid adoption of emerging technologies such as artificial intelligence, the Internet of Things (IoT), and 5G, which require highly specialized and efficient semiconductor components. EDA tools play a vital role in supporting the development of these technologies, providing the necessary capabilities to design, simulate, and verify complex semiconductor devices. As the semiconductor industry continues to evolve, the Global EDA for Semiconductor Front End Design Market is poised to experience significant growth, driven by the ongoing demand for innovative and efficient design solutions.

| Report Metric | Details |

| Report Name | EDA for Semiconductor Front End Design Market |

| Accounted market size in year | US$ 579 billion |

| Forecasted market size in 2029 | US$ 790 billion |

| CAGR | 6% |

| Base Year | year |

| Forecasted years | 2025 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Siemens Mentor, Synopsys, Cadence, Ansys, Agnisys, AMIQ EDA, Breker, CLIOSOFT, Semifore, Concept Engineering, MunEDA, Defacto Technologies, Empyrean Technology, Hejian Industrial Software Group Co., Ltd., Robei, Tango Intelligence, Xinhuazhang Technology Co., Ltd., HyperSilicon Co.,Ltd, S2C Limited, Freetech Intelligent Systems, Arcas |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |