What is Global 3D C-Arm Market?

The Global 3D C-Arm Market is a rapidly evolving segment within the medical imaging industry. A 3D C-Arm is a medical imaging device that is used primarily in orthopedic, surgical, and emergency care settings. It provides high-resolution, real-time X-ray images, which are crucial for various medical procedures. The "3D" aspect refers to its ability to produce three-dimensional images, offering a more detailed and accurate view compared to traditional 2D imaging. This advanced imaging capability is particularly beneficial for complex surgical procedures, as it allows for better visualization of anatomical structures. The market for 3D C-Arms is driven by the increasing demand for minimally invasive surgeries, advancements in imaging technology, and the growing prevalence of chronic diseases that require surgical intervention. Additionally, the aging global population and the rising number of orthopedic and cardiovascular procedures are contributing to the market's growth. The adoption of 3D C-Arms is also being fueled by the need for improved diagnostic accuracy and the ability to perform complex procedures with greater precision and safety. Overall, the Global 3D C-Arm Market is poised for significant growth as healthcare providers continue to seek advanced imaging solutions to enhance patient care and outcomes.

9 inch, 12 inch in the Global 3D C-Arm Market:

In the Global 3D C-Arm Market, devices are often categorized based on the size of their image intensifiers, with 9-inch and 12-inch being the most common. The 9-inch C-Arm is typically used in procedures that require a smaller field of view but high precision, such as orthopedic surgeries and pain management interventions. These devices are compact and easier to maneuver, making them ideal for use in smaller operating rooms or specialty clinics. They provide excellent image quality and are particularly useful for procedures that involve the extremities, such as hands, wrists, and feet. On the other hand, the 12-inch C-Arm offers a larger field of view, which is beneficial for more complex procedures that require a broader perspective, such as spinal surgeries, abdominal procedures, and vascular interventions. The larger image intensifier allows for better visualization of larger anatomical areas, which is crucial for accurate diagnosis and treatment planning. These devices are often used in hospitals and larger surgical centers where space is less of a constraint, and the need for comprehensive imaging is greater. Both 9-inch and 12-inch C-Arms are equipped with advanced imaging technologies, such as digital subtraction angiography (DSA), which enhances the visibility of blood vessels and other structures. They also feature 3D imaging capabilities, which provide a more detailed and accurate representation of the patient's anatomy, aiding in precise surgical navigation and reducing the risk of complications. The choice between a 9-inch and 12-inch C-Arm depends on the specific needs of the medical facility and the types of procedures they perform. While 9-inch C-Arms are more suited for targeted, high-precision interventions, 12-inch C-Arms are preferred for comprehensive imaging in complex surgical cases. Both types of devices play a crucial role in enhancing the quality of patient care by providing high-resolution, real-time images that guide surgeons during procedures. As the demand for advanced imaging solutions continues to grow, the Global 3D C-Arm Market is expected to see increased adoption of both 9-inch and 12-inch devices, driven by their ability to improve diagnostic accuracy and surgical outcomes.

Hospitals, Specialty Clinics in the Global 3D C-Arm Market:

The usage of 3D C-Arms in hospitals and specialty clinics has revolutionized the way medical procedures are performed, offering significant benefits in terms of diagnostic accuracy, surgical precision, and patient safety. In hospitals, 3D C-Arms are widely used in operating rooms for a variety of surgical procedures, including orthopedic, cardiovascular, and neurosurgical interventions. The ability to produce high-resolution, real-time 3D images allows surgeons to visualize the patient's anatomy in greater detail, facilitating more accurate and precise surgical navigation. This is particularly important in complex procedures, such as spinal surgeries, where the precise placement of implants and instruments is crucial to avoid complications and ensure successful outcomes. Additionally, 3D C-Arms are used in interventional radiology departments for procedures such as angiography, where detailed imaging of blood vessels is required to diagnose and treat vascular conditions. The advanced imaging capabilities of 3D C-Arms also enable hospitals to perform minimally invasive surgeries, which offer numerous benefits, including reduced recovery times, lower risk of infection, and shorter hospital stays. In specialty clinics, 3D C-Arms are used for a range of diagnostic and therapeutic procedures, particularly in fields such as orthopedics, pain management, and sports medicine. These clinics often perform procedures that require high precision and accuracy, such as joint injections, fracture reductions, and spinal interventions. The compact design and maneuverability of 3D C-Arms make them ideal for use in smaller clinical settings, where space may be limited. The ability to obtain detailed 3D images in real-time allows clinicians to make more informed decisions and perform procedures with greater confidence, ultimately improving patient outcomes. Furthermore, the use of 3D C-Arms in specialty clinics enhances the overall patient experience by reducing the need for multiple imaging sessions and minimizing exposure to radiation. As the demand for advanced imaging solutions continues to grow, the adoption of 3D C-Arms in both hospitals and specialty clinics is expected to increase, driven by their ability to improve diagnostic accuracy, enhance surgical precision, and promote better patient care.

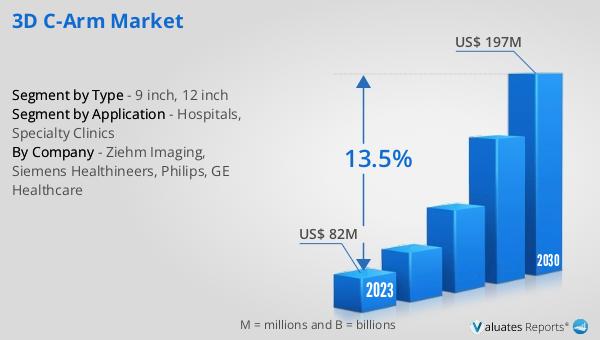

Global 3D C-Arm Market Outlook:

The global 3D C-Arm market has shown significant growth in recent years and is expected to continue this trend. In 2023, the market was valued at approximately US$ 68 million. By 2030, it is projected to reach around US$ 175.3 million, reflecting a compound annual growth rate (CAGR) of 13.5% during the forecast period from 2024 to 2030. This impressive growth can be attributed to several factors, including the increasing demand for advanced imaging solutions in medical procedures, the rising prevalence of chronic diseases that require surgical intervention, and the growing adoption of minimally invasive surgeries. The advancements in imaging technology have also played a crucial role in driving the market, as healthcare providers seek more accurate and detailed imaging solutions to enhance patient care. Additionally, the aging global population and the increasing number of orthopedic and cardiovascular procedures are contributing to the market's expansion. The ability of 3D C-Arms to provide high-resolution, real-time images that aid in precise surgical navigation and reduce the risk of complications is a key factor driving their adoption. As the healthcare industry continues to evolve, the demand for innovative imaging solutions like 3D C-Arms is expected to rise, further propelling the market's growth. Overall, the global 3D C-Arm market is poised for significant expansion, offering numerous opportunities for healthcare providers to improve diagnostic accuracy and surgical outcomes.

| Report Metric | Details |

| Report Name | 3D C-Arm Market |

| Accounted market size in 2023 | US$ 68 million |

| Forecasted market size in 2030 | US$ 175.3 million |

| CAGR | 13.5% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | Ziehm Imaging, Siemens Healthineers, Philips, GE Healthcare |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |