What is Global Commercial Loan Origination Software Market?

The Global Commercial Loan Origination Software Market refers to the industry focused on the development and deployment of software solutions that facilitate the process of originating commercial loans. This software is designed to streamline and automate various stages of the loan origination process, including application, underwriting, approval, and disbursement. By leveraging advanced technologies such as artificial intelligence, machine learning, and data analytics, these solutions aim to enhance efficiency, reduce errors, and improve the overall customer experience. Financial institutions, including banks, credit unions, and other lending organizations, utilize these software systems to manage their loan portfolios more effectively, ensure compliance with regulatory requirements, and mitigate risks associated with lending. The market for commercial loan origination software is growing rapidly due to the increasing demand for digital transformation in the financial sector, the need for improved operational efficiency, and the rising adoption of cloud-based solutions. As businesses continue to seek ways to optimize their lending processes and enhance customer satisfaction, the global commercial loan origination software market is expected to witness significant growth in the coming years.

On-premise, Cloud-based in the Global Commercial Loan Origination Software Market:

On-premise and cloud-based solutions are two primary deployment models in the Global Commercial Loan Origination Software Market. On-premise solutions involve installing the software on the financial institution's own servers and infrastructure. This model offers greater control over data security and customization, as the institution can tailor the software to meet its specific needs and regulatory requirements. However, on-premise solutions often require significant upfront investment in hardware and software, as well as ongoing maintenance and IT support. This can be a barrier for smaller institutions with limited resources. Additionally, on-premise solutions may lack the scalability and flexibility needed to adapt to changing business needs and technological advancements. In contrast, cloud-based solutions are hosted on remote servers and accessed via the internet. This model offers several advantages, including lower upfront costs, as there is no need for extensive hardware investment. Cloud-based solutions are typically offered on a subscription basis, allowing institutions to pay for only the services they need. This can be particularly beneficial for small and medium-sized enterprises (SMEs) that may not have the financial resources to invest in on-premise solutions. Cloud-based solutions also offer greater scalability, as institutions can easily adjust their usage based on demand. This flexibility allows financial institutions to quickly adapt to changing market conditions and customer needs. Another key advantage of cloud-based solutions is the ability to access the software from anywhere with an internet connection. This can enhance collaboration among team members, as well as improve customer service by allowing loan officers to access information and process applications remotely. Additionally, cloud-based solutions often come with automatic updates and maintenance, ensuring that institutions always have access to the latest features and security enhancements. This can help reduce the burden on IT staff and ensure that the software remains compliant with evolving regulatory requirements. Despite these advantages, some financial institutions may have concerns about data security and privacy when using cloud-based solutions. Storing sensitive financial information on remote servers can pose risks, particularly if the cloud service provider does not have robust security measures in place. To address these concerns, many cloud-based solution providers offer advanced security features, such as encryption, multi-factor authentication, and regular security audits. Institutions should carefully evaluate the security practices of potential providers to ensure that their data is adequately protected. In summary, both on-premise and cloud-based solutions have their own set of advantages and challenges. On-premise solutions offer greater control and customization but require significant investment and maintenance. Cloud-based solutions provide cost savings, scalability, and flexibility but may raise concerns about data security. Financial institutions must carefully consider their specific needs, resources, and risk tolerance when choosing the appropriate deployment model for their commercial loan origination software. As the market continues to evolve, it is likely that hybrid models, which combine elements of both on-premise and cloud-based solutions, will also gain traction, offering institutions the best of both worlds.

SMEs, Large Enterprises in the Global Commercial Loan Origination Software Market:

The usage of Global Commercial Loan Origination Software Market varies significantly between small and medium-sized enterprises (SMEs) and large enterprises. For SMEs, commercial loan origination software provides a crucial tool to streamline their lending processes and improve operational efficiency. SMEs often face resource constraints, making it challenging to manage loan applications, underwriting, and approvals manually. By adopting loan origination software, SMEs can automate these processes, reducing the time and effort required to process loan applications. This not only enhances productivity but also allows SMEs to offer faster and more efficient services to their customers, improving customer satisfaction and loyalty. Moreover, commercial loan origination software helps SMEs ensure compliance with regulatory requirements. Financial regulations can be complex and constantly evolving, making it difficult for smaller institutions to keep up. Loan origination software often includes built-in compliance features, such as automated checks and reporting tools, that help SMEs adhere to regulatory standards. This reduces the risk of non-compliance and potential penalties, providing peace of mind to both the institution and its customers. Additionally, the software's data analytics capabilities enable SMEs to gain valuable insights into their loan portfolios, helping them make informed decisions and manage risks more effectively. For large enterprises, commercial loan origination software offers a scalable solution to manage their extensive loan portfolios. Large financial institutions often deal with a high volume of loan applications, making manual processing impractical and inefficient. By leveraging loan origination software, large enterprises can automate and streamline their lending processes, significantly reducing processing times and operational costs. The software's advanced features, such as artificial intelligence and machine learning, enable large enterprises to enhance their underwriting processes, improving accuracy and reducing the risk of defaults. Furthermore, commercial loan origination software allows large enterprises to offer a more personalized and seamless customer experience. The software's customer relationship management (CRM) capabilities enable institutions to track and manage customer interactions, providing a holistic view of each customer's financial history and preferences. This allows loan officers to tailor their services to meet individual customer needs, enhancing customer satisfaction and loyalty. Additionally, the software's integration capabilities enable large enterprises to connect with other financial systems and third-party services, creating a more cohesive and efficient lending ecosystem. Another significant advantage for large enterprises is the ability to leverage cloud-based loan origination software. Cloud-based solutions offer greater scalability and flexibility, allowing large institutions to quickly adapt to changing market conditions and customer demands. This is particularly important for large enterprises that operate in multiple regions or countries, as cloud-based solutions can be accessed from anywhere with an internet connection. This enhances collaboration among teams and ensures that all branches and offices have access to the same up-to-date information and tools. In conclusion, the usage of commercial loan origination software provides significant benefits for both SMEs and large enterprises. For SMEs, the software offers a cost-effective solution to streamline lending processes, ensure compliance, and gain valuable insights into their loan portfolios. For large enterprises, the software provides a scalable and efficient solution to manage high volumes of loan applications, enhance underwriting accuracy, and offer a personalized customer experience. As the financial industry continues to evolve, the adoption of commercial loan origination software is likely to increase, helping institutions of all sizes improve their operational efficiency and customer satisfaction.

Global Commercial Loan Origination Software Market Outlook:

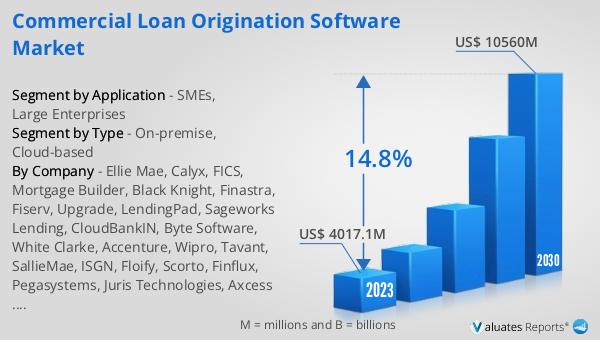

The global Commercial Loan Origination Software market was valued at US$ 4017.1 million in 2023 and is anticipated to reach US$ 10560 million by 2030, witnessing a CAGR of 14.8% during the forecast period 2024-2030. This significant growth reflects the increasing demand for digital transformation in the financial sector, as institutions seek to enhance their lending processes and improve customer experience. The adoption of advanced technologies such as artificial intelligence, machine learning, and data analytics is driving the development of more sophisticated and efficient loan origination solutions. Additionally, the rising popularity of cloud-based solutions is contributing to the market's expansion, as these solutions offer greater scalability, flexibility, and cost savings compared to traditional on-premise systems. Financial institutions of all sizes are recognizing the benefits of commercial loan origination software, including improved operational efficiency, reduced errors, and enhanced compliance with regulatory requirements. As a result, the global commercial loan origination software market is expected to continue its robust growth trajectory in the coming years, driven by the ongoing digital transformation of the financial industry and the increasing adoption of innovative technologies.

| Report Metric | Details |

| Report Name | Commercial Loan Origination Software Market |

| Accounted market size in 2023 | US$ 4017.1 million |

| Forecasted market size in 2030 | US$ 10560 million |

| CAGR | 14.8% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Ellie Mae, Calyx, FICS, Mortgage Builder, Black Knight, Finastra, Fiserv, Upgrade, LendingPad, Sageworks Lending, CloudBankIN, Byte Software, White Clarke, Accenture, Wipro, Tavant, SallieMae, ISGN, Floify, Scorto, Finflux, Pegasystems, Juris Technologies, Axcess Consulting |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |