What is Global 3D Secure Payment Authentication Market?

The Global 3D Secure Payment Authentication Market refers to the industry focused on providing enhanced security for online transactions. This market revolves around the 3D Secure protocol, which is an additional layer of security for online credit and debit card transactions. The protocol is designed to reduce fraud and provide a safer online shopping experience by requiring cardholders to complete an additional verification step. This step typically involves entering a password or a one-time code sent to the cardholder's mobile device. The market includes various stakeholders such as banks, merchants, and payment gateways, all of whom play a role in implementing and maintaining this security measure. The growing prevalence of online shopping and the increasing need for secure payment methods are driving the expansion of this market. As more consumers and businesses recognize the importance of protecting sensitive financial information, the demand for 3D Secure Payment Authentication solutions continues to rise.

Access Control Server, Merchant Plug-in, Others in the Global 3D Secure Payment Authentication Market:

Access Control Server (ACS), Merchant Plug-in (MPI), and other components are integral parts of the Global 3D Secure Payment Authentication Market. The Access Control Server is a critical component that banks and card issuers use to authenticate cardholders during online transactions. When a cardholder initiates a purchase, the ACS verifies their identity by prompting them to enter a password or a one-time code. This process ensures that the person making the transaction is indeed the legitimate cardholder, thereby reducing the risk of fraud. The ACS communicates with the card issuer's database to validate the cardholder's credentials and approve or decline the transaction based on the verification results. On the other hand, the Merchant Plug-in is a software module that merchants integrate into their online payment systems. The MPI facilitates the communication between the merchant's website and the card issuer's ACS. When a customer makes a purchase, the MPI sends a request to the ACS to authenticate the cardholder. If the authentication is successful, the MPI proceeds with the transaction, ensuring that the payment is secure. The MPI also helps merchants comply with the 3D Secure protocol, which is essential for reducing chargebacks and maintaining customer trust. Other components in the 3D Secure Payment Authentication Market include the Directory Server and the Cardholder Authentication Verification Value (CAVV). The Directory Server acts as a central hub that routes authentication requests between the merchant, the ACS, and the card issuer. It ensures that the authentication process is seamless and efficient, minimizing delays and disruptions during online transactions. The CAVV is a unique code generated during the authentication process, which serves as proof that the cardholder has been successfully verified. This code is included in the transaction data sent to the card issuer, providing an additional layer of security. Together, these components work in harmony to create a robust and secure online payment environment. The collaboration between banks, merchants, and payment gateways is crucial for the successful implementation of 3D Secure Payment Authentication solutions. As the market continues to evolve, advancements in technology and increased adoption of secure payment methods are expected to drive further growth and innovation.

Banks, Merchants & Payment Gateway in the Global 3D Secure Payment Authentication Market:

The usage of Global 3D Secure Payment Authentication Market spans across various sectors, including banks, merchants, and payment gateways. Banks play a pivotal role in this market by implementing Access Control Servers (ACS) to authenticate cardholders during online transactions. When a customer initiates a purchase, the bank's ACS prompts them to enter a password or a one-time code, ensuring that the transaction is being made by the legitimate cardholder. This process not only reduces the risk of fraud but also enhances customer trust in the bank's security measures. Banks benefit from reduced chargebacks and increased customer satisfaction, as cardholders feel more secure when making online purchases. Merchants, on the other hand, integrate Merchant Plug-ins (MPI) into their online payment systems to facilitate the authentication process. The MPI communicates with the bank's ACS to verify the cardholder's identity before proceeding with the transaction. By adopting 3D Secure Payment Authentication, merchants can significantly reduce the risk of fraudulent transactions and chargebacks. This not only protects their revenue but also enhances their reputation as a secure and trustworthy online retailer. Additionally, merchants can offer a seamless and secure shopping experience to their customers, which can lead to increased sales and customer loyalty. Payment gateways act as intermediaries between merchants and banks, ensuring that the authentication process is smooth and efficient. They play a crucial role in routing authentication requests and responses between the merchant's website and the bank's ACS. By supporting 3D Secure Payment Authentication, payment gateways help merchants comply with security protocols and reduce the risk of fraud. They also provide value-added services such as real-time fraud detection and prevention, further enhancing the security of online transactions. Overall, the collaboration between banks, merchants, and payment gateways is essential for the successful implementation of 3D Secure Payment Authentication solutions. Each stakeholder plays a vital role in ensuring that online transactions are secure and that cardholders are protected from fraud. As the market continues to grow, the adoption of 3D Secure Payment Authentication is expected to increase, driven by the need for enhanced security and the growing prevalence of online shopping.

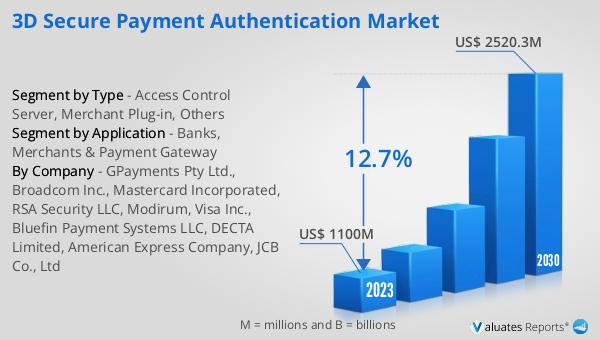

Global 3D Secure Payment Authentication Market Outlook:

The global 3D Secure Payment Authentication market was valued at US$ 1100 million in 2023 and is anticipated to reach US$ 2520.3 million by 2030, witnessing a CAGR of 12.7% during the forecast period 2024-2030. This significant growth reflects the increasing demand for secure online payment solutions as more consumers and businesses engage in e-commerce. The 3D Secure protocol, which adds an extra layer of security to online transactions, is becoming a standard practice for many financial institutions and merchants. The market's expansion is driven by the rising awareness of online fraud and the need to protect sensitive financial information. As technology continues to advance, the adoption of 3D Secure Payment Authentication solutions is expected to grow, providing a safer and more secure online shopping experience for consumers worldwide. The collaboration between banks, merchants, and payment gateways is crucial for the successful implementation of these solutions, ensuring that online transactions are secure and that cardholders are protected from fraud.

| Report Metric | Details |

| Report Name | 3D Secure Payment Authentication Market |

| Accounted market size in 2023 | US$ 1100 million |

| Forecasted market size in 2030 | US$ 2520.3 million |

| CAGR | 12.7% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | GPayments Pty Ltd., Broadcom Inc., Mastercard Incorporated, RSA Security LLC, Modirum, Visa Inc., Bluefin Payment Systems LLC, DECTA Limited, American Express Company, JCB Co., Ltd |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |