What is Employer Liability Business Insurance - Global Market?

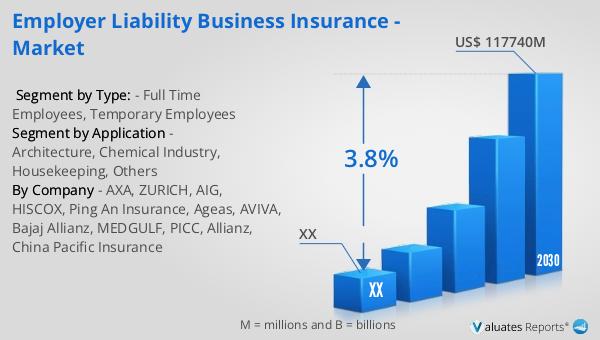

Employer Liability Business Insurance is a crucial component of the global insurance market, designed to protect businesses from financial losses associated with claims made by employees who suffer work-related injuries or illnesses. This type of insurance covers legal costs and compensation payments that a company might be liable for if an employee claims that their injury or illness was caused by their work. The global market for Employer Liability Business Insurance was valued at approximately US$ 92,150 million in 2023 and is projected to grow to around US$ 117,740 million by 2030, reflecting a compound annual growth rate (CAGR) of 3.8% during the forecast period from 2024 to 2030. This growth is driven by an increasing awareness among companies about the importance of safeguarding their workforce and mitigating potential financial risks. As economies develop, more organizations recognize the necessity of purchasing employer liability insurance to transfer risks associated with employee claims, ensuring both compliance with legal requirements and the protection of their financial stability. This insurance not only provides peace of mind to employers but also demonstrates a commitment to employee welfare, which can enhance a company's reputation and employee satisfaction.

Full Time Employees, Temporary Employees in the Employer Liability Business Insurance - Global Market:

In the context of Employer Liability Business Insurance, understanding the distinction between full-time and temporary employees is essential for businesses operating in the global market. Full-time employees are typically those who work a standard number of hours per week, often receiving a comprehensive benefits package that includes health insurance, retirement plans, and paid leave. These employees are usually considered permanent staff members, and their employment is often governed by long-term contracts. Employer Liability Business Insurance for full-time employees is crucial as it ensures that any work-related injuries or illnesses are covered, protecting both the employee and the employer from financial strain. On the other hand, temporary employees are hired for a specific period or project and may not receive the same level of benefits as full-time employees. They are often brought in to handle increased workloads or to provide specialized skills for short-term needs. Despite their temporary status, these employees are still entitled to protection under employer liability insurance, as they can also suffer from work-related injuries or illnesses. The global market for Employer Liability Business Insurance must account for the varying needs of businesses employing both full-time and temporary staff. Companies must carefully assess their workforce composition and ensure that their insurance policies adequately cover all employees, regardless of their employment status. This involves understanding the specific risks associated with different types of employment and tailoring insurance coverage to meet those needs. For instance, industries with a high reliance on temporary workers, such as construction or event management, may face different risks compared to those with predominantly full-time staff, like corporate offices. As the global market for Employer Liability Business Insurance continues to grow, businesses must remain vigilant in evaluating their insurance needs and ensuring compliance with local regulations. This includes staying informed about changes in labor laws and insurance requirements that may impact coverage for both full-time and temporary employees. By doing so, companies can protect themselves from potential legal and financial liabilities while fostering a safe and supportive work environment for all employees. Ultimately, the effective management of Employer Liability Business Insurance for both full-time and temporary employees is a critical aspect of risk management in today's dynamic and diverse workforce.

Architecture, Chemical Industry, Housekeeping, Others in the Employer Liability Business Insurance - Global Market:

Employer Liability Business Insurance plays a significant role across various industries, including architecture, the chemical industry, housekeeping, and others, by providing essential protection against potential liabilities arising from employee injuries or illnesses. In the field of architecture, professionals often work on construction sites or in environments where they are exposed to physical hazards. Employer Liability Business Insurance is crucial in this sector to cover any claims related to accidents or injuries that may occur on-site, ensuring that architectural firms can manage financial risks while maintaining compliance with safety regulations. In the chemical industry, employees are frequently exposed to hazardous substances and environments, making the risk of work-related illnesses or injuries particularly high. Employer Liability Business Insurance is vital for chemical companies to protect themselves from potential claims and legal actions, as well as to demonstrate a commitment to employee safety and well-being. This insurance helps cover medical expenses, legal fees, and compensation payments, allowing chemical companies to focus on their core operations without the burden of financial uncertainty. Housekeeping, often considered a high-risk occupation due to the physical demands and exposure to cleaning chemicals, also benefits significantly from Employer Liability Business Insurance. This insurance provides coverage for injuries such as slips, trips, and falls, as well as illnesses resulting from prolonged exposure to cleaning agents. By securing this insurance, housekeeping companies can ensure that their employees receive the necessary support and compensation in the event of a work-related incident, fostering a safer and more secure working environment. Beyond these specific industries, Employer Liability Business Insurance is essential for any business that employs staff, regardless of the sector. It provides a safety net for companies, allowing them to manage the financial implications of employee claims effectively. By investing in this insurance, businesses can protect their financial stability, comply with legal requirements, and demonstrate a commitment to employee welfare. As the global market for Employer Liability Business Insurance continues to expand, companies across various industries must recognize the importance of this coverage and ensure that their policies are tailored to meet the unique risks and needs of their workforce.

Employer Liability Business Insurance - Global Market Outlook:

The global market for Employer Liability Business Insurance was valued at approximately US$ 92,150 million in 2023, with projections indicating a growth to around US$ 117,740 million by 2030. This represents a compound annual growth rate (CAGR) of 3.8% during the forecast period from 2024 to 2030. This growth is largely attributed to the increasing recognition among businesses of the importance of protecting their employees and mitigating potential financial risks. As economies continue to develop, more companies and organizations are realizing the necessity of purchasing employer liability commercial insurance to transfer risks associated with employee claims. This insurance not only provides financial protection for businesses but also demonstrates a commitment to employee welfare, which can enhance a company's reputation and employee satisfaction. By investing in Employer Liability Business Insurance, companies can safeguard their financial stability, comply with legal requirements, and foster a safe and supportive work environment for their employees. As the global market for this insurance continues to expand, businesses must remain vigilant in evaluating their insurance needs and ensuring that their policies are tailored to meet the unique risks and needs of their workforce.

| Report Metric | Details |

| Report Name | Employer Liability Business Insurance - Market |

| Forecasted market size in 2030 | US$ 117740 million |

| CAGR | 3.8% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | AXA, ZURICH, AIG, HISCOX, Ping An Insurance, Ageas, AVIVA, Bajaj Allianz, MEDGULF, PICC, Allianz, China Pacific Insurance |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |