What is Global Liability Insurance for Pet Market?

Global Liability Insurance for Pet Market is a specialized insurance product designed to protect pet owners from financial losses that may arise due to their pets' actions. This type of insurance covers various liabilities, such as injuries caused by pets to third parties or damage to property. With the increasing number of pet ownership globally, the demand for such insurance has been on the rise. Pet owners are becoming more aware of the potential risks associated with their pets and are seeking ways to mitigate these risks. The insurance provides peace of mind to pet owners, knowing that they are financially protected in case their pets cause any harm or damage. This market is particularly significant in regions with high pet ownership rates and stringent liability laws. The coverage typically includes legal fees, medical expenses for injured parties, and repair costs for damaged property. As the pet population continues to grow, the Global Liability Insurance for Pet Market is expected to expand further, offering more comprehensive and tailored insurance products to meet the diverse needs of pet owners.

Third Party Personal Injury Insurance, Property Damage Insurance in the Global Liability Insurance for Pet Market:

Third Party Personal Injury Insurance and Property Damage Insurance are two critical components of Global Liability Insurance for Pet Market. Third Party Personal Injury Insurance covers the medical expenses and legal fees if a pet causes injury to a person who is not the owner. For instance, if a dog bites a neighbor or a cat scratches a visitor, this insurance will cover the costs associated with the injury, including hospital bills and any legal claims that may arise. This type of insurance is crucial for pet owners as it protects them from potentially high medical costs and legal fees, which can be financially devastating. On the other hand, Property Damage Insurance covers the costs of repairing or replacing property that a pet may damage. This could include anything from a dog chewing on a neighbor's expensive garden furniture to a cat scratching up a friend's antique sofa. The insurance ensures that the pet owner does not have to bear the financial burden of such damages out of pocket. Both types of insurance are essential for comprehensive coverage, providing pet owners with a safety net against unforeseen incidents. The increasing awareness of these insurance products is driving their demand in the market. Pet owners are recognizing the importance of being prepared for any eventuality, and insurance companies are responding by offering more tailored and comprehensive policies. The Global Liability Insurance for Pet Market is thus evolving to meet the growing needs of pet owners, ensuring that they have the necessary protection against potential liabilities. This evolution is also driven by the increasing legal requirements in many regions, where pet owners are held accountable for their pets' actions. As a result, the market is seeing a surge in the adoption of these insurance products, with more pet owners opting for comprehensive coverage to safeguard themselves against potential financial losses. The insurance industry is also innovating, offering more flexible and affordable options to cater to a wider range of pet owners. This includes customizable policies that allow pet owners to choose the level of coverage they need, ensuring that they only pay for what they require. The growing competition in the market is also leading to better customer service and more competitive pricing, making it easier for pet owners to find the right insurance product for their needs. Overall, Third Party Personal Injury Insurance and Property Damage Insurance are vital components of the Global Liability Insurance for Pet Market, providing essential protection for pet owners and contributing to the market's growth and development.

Dog, Cat, Others in the Global Liability Insurance for Pet Market:

The usage of Global Liability Insurance for Pet Market varies across different types of pets, including dogs, cats, and others. For dogs, this insurance is particularly important due to the higher likelihood of incidents such as bites or aggressive behavior. Dog owners often face significant financial risks if their pets cause injury to a person or damage to property. The insurance helps mitigate these risks by covering medical expenses, legal fees, and repair costs. For instance, if a dog bites a passerby, the insurance will cover the victim's medical bills and any legal claims that may arise. This provides dog owners with peace of mind, knowing that they are protected against potential liabilities. For cats, the risks are generally lower compared to dogs, but they are not negligible. Cats can cause injuries through scratching or biting and can also damage property, such as furniture or carpets. The insurance for cats typically covers these types of incidents, ensuring that cat owners are not financially burdened by their pets' actions. This is particularly important for indoor cats, which may have a higher likelihood of causing damage to household items. Other pets, such as birds, reptiles, and small mammals, also benefit from liability insurance, although the risks associated with these pets are generally lower. However, incidents can still occur, such as a bird escaping and causing damage to a neighbor's property or a small mammal biting a visitor. The insurance provides coverage for these types of incidents, ensuring that pet owners are protected against unexpected financial losses. The Global Liability Insurance for Pet Market is thus essential for all types of pet owners, providing comprehensive coverage against potential liabilities. The insurance products are designed to cater to the specific needs of different types of pets, ensuring that pet owners have the necessary protection regardless of the type of pet they own. This tailored approach is driving the demand for liability insurance in the pet market, as more pet owners recognize the importance of being prepared for any eventuality. The increasing awareness of the benefits of liability insurance is also contributing to the market's growth, with more pet owners opting for comprehensive coverage to safeguard themselves against potential financial losses. The insurance industry is responding to this demand by offering more flexible and affordable options, making it easier for pet owners to find the right insurance product for their needs. Overall, the usage of Global Liability Insurance for Pet Market is crucial for all types of pet owners, providing essential protection against potential liabilities and contributing to the market's growth and development.

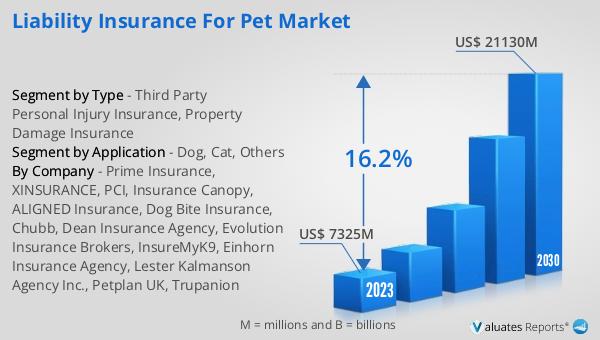

Global Liability Insurance for Pet Market Outlook:

The global Liability Insurance for Pet market was valued at US$ 7325 million in 2023 and is anticipated to reach US$ 21130 million by 2030, witnessing a CAGR of 16.2% during the forecast period 2024-2030. This significant growth reflects the increasing awareness and demand for pet liability insurance among pet owners worldwide. As more people recognize the potential financial risks associated with pet ownership, the demand for comprehensive insurance coverage is on the rise. The market's growth is also driven by the increasing number of pet owners globally, particularly in regions with high pet ownership rates and stringent liability laws. Insurance companies are responding to this demand by offering more tailored and comprehensive insurance products, ensuring that pet owners have the necessary protection against potential liabilities. The market's expansion is also supported by the growing legal requirements in many regions, where pet owners are held accountable for their pets' actions. This has led to a surge in the adoption of liability insurance products, with more pet owners opting for comprehensive coverage to safeguard themselves against potential financial losses. The insurance industry is also innovating, offering more flexible and affordable options to cater to a wider range of pet owners. This includes customizable policies that allow pet owners to choose the level of coverage they need, ensuring that they only pay for what they require. The growing competition in the market is also leading to better customer service and more competitive pricing, making it easier for pet owners to find the right insurance product for their needs. Overall, the global Liability Insurance for Pet market is poised for significant growth, driven by increasing awareness, demand, and legal requirements, ensuring that pet owners have the necessary protection against potential liabilities.

| Report Metric | Details |

| Report Name | Liability Insurance for Pet Market |

| Accounted market size in 2023 | US$ 7325 million |

| Forecasted market size in 2030 | US$ 21130 million |

| CAGR | 16.2% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Prime Insurance, XINSURANCE, PCI, Insurance Canopy, ALIGNED Insurance, Dog Bite Insurance, Chubb, Dean Insurance Agency, Evolution Insurance Brokers, InsureMyK9, Einhorn Insurance Agency, Lester Kalmanson Agency Inc., Petplan UK, Trupanion |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |