What is Global SIM IC Market?

The Global SIM IC Market refers to the worldwide industry focused on the production and distribution of SIM (Subscriber Identity Module) integrated circuits (ICs). These tiny chips are essential components in mobile devices, enabling secure communication and data exchange between the device and the network provider. SIM ICs store unique information such as the International Mobile Subscriber Identity (IMSI) and encryption keys, which authenticate and identify subscribers on a mobile network. The market for SIM ICs is driven by the increasing demand for mobile connectivity, the proliferation of smartphones, and the expansion of IoT (Internet of Things) devices. As technology advances, SIM ICs have evolved from standard-sized chips to smaller formats like micro and nano SIMs, catering to the need for more compact and efficient mobile devices. The Global SIM IC Market is a crucial segment of the broader semiconductor industry, reflecting trends in mobile technology, consumer electronics, and telecommunications infrastructure. As mobile networks continue to expand globally, the demand for SIM ICs is expected to grow, driven by innovations in mobile technology and the increasing need for secure, reliable communication solutions.

Standard SIM Chip, Micro SIM Chip, Nano SIM Chip in the Global SIM IC Market:

In the Global SIM IC Market, SIM chips have evolved significantly to meet the changing demands of mobile technology and consumer preferences. The Standard SIM Chip, also known as the Mini SIM, was the original format used in mobile devices. It measures 25mm x 15mm and was widely used in early mobile phones. Despite its larger size compared to newer formats, the Standard SIM Chip remains in use in some older devices and certain regions where technological upgrades are slower. As mobile devices became more compact, the need for smaller SIM cards led to the development of the Micro SIM Chip. Introduced in 2010, the Micro SIM measures 15mm x 12mm, offering a more compact solution without compromising functionality. This format gained popularity with the rise of smartphones, as manufacturers sought to maximize space for other components like batteries and processors. The Nano SIM Chip, the smallest of the three, measures just 12.3mm x 8.8mm. It was introduced in 2012 and quickly became the standard for most modern smartphones. The Nano SIM's reduced size allows for even more efficient use of space within mobile devices, accommodating the trend towards slimmer and more feature-rich phones. Each SIM chip format serves the same fundamental purpose: to securely store subscriber information and facilitate communication with mobile networks. However, the transition from Standard to Nano SIMs reflects broader trends in the mobile industry, such as miniaturization, increased functionality, and the demand for more aesthetically pleasing devices. As the Global SIM IC Market continues to evolve, manufacturers are exploring new technologies like eSIMs (embedded SIMs), which eliminate the need for a physical SIM card altogether. This innovation represents the next step in the evolution of SIM technology, offering even greater flexibility and convenience for consumers and network providers alike.

Consumer Electronics, Automotive, Other in the Global SIM IC Market:

The Global SIM IC Market plays a vital role in various sectors, including consumer electronics, automotive, and other industries. In consumer electronics, SIM ICs are primarily used in mobile phones, tablets, and wearable devices. These chips enable secure communication and data exchange, allowing users to access mobile networks for voice calls, messaging, and internet connectivity. As the demand for smart devices continues to grow, the need for reliable and efficient SIM ICs becomes increasingly important. In the automotive sector, SIM ICs are used in connected vehicles to facilitate communication between the vehicle and external networks. This connectivity enables features such as real-time navigation, remote diagnostics, and infotainment services. As the automotive industry moves towards autonomous and electric vehicles, the integration of SIM ICs becomes crucial for ensuring seamless communication and data exchange. Beyond consumer electronics and automotive, SIM ICs find applications in various other industries, including healthcare, logistics, and smart cities. In healthcare, SIM ICs are used in medical devices and wearables to monitor patient health and transmit data to healthcare providers. In logistics, SIM ICs enable real-time tracking and monitoring of goods, improving supply chain efficiency. In smart cities, SIM ICs are used in IoT devices to manage infrastructure, enhance public safety, and improve urban living conditions. The versatility and adaptability of SIM ICs make them an essential component in the digital transformation of various industries, driving innovation and connectivity across the globe.

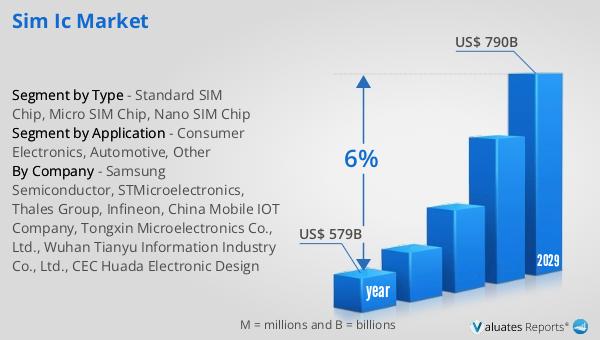

Global SIM IC Market Outlook:

The global semiconductor market, which includes the Global SIM IC Market, was valued at approximately $579 billion in 2022. This market is projected to grow significantly, reaching around $790 billion by 2029. This growth represents a compound annual growth rate (CAGR) of 6% over the forecast period. The semiconductor industry is a critical component of modern technology, providing the essential building blocks for electronic devices, including SIM ICs. The projected growth of the semiconductor market reflects the increasing demand for advanced electronic devices, driven by technological advancements and the proliferation of IoT devices. As the world becomes more connected, the need for efficient and reliable semiconductor solutions, including SIM ICs, continues to rise. This growth is also fueled by the expansion of mobile networks, the development of 5G technology, and the increasing adoption of smart devices across various industries. The semiconductor market's expansion highlights the importance of innovation and investment in research and development to meet the evolving needs of consumers and industries worldwide. As the market grows, companies in the semiconductor industry must continue to adapt and innovate to remain competitive and capitalize on emerging opportunities.

| Report Metric | Details |

| Report Name | SIM IC Market |

| Accounted market size in year | US$ 579 billion |

| Forecasted market size in 2029 | US$ 790 billion |

| CAGR | 6% |

| Base Year | year |

| Forecasted years | 2025 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Sales by Region |

|

| By Company | Samsung Semiconductor, STMicroelectronics, Thales Group, Infineon, China Mobile IOT Company, Tongxin Microelectronics Co., Ltd., Wuhan Tianyu Information Industry Co., Ltd., CEC Huada Electronic Design |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |