What is Global SiC Wafer Fabrication Market?

The Global SiC Wafer Fabrication Market refers to the worldwide industry involved in the production and processing of silicon carbide (SiC) wafers. These wafers are crucial components in the manufacturing of high-performance semiconductors. SiC wafers are known for their exceptional thermal conductivity, high electric field strength, and wide bandgap, making them ideal for applications that require high efficiency and reliability under extreme conditions. The market encompasses various stages of wafer production, including crystal growth, wafer slicing, polishing, and epitaxial growth. The demand for SiC wafers is driven by their use in power electronics, automotive, renewable energy, and telecommunications, among other sectors. As industries continue to seek more efficient and durable materials for electronic components, the SiC wafer fabrication market is expected to grow significantly. This growth is fueled by advancements in technology, increasing adoption of electric vehicles (EVs), and the rising need for energy-efficient solutions. The market is characterized by a competitive landscape with numerous players striving to innovate and improve the quality and performance of SiC wafers to meet the evolving demands of various industries.

in the Global SiC Wafer Fabrication Market:

The Global SiC Wafer Fabrication Market caters to a diverse range of customers, each with specific requirements and applications for SiC wafers. One of the primary types of SiC wafers used is the 4H-SiC, which is favored for its superior electron mobility and high breakdown voltage, making it suitable for high-power and high-frequency applications. Another type is the 6H-SiC wafer, which, although less common, is used in certain niche applications due to its unique properties. Customers in the automotive industry, particularly those involved in the production of electric vehicles (EVs) and hybrid electric vehicles (HEVs), rely heavily on SiC wafers for their power electronics. These wafers enable the development of more efficient and compact power modules, which are essential for improving the performance and range of EVs. In the renewable energy sector, SiC wafers are used in photovoltaic (PV) inverters and wind power converters, where their high efficiency and thermal stability contribute to better energy conversion and reduced losses. Data centers and servers also benefit from SiC wafers, as they help in managing power more efficiently, leading to lower energy consumption and improved performance. Uninterruptible Power Supplies (UPS) systems, which are critical for maintaining power continuity in various industries, utilize SiC wafers to enhance their reliability and efficiency. Additionally, SiC wafers are employed in energy storage systems, where their ability to handle high power densities and temperatures makes them ideal for battery management and power conversion. The telecommunications industry uses SiC wafers in RF and microwave devices, which require high-frequency performance and robustness. Overall, the versatility and superior properties of SiC wafers make them indispensable across a wide range of applications, driving their demand in the global market.

Automotive & EV/HEV, EV Charging, UPS, Data Center & Server, PV, Energy Storage, Wind Power, Others in the Global SiC Wafer Fabrication Market:

The usage of SiC wafers in the automotive and EV/HEV sectors is particularly noteworthy. These wafers are integral to the development of power electronics that manage the flow of electricity within electric vehicles. SiC-based components, such as inverters and onboard chargers, offer higher efficiency and reduced energy losses compared to traditional silicon-based components. This translates to longer driving ranges and faster charging times for EVs, making them more appealing to consumers. In the realm of EV charging, SiC wafers are used in fast chargers, which require high power handling capabilities and efficiency. These fast chargers can significantly reduce the time it takes to charge an electric vehicle, thereby addressing one of the major concerns of EV adoption. Uninterruptible Power Supplies (UPS) systems, which provide backup power during outages, also benefit from SiC technology. The high efficiency and reliability of SiC-based UPS systems ensure that critical operations in industries such as healthcare, data centers, and manufacturing remain uninterrupted. Data centers and servers, which are the backbone of the digital economy, use SiC wafers to enhance power management and reduce energy consumption. This not only lowers operational costs but also contributes to sustainability efforts by reducing the carbon footprint. In the photovoltaic (PV) sector, SiC wafers are used in inverters that convert solar energy into usable electricity. The high efficiency and thermal stability of SiC-based inverters improve the overall performance of solar power systems. Energy storage systems, which are essential for balancing supply and demand in renewable energy grids, also utilize SiC wafers. These wafers enable the development of efficient power conversion systems that can handle high power densities and temperatures. Wind power converters, which convert the mechanical energy from wind turbines into electrical energy, benefit from the robustness and efficiency of SiC wafers. Finally, SiC wafers find applications in various other sectors, including telecommunications, where they are used in RF and microwave devices that require high-frequency performance and durability. The widespread usage of SiC wafers across these diverse applications underscores their importance in advancing technology and improving efficiency in various industries.

Global SiC Wafer Fabrication Market Outlook:

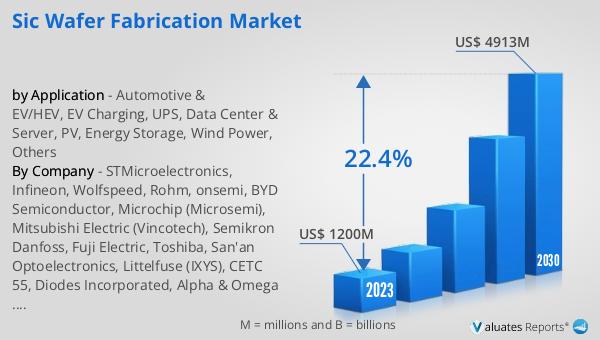

The global SiC Wafer Fabrication market was valued at $1.2 billion in 2023 and is projected to grow significantly, reaching $4.913 billion by 2030. This impressive growth is expected to occur at a compound annual growth rate (CAGR) of 22.4% from 2024 to 2030. The increasing demand for SiC wafers in various high-performance applications, such as electric vehicles, renewable energy systems, and power electronics, is a major driver of this market expansion. The superior properties of SiC wafers, including high thermal conductivity, high electric field strength, and wide bandgap, make them ideal for use in environments that require high efficiency and reliability. As industries continue to seek more efficient and durable materials for electronic components, the SiC wafer fabrication market is poised for substantial growth. This growth is further fueled by advancements in technology, increasing adoption of electric vehicles, and the rising need for energy-efficient solutions. The competitive landscape of the market is characterized by numerous players striving to innovate and improve the quality and performance of SiC wafers to meet the evolving demands of various industries. Overall, the future of the global SiC Wafer Fabrication market looks promising, with significant growth opportunities on the horizon.

| Report Metric | Details |

| Report Name | SiC Wafer Fabrication Market |

| Accounted market size in 2023 | US$ 1200 million |

| Forecasted market size in 2030 | US$ 4913 million |

| CAGR | 22.4% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | STMicroelectronics, Infineon, Wolfspeed, Rohm, onsemi, BYD Semiconductor, Microchip (Microsemi), Mitsubishi Electric (Vincotech), Semikron Danfoss, Fuji Electric, Toshiba, San'an Optoelectronics, Littelfuse (IXYS), CETC 55, Diodes Incorporated, Alpha & Omega Semiconductor, Bosch, GE Aerospace, KEC Corporation, PANJIT Group, Nexperia, Vishay Intertechnology, Zhuzhou CRRC Times Electric, China Resources Microelectronics Limited, Yangzhou Yangjie Electronic Technology, Changzhou Galaxy Century Microelectronics, Hangzhou Silan Microelectronics, SK powertech, InventChip Technology, Hebei Sinopack Electronic Technology, X-Fab, Episil Technology Inc., Sanan IC, HLMC, GTA Semiconductor Co., Ltd., Beijing Yandong Microelectronics, United Nova Technology, Global Power Technology, Wuhu Tus-Semiconductor, AscenPower, Clas-SiC Wafer Fab, SiCamore Semi, DB HiTek, Nanjing Quenergy Semiconductor, by Technology, IDM, Foundry |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |