What is Global System on Module Boards Market?

The Global System on Module (SoM) Boards Market is a rapidly evolving segment within the electronics industry, characterized by its compact and integrated design that combines a microprocessor, memory, and essential peripherals on a single board. These modules serve as the heart of various embedded systems, offering a versatile and efficient solution for developers looking to streamline product development and reduce time-to-market. SoM boards are particularly valued for their ability to simplify the design process, allowing engineers to focus on application-specific features rather than the complexities of processor integration. This market is driven by the increasing demand for smart and connected devices across various industries, including automotive, industrial automation, healthcare, and consumer electronics. As technology continues to advance, the need for more powerful and efficient computing solutions grows, further propelling the adoption of SoM boards. The market is also influenced by trends such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning, which require robust and adaptable hardware platforms. Overall, the Global System on Module Boards Market is poised for significant growth as industries seek to leverage the benefits of modular and scalable computing solutions.

ARM, X86, Power PC, Others in the Global System on Module Boards Market:

In the Global System on Module Boards Market, different architectures play a crucial role in determining the performance and application suitability of the modules. ARM, X86, PowerPC, and other architectures each bring unique strengths and capabilities to the table. ARM architecture is renowned for its power efficiency and is widely used in mobile and embedded applications. Its low power consumption makes it ideal for battery-powered devices and applications where energy efficiency is paramount. ARM-based SoM boards are prevalent in consumer electronics, IoT devices, and industrial automation, where they provide a balance of performance and energy efficiency. On the other hand, X86 architecture is synonymous with high performance and compatibility with a wide range of software applications. It is commonly used in applications that require substantial processing power, such as servers, desktops, and high-performance computing systems. X86-based SoM boards are favored in industries like telecommunications, where processing power and software compatibility are critical. PowerPC architecture, although less common than ARM and X86, offers robust performance and reliability, making it suitable for applications in aerospace, defense, and automotive industries. PowerPC-based SoM boards are often chosen for their ability to handle complex computations and real-time processing tasks. Additionally, other architectures, such as MIPS and RISC-V, are gaining traction in the market, offering alternative solutions for specific applications. MIPS architecture is known for its simplicity and efficiency, making it suitable for embedded systems and networking equipment. RISC-V, an open-source architecture, is gaining popularity due to its flexibility and customization options, allowing developers to tailor the architecture to their specific needs. Each architecture has its own ecosystem of development tools, software libraries, and support communities, which play a significant role in the decision-making process for developers and manufacturers. The choice of architecture often depends on factors such as power consumption, processing power, software compatibility, and the specific requirements of the target application. As the Global System on Module Boards Market continues to evolve, the diversity of architectures available provides developers with a wide range of options to meet the demands of various industries and applications.

Defense and Aerospace, Communications, Medical, Automations and Control, Automotive and Transport, Others in the Global System on Module Boards Market:

The Global System on Module Boards Market finds extensive usage across a variety of sectors, each benefiting from the unique advantages offered by these compact and integrated computing solutions. In the defense and aerospace industry, SoM boards are utilized for their reliability, performance, and ability to withstand harsh environments. They are employed in applications such as avionics, radar systems, and unmanned aerial vehicles (UAVs), where real-time processing and robust performance are critical. The communications sector leverages SoM boards for their processing power and connectivity capabilities, making them ideal for use in telecommunications infrastructure, network equipment, and data centers. These boards enable efficient data processing and transmission, supporting the growing demand for high-speed and reliable communication networks. In the medical field, SoM boards are used in medical imaging devices, patient monitoring systems, and portable diagnostic equipment. Their compact size and processing capabilities allow for the development of advanced medical devices that enhance patient care and diagnostic accuracy. The automation and control industry benefits from SoM boards in applications such as industrial automation, robotics, and smart manufacturing. These boards provide the processing power and connectivity needed to support the development of intelligent and autonomous systems that improve efficiency and productivity. In the automotive and transport sector, SoM boards are used in advanced driver-assistance systems (ADAS), infotainment systems, and vehicle-to-everything (V2X) communication systems. Their ability to handle complex computations and real-time data processing makes them essential for the development of smart and connected vehicles. Additionally, SoM boards find applications in other areas such as consumer electronics, energy management, and smart home devices, where they enable the development of innovative and efficient products. Overall, the versatility and adaptability of SoM boards make them a valuable asset across a wide range of industries, driving innovation and enhancing the capabilities of modern technology.

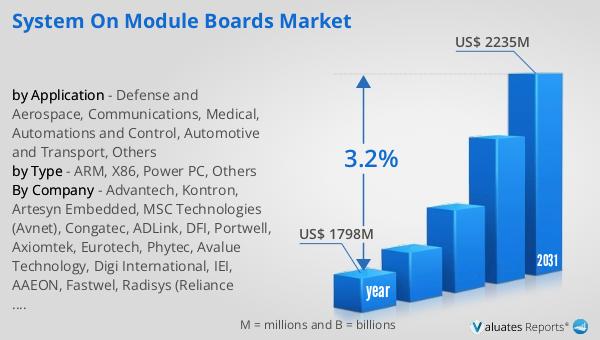

Global System on Module Boards Market Outlook:

The global market for System on Module Boards was valued at approximately $1.798 billion in 2024, and it is anticipated to expand to a revised size of around $2.235 billion by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 3.2% over the forecast period. This steady growth is indicative of the increasing demand for compact and efficient computing solutions across various industries. The rise in adoption of IoT devices, advancements in AI and machine learning, and the growing need for smart and connected devices are key factors driving this market expansion. As industries continue to seek ways to enhance efficiency and reduce time-to-market, the demand for System on Module Boards is expected to rise. These boards offer a streamlined approach to product development, allowing companies to focus on application-specific features rather than the complexities of processor integration. The market's growth is also supported by the increasing trend towards automation and digitalization in sectors such as automotive, industrial automation, healthcare, and telecommunications. As technology continues to evolve, the need for more powerful and efficient computing solutions will further propel the adoption of System on Module Boards, making them an integral part of modern technology infrastructure.

| Report Metric | Details |

| Report Name | System on Module Boards Market |

| Accounted market size in year | US$ 1798 million |

| Forecasted market size in 2031 | US$ 2235 million |

| CAGR | 3.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Advantech, Kontron, Artesyn Embedded, MSC Technologies (Avnet), Congatec, ADLink, DFI, Portwell, Axiomtek, Eurotech, Phytec, Avalue Technology, Digi International, IEI, AAEON, Fastwel, Radisys (Reliance Industries), Toradex, ASRock, SECO srl, Technexion |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |