What is Global Cell Phone Lenses Market?

The Global Cell Phone Lenses Market is a dynamic and rapidly evolving sector within the broader mobile technology industry. As smartphones have become an integral part of daily life, the demand for enhanced photography capabilities has surged, leading to the development and proliferation of specialized cell phone lenses. These lenses are designed to augment the photographic capabilities of smartphone cameras, offering users the ability to capture high-quality images with greater versatility. The market encompasses a variety of lens types, each catering to different photographic needs and preferences. From wide-angle lenses that allow for expansive landscape shots to macro lenses that capture intricate details, the options are vast and varied. This market is driven by technological advancements, consumer demand for superior image quality, and the increasing popularity of social media platforms where visual content is paramount. As a result, manufacturers are continually innovating to produce lenses that are not only high-performing but also compact and user-friendly. The Global Cell Phone Lenses Market is characterized by intense competition, with numerous players striving to capture market share by offering unique and innovative products. This competitive landscape ensures that consumers have access to a wide range of options, catering to both amateur photographers and professional users alike.

Wide-angle Lens, Ultra-wide-angle Lens, Telephoto Lens, Macro Lens, Monochrome Lens in the Global Cell Phone Lenses Market:

In the realm of the Global Cell Phone Lenses Market, various types of lenses serve distinct purposes, enhancing the photographic capabilities of smartphones. Wide-angle lenses are particularly popular for their ability to capture more of the scene in a single shot, making them ideal for landscape photography, group photos, and architectural shots. These lenses have a shorter focal length, allowing them to encompass a broader field of view. Ultra-wide-angle lenses take this a step further, offering an even wider perspective that can be particularly useful in tight spaces or when trying to capture dramatic, sweeping vistas. They are often used in real estate photography to give a sense of space and in creative photography to achieve unique perspectives. Telephoto lenses, on the other hand, are designed to magnify distant subjects, making them perfect for wildlife photography, sports events, or any situation where the subject is far away. These lenses have a longer focal length, which allows them to bring distant objects closer without sacrificing image quality. Macro lenses are specialized for close-up photography, enabling users to capture minute details with stunning clarity. They are commonly used for photographing small subjects like insects, flowers, or intricate textures, providing a magnified view that reveals details not visible to the naked eye. Monochrome lenses, while less common, are designed to capture images in black and white, emphasizing contrast and texture. These lenses are favored by photographers who appreciate the timeless quality of monochrome photography and wish to explore the nuances of light and shadow. Each of these lenses plays a crucial role in the Global Cell Phone Lenses Market, catering to diverse consumer needs and preferences. As smartphone photography continues to evolve, the demand for specialized lenses is expected to grow, driven by the desire for enhanced image quality and creative expression.

Front Camera, Rear Camera in the Global Cell Phone Lenses Market:

The usage of cell phone lenses in the Global Cell Phone Lenses Market is primarily focused on enhancing the capabilities of both front and rear cameras on smartphones. The front camera, often referred to as the selfie camera, has become increasingly important in recent years due to the rise of social media and video communication platforms. Wide-angle and ultra-wide-angle lenses are particularly beneficial for front cameras, as they allow users to capture more of their surroundings in selfies or group photos. This is especially useful for vlogging or live streaming, where capturing a broader scene can enhance the viewer's experience. Additionally, some front cameras are equipped with portrait lenses that create a bokeh effect, blurring the background to emphasize the subject, which is highly desirable for professional-looking selfies. On the other hand, the rear camera, which is typically more advanced, benefits from a wider range of lens options. Telephoto lenses are commonly used in rear cameras to provide optical zoom capabilities, allowing users to capture distant subjects with clarity. This is particularly useful for travel photography, wildlife photography, and capturing events from a distance. Macro lenses are also popular for rear cameras, enabling users to explore the world of close-up photography and capture intricate details that are often overlooked. The versatility of rear cameras is further enhanced by the use of monochrome lenses, which can add a creative and artistic touch to photographs by focusing on contrast and texture. Overall, the integration of specialized lenses in both front and rear cameras has significantly expanded the possibilities of smartphone photography, allowing users to capture a wide range of subjects and scenes with professional-level quality. As the Global Cell Phone Lenses Market continues to grow, the development of innovative lens technologies is expected to further enhance the capabilities of smartphone cameras, providing users with even more creative options.

Global Cell Phone Lenses Market Outlook:

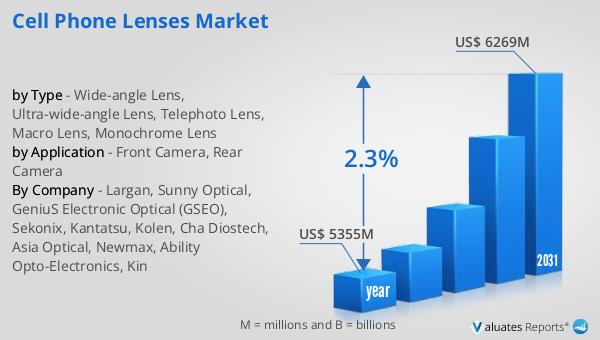

The global market for cell phone lenses was valued at approximately $5,355 million in 2024, with projections indicating that it will reach an adjusted size of around $6,269 million by 2031. This growth is expected to occur at a compound annual growth rate (CAGR) of 2.3% over the forecast period. The market is dominated by the top three companies, which collectively hold a significant share of over 65%. Among the countries, China stands out as the largest market, accounting for about 69% of the total market share, followed by South Korea and Japan. This dominance can be attributed to several factors, including the high demand for advanced smartphone photography capabilities and the presence of major smartphone manufacturers in these regions. The competitive landscape of the Global Cell Phone Lenses Market is characterized by continuous innovation and the introduction of new products that cater to the evolving needs of consumers. As the market continues to expand, companies are focusing on developing lenses that offer superior performance, compact design, and ease of use. This focus on innovation is expected to drive further growth in the market, providing consumers with a wide range of options to enhance their smartphone photography experience.

| Report Metric | Details |

| Report Name | Cell Phone Lenses Market |

| Accounted market size in year | US$ 5355 million |

| Forecasted market size in 2031 | US$ 6269 million |

| CAGR | 2.3% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Largan, Sunny Optical, GeniuS Electronic Optical (GSEO), Sekonix, Kantatsu, Kolen, Cha Diostech, Asia Optical, Newmax, Ability Opto-Electronics, Kin |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |