What is Global Composite Pipes For Chemical Market?

The Global Composite Pipes for Chemical Market is a specialized segment within the broader industrial piping industry, focusing on the development and application of composite materials for transporting chemicals. These pipes are engineered to withstand the harsh conditions often associated with chemical transport, such as high temperatures, corrosive substances, and pressure variations. Composite pipes are typically made from a combination of materials, including polymers and fibers, which provide enhanced durability and resistance compared to traditional metal pipes. The market for these pipes is driven by the increasing demand for efficient and reliable piping solutions in various industries, such as oil and gas, chemical manufacturing, and water treatment. As industries continue to expand and modernize, the need for advanced piping systems that can handle complex chemical processes becomes more critical. This demand is further fueled by the growing emphasis on sustainability and environmental protection, as composite pipes often offer a more eco-friendly alternative due to their longer lifespan and reduced maintenance requirements. Overall, the Global Composite Pipes for Chemical Market represents a dynamic and evolving sector, poised for growth as industries seek innovative solutions to meet their operational needs.

Clad Pipes, Non-metal Composite Pipe in the Global Composite Pipes For Chemical Market:

Clad pipes and non-metal composite pipes are two significant categories within the Global Composite Pipes for Chemical Market, each offering unique benefits and applications. Clad pipes are essentially metal pipes that have been coated or lined with a different material, typically a corrosion-resistant alloy. This cladding process enhances the pipe's ability to withstand corrosive environments, making them ideal for transporting aggressive chemicals. The outer metal layer provides structural integrity, while the inner cladding offers protection against chemical attack. Clad pipes are often used in industries where both mechanical strength and chemical resistance are paramount, such as in oil refineries and chemical processing plants. On the other hand, non-metal composite pipes are constructed entirely from non-metallic materials, such as reinforced polymers or fiberglass. These pipes are lightweight, corrosion-resistant, and offer excellent thermal insulation properties. Non-metal composite pipes are particularly advantageous in applications where weight reduction is crucial, such as in offshore oil and gas platforms. Additionally, their non-metallic nature makes them immune to galvanic corrosion, a common issue in metal piping systems. The choice between clad pipes and non-metal composite pipes often depends on the specific requirements of the application, including factors such as chemical compatibility, temperature, pressure, and cost considerations. Both types of pipes play a vital role in the chemical industry, providing reliable and efficient solutions for transporting a wide range of substances. As the demand for advanced piping systems continues to grow, innovations in materials and manufacturing processes are expected to further enhance the performance and versatility of clad and non-metal composite pipes.

Liquid Transport, Gas Transport in the Global Composite Pipes For Chemical Market:

The usage of Global Composite Pipes for Chemical Market in liquid and gas transport is a testament to their versatility and efficiency. In liquid transport, composite pipes are widely used due to their ability to handle a variety of fluids, including corrosive chemicals, water, and oil. Their corrosion-resistant properties make them ideal for transporting aggressive liquids that would otherwise degrade traditional metal pipes. Additionally, composite pipes offer excellent thermal insulation, which is crucial in maintaining the temperature of transported liquids, especially in industries such as chemical processing and oil refining. The lightweight nature of composite pipes also facilitates easier installation and reduces the overall infrastructure costs. In gas transport, composite pipes are equally valuable, providing a safe and reliable means of transporting gases under high pressure. Their non-metallic construction eliminates the risk of galvanic corrosion, which can be a significant concern in metal piping systems. Composite pipes are also designed to withstand the high pressures associated with gas transport, ensuring the safe and efficient delivery of gases such as natural gas, hydrogen, and industrial gases. The flexibility of composite pipes allows for easier routing and installation, particularly in complex industrial environments. Furthermore, their durability and low maintenance requirements make them a cost-effective solution for long-term gas transport applications. As industries continue to seek efficient and sustainable piping solutions, the role of composite pipes in liquid and gas transport is expected to grow, driven by advancements in material science and engineering.

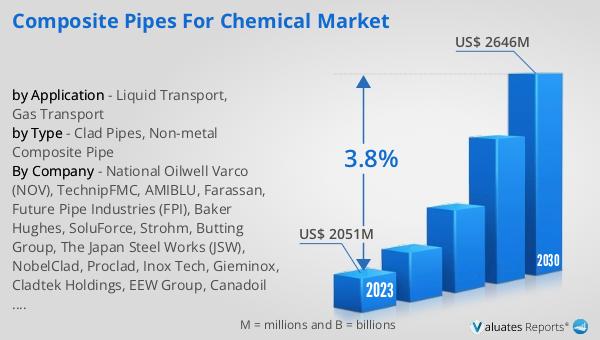

Global Composite Pipes For Chemical Market Outlook:

The outlook for the Global Composite Pipes for Chemical Market indicates a promising growth trajectory, with projections suggesting an increase from US$ 2,115 million in 2024 to US$ 2,736 million by 2031. This growth, at a compound annual growth rate (CAGR) of 3.8% from 2025 to 2031, is largely driven by the critical product segments and diverse end-use applications that these pipes serve. Industries such as oil and gas, chemical manufacturing, and water treatment are increasingly adopting composite pipes due to their superior performance and durability. However, the market is not without its challenges. Evolving U.S. tariff policies introduce a level of trade-cost volatility and supply chain uncertainty that could impact the market dynamics. These policies may affect the cost of raw materials and finished products, influencing the pricing strategies of manufacturers and potentially altering the competitive landscape. Despite these challenges, the demand for composite pipes is expected to remain robust, supported by the ongoing need for efficient and reliable piping solutions in various industrial applications. As the market continues to evolve, manufacturers are likely to focus on innovation and strategic partnerships to navigate the complexities of the global trade environment and capitalize on the growth opportunities in the composite pipes sector.

| Report Metric | Details |

| Report Name | Composite Pipes For Chemical Market |

| Accounted market size in 2024 | US$ 2115 million |

| Forecasted market size in 2031 | US$ 2736 million |

| CAGR | 3.8% |

| Base Year | 2024 |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Sales by Region |

|

| By Company | National Oilwell Varco (NOV), TechnipFMC, AMIBLU, Farassan, Future Pipe Industries (FPI), Baker Hughes, SoluForce, Strohm, Butting Group, The Japan Steel Works (JSW), NobelClad, Proclad, Inox Tech, Gieminox, Cladtek Holdings, EEW Group, Canadoil Group, Xinxing Ductile, Jiangsu New Sunshine, Zhejiang Jiuli Group, Xian Sunward Aeromat, Jiangsu Shunlong, Jiangsu Zhongxin, Lianyungang Zhongfu Lianzhong |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |