What is Global Corporate Debt Collection Service Market?

The Global Corporate Debt Collection Service Market refers to the industry that provides specialized services to businesses for recovering outstanding debts from other companies or individuals. These services are crucial for maintaining cash flow and financial stability, especially for businesses that extend credit to their customers. Debt collection agencies employ various strategies and tools to recover debts, including contacting debtors, negotiating repayment plans, and, if necessary, taking legal action. The market for these services is global, with agencies operating in multiple countries to help businesses manage their receivables more effectively. This market is driven by the increasing need for businesses to manage their credit risk and ensure timely payments, which is essential for their financial health and operational efficiency. The services offered can vary widely, from early-stage collections to handling severely delinquent accounts, making it a versatile solution for businesses of all sizes and industries.

Early Out Debt, Bad Debt in the Global Corporate Debt Collection Service Market:

Early Out Debt and Bad Debt are two critical components within the Global Corporate Debt Collection Service Market. Early Out Debt refers to accounts that are relatively new and have just started to show signs of delinquency. These accounts are typically easier to collect because the debtor is still relatively engaged and the debt is not yet considered severely overdue. Collection agencies often employ a softer approach for Early Out Debt, focusing on customer service and maintaining a positive relationship with the debtor. This might include sending reminder notices, making phone calls, or offering flexible repayment plans to encourage timely payment. The goal is to resolve the debt quickly and efficiently before it escalates into a more serious issue. On the other hand, Bad Debt refers to accounts that have been delinquent for a longer period and are considered more challenging to collect. These debts are often written off by the original creditor as uncollectible, but collection agencies specialize in recovering even these difficult accounts. The strategies for collecting Bad Debt are more aggressive and may include legal action, asset seizure, or other measures to compel payment. Collection agencies use advanced analytics and skip tracing techniques to locate debtors who may have changed addresses or contact information. The process is more intensive and requires a higher level of expertise and resources. The distinction between Early Out Debt and Bad Debt is crucial for businesses as it determines the approach and resources needed for effective debt recovery. Early Out Debt management focuses on prevention and early intervention, aiming to resolve issues before they become severe. This approach helps maintain customer relationships and reduces the overall cost of collections. In contrast, Bad Debt management is about recovery and mitigation, focusing on recouping as much of the outstanding amount as possible. This often involves higher costs and more complex procedures, but it is essential for minimizing financial losses. Both Early Out Debt and Bad Debt management are integral to the Global Corporate Debt Collection Service Market. They represent different stages of the debt lifecycle and require tailored strategies to address the unique challenges of each stage. By offering specialized services for both types of debt, collection agencies provide comprehensive solutions that help businesses manage their receivables more effectively. This not only improves cash flow but also enhances financial stability and operational efficiency. The ability to recover debts at various stages of delinquency is a key factor driving the growth and demand for corporate debt collection services worldwide.

Large Enterprises, SMEs in the Global Corporate Debt Collection Service Market:

The usage of Global Corporate Debt Collection Service Market varies significantly between Large Enterprises and Small and Medium-sized Enterprises (SMEs). Large Enterprises often have extensive credit operations, dealing with a high volume of transactions and a diverse customer base. For these organizations, debt collection services are essential for managing large-scale receivables and ensuring timely payments. They typically engage with collection agencies to handle both Early Out Debt and Bad Debt, leveraging the agencies' expertise and resources to maintain cash flow and financial stability. Large Enterprises benefit from the advanced analytics, legal support, and comprehensive reporting provided by collection agencies, which help them manage their credit risk more effectively. These services allow them to focus on their core business operations while ensuring that outstanding debts are being pursued diligently. In contrast, SMEs usually have more limited resources and smaller credit operations. For these businesses, the impact of unpaid debts can be more significant, potentially threatening their financial health and operational viability. Debt collection services are equally important for SMEs, but their needs and approaches may differ from those of Large Enterprises. SMEs often require more personalized and flexible solutions, as they may not have the same level of internal resources to manage collections. Collection agencies working with SMEs often provide tailored services that address the specific challenges faced by smaller businesses, such as limited cash flow and tighter budgets. These services might include more frequent communication with debtors, customized repayment plans, and a focus on maintaining positive customer relationships to ensure repeat business. Both Large Enterprises and SMEs benefit from the expertise and resources of debt collection agencies, but their usage patterns and requirements can vary. Large Enterprises may prioritize efficiency and scalability, seeking comprehensive solutions that can handle high volumes of debt across multiple regions and customer segments. They may also require more sophisticated reporting and analytics to monitor the performance of their receivables and make informed decisions. On the other hand, SMEs may prioritize cost-effectiveness and flexibility, looking for solutions that can be adapted to their specific needs and financial constraints. They may also place a higher emphasis on customer service and relationship management, as maintaining a loyal customer base is crucial for their growth and sustainability. In summary, the Global Corporate Debt Collection Service Market serves a wide range of businesses, from Large Enterprises to SMEs, each with its unique needs and challenges. By offering specialized services tailored to the size and nature of the business, collection agencies play a vital role in helping organizations manage their receivables, improve cash flow, and maintain financial stability. Whether dealing with Early Out Debt or Bad Debt, these services provide essential support that enables businesses to focus on their core operations while ensuring that outstanding debts are being pursued effectively.

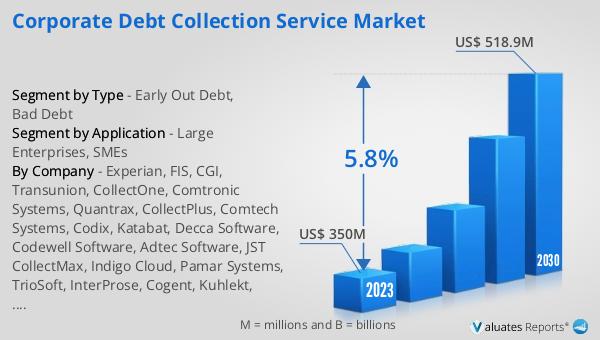

Global Corporate Debt Collection Service Market Outlook:

The global Corporate Debt Collection Service market was valued at US$ 350 million in 2023 and is anticipated to reach US$ 518.9 million by 2030, witnessing a CAGR of 5.8% during the forecast period 2024-2030. This growth reflects the increasing demand for specialized debt recovery services as businesses seek to manage their receivables more effectively and mitigate financial risks. The market's expansion is driven by the need for efficient and reliable debt collection solutions that can handle both Early Out Debt and Bad Debt, providing businesses with the tools and expertise required to recover outstanding amounts. As companies continue to extend credit to their customers, the importance of maintaining healthy cash flow and financial stability becomes paramount. Debt collection agencies play a crucial role in this process, offering a range of services that cater to the diverse needs of businesses across various industries and regions. The projected growth of the market underscores the value and necessity of these services in today's complex and dynamic business environment.

| Report Metric | Details |

| Report Name | Corporate Debt Collection Service Market |

| Accounted market size in 2023 | US$ 350 million |

| Forecasted market size in 2030 | US$ 518.9 million |

| CAGR | 5.8% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Experian, FIS, CGI, Transunion, CollectOne, Comtronic Systems, Quantrax, CollectPlus, Comtech Systems, Codix, Katabat, Decca Software, Codewell Software, Adtec Software, JST CollectMax, Indigo Cloud, Pamar Systems, TrioSoft, InterProse, Cogent, Kuhlekt, Lariat Software, Case Master, coeo Inkasso GmbH, Prestige Services Inc, Atradius Collections, UNIVERSUM Group, Asta Funding, Hilton-Baird Collection Services, SVG Legal Services |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |