What is Global Digital Asset Platform Market?

The Global Digital Asset Platform Market is a rapidly evolving sector that encompasses a wide range of technologies and services designed to manage, store, and trade digital assets. These platforms provide the infrastructure needed for the secure handling of digital currencies, tokens, and other forms of digital assets. They offer various functionalities such as digital wallets, trading platforms, and asset management tools, making it easier for individuals and businesses to engage in the digital economy. The market is driven by the increasing adoption of blockchain technology, the growing popularity of cryptocurrencies, and the need for secure and efficient digital asset management solutions. As more industries recognize the potential of digital assets, the demand for robust and versatile digital asset platforms continues to grow. These platforms are not only used for trading and investment purposes but also for a wide range of applications including supply chain management, identity verification, and digital rights management. The global digital asset platform market is poised for significant growth as it continues to innovate and expand its offerings to meet the diverse needs of its users.

Digital Currency Trading Platform, Lending Platform in the Global Digital Asset Platform Market:

Digital Currency Trading Platforms and Lending Platforms are two critical components of the Global Digital Asset Platform Market. Digital Currency Trading Platforms are online services that allow users to buy, sell, and trade various digital currencies such as Bitcoin, Ethereum, and other altcoins. These platforms provide a marketplace where buyers and sellers can interact, often offering advanced trading tools, real-time market data, and secure transaction processing. They cater to both individual investors and institutional traders, providing features like margin trading, futures contracts, and automated trading bots. Security is a paramount concern for these platforms, and they employ various measures such as two-factor authentication, encryption, and cold storage to protect users' assets. On the other hand, Lending Platforms in the digital asset space enable users to lend their digital currencies to others in exchange for interest payments. These platforms facilitate peer-to-peer lending, where borrowers can obtain loans without the need for traditional financial intermediaries. Lenders can earn interest on their digital assets, while borrowers can access funds quickly and often at lower interest rates compared to traditional loans. The lending process is typically secured by smart contracts, which automate the terms of the loan and ensure that both parties fulfill their obligations. These platforms also offer features like collateral management, credit scoring, and risk assessment to ensure the safety and reliability of the lending process. Both Digital Currency Trading Platforms and Lending Platforms are integral to the broader digital asset ecosystem, providing essential services that enhance liquidity, accessibility, and utility of digital assets. As the market continues to mature, these platforms are likely to see further innovation and integration with other financial services, driving greater adoption and usage of digital assets across various sectors.

Financial Services, Social Media in the Global Digital Asset Platform Market:

The usage of the Global Digital Asset Platform Market extends into several key areas, including Financial Services and Social Media. In the realm of Financial Services, digital asset platforms are revolutionizing the way financial transactions are conducted. They offer a secure and efficient means of transferring value across borders, reducing the need for traditional banking intermediaries and lowering transaction costs. Financial institutions are increasingly adopting these platforms to offer new products and services, such as digital wallets, asset tokenization, and blockchain-based payment systems. These innovations enable faster settlement times, enhanced transparency, and improved security, making financial services more accessible and inclusive. Additionally, digital asset platforms are being used for regulatory compliance and fraud prevention, leveraging blockchain's immutable ledger to provide a transparent and auditable record of transactions. In the context of Social Media, digital asset platforms are creating new opportunities for content creators and users to monetize their activities. Social media platforms are integrating digital currencies and tokens to enable micropayments, tipping, and rewards for content creation and engagement. This not only provides a new revenue stream for creators but also fosters a more interactive and engaging user experience. Users can earn tokens for their contributions, which can be traded or used within the platform's ecosystem. Furthermore, digital asset platforms are being used to verify the authenticity of digital content, combating issues like fake news and digital piracy. By leveraging blockchain technology, social media platforms can ensure that content is original and has not been tampered with, enhancing trust and credibility. Overall, the integration of digital asset platforms in Financial Services and Social Media is driving innovation, improving efficiency, and creating new economic opportunities for individuals and businesses alike.

Global Digital Asset Platform Market Outlook:

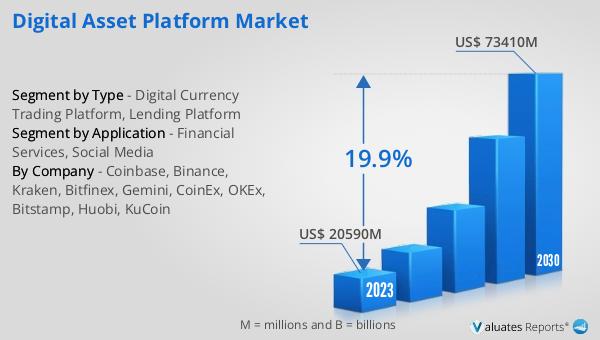

The global Digital Asset Platform market, valued at US$ 20,590 million in 2023, is projected to reach US$ 73,410 million by 2030, reflecting a compound annual growth rate (CAGR) of 19.9% during the forecast period from 2024 to 2030. This significant growth underscores the increasing adoption and reliance on digital asset platforms across various industries. The market's expansion is driven by the rising popularity of cryptocurrencies, the growing need for secure and efficient digital asset management solutions, and the broader adoption of blockchain technology. As more businesses and individuals recognize the potential benefits of digital assets, the demand for robust and versatile platforms continues to rise. These platforms are not only facilitating trading and investment but are also being integrated into various applications such as supply chain management, identity verification, and digital rights management. The projected growth of the market highlights the ongoing innovation and development within the sector, as digital asset platforms evolve to meet the diverse needs of their users. This trend is expected to continue, with digital asset platforms playing an increasingly important role in the global economy.

| Report Metric | Details |

| Report Name | Digital Asset Platform Market |

| Accounted market size in 2023 | US$ 20590 million |

| Forecasted market size in 2030 | US$ 73410 million |

| CAGR | 19.9% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Coinbase, Binance, Kraken, Bitfinex, Gemini, CoinEx, OKEx, Bitstamp, Huobi, KuCoin |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |