What is Global Advanced Packaging for Automotive Chips Market?

The Global Advanced Packaging for Automotive Chips Market refers to the specialized techniques and technologies used to encase and protect semiconductor chips used in automotive applications. These advanced packaging methods are crucial for enhancing the performance, reliability, and longevity of automotive chips, which are integral to modern vehicles' electronic systems. As cars become more sophisticated with features like autonomous driving, advanced driver-assistance systems (ADAS), and enhanced infotainment systems, the demand for high-performance and durable semiconductor chips has surged. Advanced packaging solutions, such as Flip Chip (FC), Wafer-Level Chip Scale Packaging (WLCSP), and other innovative methods, are employed to meet these stringent requirements. These packaging techniques help in managing heat dissipation, reducing power consumption, and improving the overall efficiency of the chips. The market for advanced packaging in automotive chips is growing rapidly, driven by the increasing complexity and functionality of automotive electronics. This growth is further fueled by the automotive industry's shift towards electric and hybrid vehicles, which require more sophisticated electronic components.

FC (Flip Chip), WLCSP, Others in the Global Advanced Packaging for Automotive Chips Market:

Flip Chip (FC), Wafer-Level Chip Scale Packaging (WLCSP), and other advanced packaging methods play a pivotal role in the Global Advanced Packaging for Automotive Chips Market. Flip Chip (FC) is a method where the semiconductor die is flipped and connected directly to the substrate or circuit board using solder bumps. This technique offers several advantages, including improved electrical performance, better heat dissipation, and reduced signal inductance. FC is particularly beneficial for high-frequency and high-power applications, making it ideal for automotive chips that require robust performance and reliability. Wafer-Level Chip Scale Packaging (WLCSP) is another advanced packaging method where the packaging is done at the wafer level, before the individual chips are cut from the wafer. This approach allows for a smaller footprint, lower cost, and enhanced performance. WLCSP is highly suitable for automotive applications where space is at a premium, and there is a need for high-density integration. Other advanced packaging methods include System-in-Package (SiP), Fan-Out Wafer-Level Packaging (FOWLP), and Through-Silicon Via (TSV) technology. SiP involves integrating multiple chips and passive components into a single package, providing a compact and efficient solution for complex automotive systems. FOWLP offers improved thermal and electrical performance by redistributing the chip's I/O connections over a larger area, making it suitable for high-performance automotive applications. TSV technology enables vertical stacking of chips, allowing for higher integration density and improved performance. These advanced packaging methods collectively contribute to the enhanced performance, reliability, and miniaturization of automotive chips, meeting the stringent requirements of modern automotive electronics. As the automotive industry continues to evolve with advancements in autonomous driving, electric vehicles, and connected car technologies, the demand for advanced packaging solutions is expected to grow, driving innovation and development in the Global Advanced Packaging for Automotive Chips Market.

Automotive OSAT, Automotive IDM in the Global Advanced Packaging for Automotive Chips Market:

The usage of Global Advanced Packaging for Automotive Chips Market in areas such as Automotive OSAT (Outsourced Semiconductor Assembly and Test) and Automotive IDM (Integrated Device Manufacturer) is significant. Automotive OSAT companies specialize in providing assembly and testing services for semiconductor chips used in automotive applications. These companies leverage advanced packaging technologies to enhance the performance and reliability of automotive chips. By outsourcing the assembly and testing processes to OSAT providers, automotive chip manufacturers can focus on their core competencies, such as design and development, while ensuring that their chips meet the stringent quality and performance standards required in the automotive industry. OSAT providers play a crucial role in the supply chain, offering specialized expertise and state-of-the-art facilities for advanced packaging and testing. On the other hand, Automotive IDM companies are vertically integrated, handling the entire semiconductor manufacturing process from design to production, including packaging and testing. IDMs leverage advanced packaging technologies to develop high-performance and reliable automotive chips in-house. This vertical integration allows IDMs to have greater control over the quality and performance of their chips, ensuring that they meet the specific requirements of automotive applications. Advanced packaging solutions, such as Flip Chip, WLCSP, and other innovative methods, are employed by both OSAT and IDM companies to enhance the performance, reliability, and miniaturization of automotive chips. These packaging techniques help in managing heat dissipation, reducing power consumption, and improving the overall efficiency of the chips. As the automotive industry continues to evolve with advancements in autonomous driving, electric vehicles, and connected car technologies, the demand for advanced packaging solutions is expected to grow, driving innovation and development in the Global Advanced Packaging for Automotive Chips Market.

Global Advanced Packaging for Automotive Chips Market Outlook:

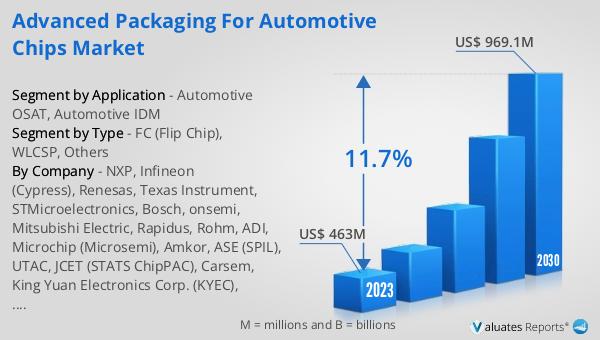

The global market for Advanced Packaging for Automotive Chips was valued at approximately $463 million in 2023. Projections indicate that this market is set to grow significantly, reaching an estimated $969.1 million by the year 2030. This growth trajectory represents a compound annual growth rate (CAGR) of 11.7% over the forecast period from 2024 to 2030. This substantial increase underscores the rising demand for advanced packaging solutions in the automotive sector, driven by the increasing complexity and functionality of automotive electronics. As vehicles become more sophisticated with features like autonomous driving, advanced driver-assistance systems (ADAS), and enhanced infotainment systems, the need for high-performance and reliable semiconductor chips has surged. Advanced packaging methods, such as Flip Chip (FC), Wafer-Level Chip Scale Packaging (WLCSP), and other innovative techniques, are crucial in meeting these stringent requirements. These packaging solutions help in managing heat dissipation, reducing power consumption, and improving the overall efficiency of the chips, thereby enhancing the performance and reliability of automotive electronic systems. The anticipated growth in the Global Advanced Packaging for Automotive Chips Market reflects the automotive industry's ongoing shift towards electric and hybrid vehicles, which require more sophisticated electronic components. This trend is expected to drive further innovation and development in advanced packaging technologies, ensuring that automotive chips can meet the evolving demands of modern vehicles.

| Report Metric | Details |

| Report Name | Advanced Packaging for Automotive Chips Market |

| Accounted market size in 2023 | US$ 463 million |

| Forecasted market size in 2030 | US$ 969.1 million |

| CAGR | 11.7% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | NXP, Infineon (Cypress), Renesas, Texas Instrument, STMicroelectronics, Bosch, onsemi, Mitsubishi Electric, Rapidus, Rohm, ADI, Microchip (Microsemi), Amkor, ASE (SPIL), UTAC, JCET (STATS ChipPAC), Carsem, King Yuan Electronics Corp. (KYEC), KINGPAK Technology Inc, Powertech Technology Inc. (PTI), SFA Semicon, Unisem Group, Chipbond Technology Corporation, ChipMOS TECHNOLOGIES, OSE CORP., Sigurd Microelectronics, Natronix Semiconductor Technology, Nepes, KESM Industries Berhad, Forehope Electronic (Ningbo) Co.,Ltd., Union Semiconductor(Hefei)Co., Ltd., Tongfu Microelectronics (TFME), Hefei Chipmore Technology Co.,Ltd., HT-tech, China Wafer Level CSP Co., Ltd, Ningbo ChipEx Semiconductor Co., Ltd, Guangdong Leadyo IC Testing, Unimos Microelectronics (Shanghai), Sino Technology, Taiji Semiconductor (Suzhou) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |