What is Global Methylglycinediacetic Acid Market?

The Global Methylglycinediacetic Acid Market is a dynamic and evolving sector within the chemical industry, focusing on the production and application of methylglycinediacetic acid (MGDA). MGDA is a chelating agent, which means it has the ability to bind with metal ions, making it highly valuable in various industrial applications. This market is driven by the increasing demand for environmentally friendly and biodegradable chelating agents, as MGDA is known for its excellent biodegradability and low toxicity. It is widely used in industries such as detergents, textiles, and pulp and paper, where it helps improve the efficiency and effectiveness of processes by preventing metal ion interference. The market's growth is also fueled by the rising awareness and regulatory pressures to reduce the environmental impact of industrial processes, prompting industries to adopt more sustainable alternatives like MGDA. As a result, the Global Methylglycinediacetic Acid Market is expected to continue expanding, driven by technological advancements and the increasing adoption of green chemistry practices across various sectors.

Solution, Powder in the Global Methylglycinediacetic Acid Market:

In the Global Methylglycinediacetic Acid Market, the forms of MGDA available are primarily solution and powder. The solution form of MGDA is particularly popular due to its ease of use and versatility in various applications. It is often preferred in industries where liquid formulations are more convenient, such as in the production of liquid detergents and cleaning agents. The solution form allows for easy mixing and integration into existing formulations, making it a practical choice for manufacturers looking to enhance the performance of their products. On the other hand, the powder form of MGDA is favored in applications where precise dosing and stability are crucial. The powder form is often used in solid detergent formulations, where it can be easily measured and mixed with other ingredients to achieve the desired chelating effect. Additionally, the powder form is advantageous in terms of storage and transportation, as it typically has a longer shelf life and is less prone to degradation compared to liquid forms. Both forms of MGDA offer unique benefits and are chosen based on the specific requirements of the application and the preferences of the manufacturers. The choice between solution and powder forms of MGDA is influenced by factors such as the nature of the end product, the manufacturing process, and the desired performance characteristics. For instance, in the detergent industry, the solution form is often used in liquid detergents to enhance their cleaning power and stability, while the powder form is used in powdered detergents to improve their effectiveness in hard water conditions. In the textile industry, MGDA in solution form is used to prevent metal ion interference during dyeing processes, ensuring vibrant and consistent colors. The powder form, on the other hand, is used in textile finishing processes to enhance the durability and quality of the fabrics. In the pulp and paper industry, MGDA in solution form is used to improve the efficiency of bleaching processes, reducing the need for harsh chemicals and minimizing environmental impact. The powder form is used in paper manufacturing to enhance the brightness and quality of the final product. Overall, the choice between solution and powder forms of MGDA is determined by the specific needs of the industry and the desired outcomes of the application. As the demand for sustainable and efficient chelating agents continues to grow, the Global Methylglycinediacetic Acid Market is expected to see increased adoption of both solution and powder forms, driven by their unique advantages and the growing emphasis on environmentally friendly practices.

Detergent, Pulp and Paper, Textile Industry, Others in the Global Methylglycinediacetic Acid Market:

Methylglycinediacetic acid (MGDA) plays a crucial role in various industries, including detergents, pulp and paper, textiles, and others, due to its exceptional chelating properties. In the detergent industry, MGDA is primarily used to enhance the cleaning efficiency of products by binding with metal ions that can interfere with the cleaning process. This results in improved stain removal and overall cleaning performance, making MGDA a preferred choice for manufacturers aiming to produce high-quality detergents. Its biodegradability and low toxicity also align with the growing consumer demand for environmentally friendly cleaning products. In the pulp and paper industry, MGDA is used to improve the efficiency of bleaching processes. By chelating metal ions, MGDA helps reduce the need for harsh chemicals, resulting in a more sustainable and environmentally friendly production process. This not only enhances the quality of the final paper product but also minimizes the environmental impact of paper manufacturing. In the textile industry, MGDA is used to prevent metal ion interference during dyeing processes, ensuring vibrant and consistent colors. It also enhances the durability and quality of fabrics, making it a valuable additive in textile manufacturing. The use of MGDA in the textile industry aligns with the growing demand for high-quality and sustainable textiles. Beyond these industries, MGDA finds applications in various other sectors, including agriculture, water treatment, and personal care products. In agriculture, MGDA is used as a chelating agent in fertilizers to improve nutrient availability and uptake by plants. In water treatment, MGDA helps prevent scale formation and corrosion, ensuring the efficient operation of water systems. In personal care products, MGDA is used to enhance the stability and performance of formulations, contributing to the development of high-quality and effective products. Overall, the versatility and effectiveness of MGDA make it a valuable component in a wide range of applications, driving its demand across various industries. As the emphasis on sustainability and environmental responsibility continues to grow, the use of MGDA is expected to increase, further solidifying its position in the global market.

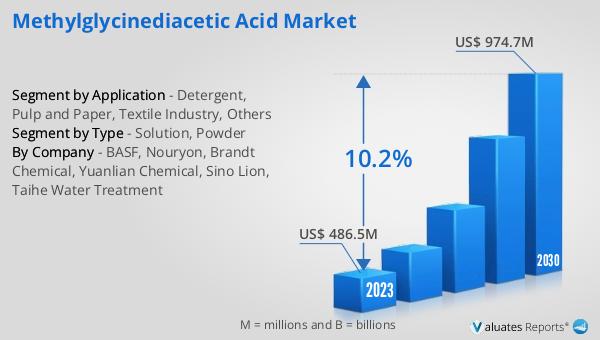

Global Methylglycinediacetic Acid Market Outlook:

The global market for Methylglycinediacetic Acid was valued at $595 million in 2024 and is anticipated to expand to a revised size of $1,161 million by 2031, reflecting a compound annual growth rate (CAGR) of 10.2% during the forecast period. Leading the market are BASF and Nouryon, which together account for approximately 95% of the total market share, underscoring their dominance in this sector. Geographically, Europe holds a significant portion of the market, capturing about 50% of the global share, followed by North America, which accounts for roughly 30%. This distribution highlights the strong presence and demand for MGDA in these regions, driven by the industrial and regulatory landscape that favors sustainable and efficient chemical solutions. In terms of product type, the solution segment holds a substantial share of about 60%, indicating a preference for liquid formulations that offer ease of use and integration into various applications. The detergent segment is particularly noteworthy, as it accounts for nearly 80% of the global application share, emphasizing the critical role of MGDA in enhancing the performance and sustainability of cleaning products. This market outlook reflects the growing importance of MGDA as a versatile and environmentally friendly chelating agent, with significant potential for continued growth and innovation across multiple industries.

| Report Metric | Details |

| Report Name | Methylglycinediacetic Acid Market |

| Accounted market size in year | US$ 595 million |

| Forecasted market size in 2031 | US$ 1161 million |

| CAGR | 10.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | BASF, Nouryon, Brandt Chemical, Yuanlian Chemical, Sino Lion, Taihe Water Treatment |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |