What is Global Composite Pipes For Water Treatment Market?

The Global Composite Pipes for Water Treatment Market is a specialized segment within the broader piping industry, focusing on the development and application of composite materials for water treatment processes. These pipes are engineered using a combination of materials, typically involving a core of metal or plastic reinforced with fibers such as glass or carbon. This unique construction offers several advantages over traditional piping materials, including enhanced durability, corrosion resistance, and reduced weight. The market for these pipes is driven by the increasing demand for efficient and sustainable water management solutions across various sectors, including municipal, industrial, and commercial applications. As water scarcity and pollution become more pressing global issues, the need for advanced water treatment technologies, including composite pipes, is expected to grow. These pipes are particularly valued for their ability to withstand harsh environmental conditions and chemical exposures, making them ideal for transporting treated water, wastewater, and other fluids. The market is characterized by ongoing innovation, with manufacturers continually seeking to improve the performance and cost-effectiveness of composite pipe solutions. As a result, the Global Composite Pipes for Water Treatment Market is poised for steady growth, driven by technological advancements and the increasing emphasis on sustainable infrastructure development.

Clad Pipes, Non-metal Composite Pipe in the Global Composite Pipes For Water Treatment Market:

Clad pipes and non-metal composite pipes are two significant categories within the Global Composite Pipes for Water Treatment Market, each offering distinct advantages and applications. Clad pipes are constructed by bonding a layer of corrosion-resistant material, such as stainless steel or nickel alloy, onto a carbon steel or alloy steel base. This cladding process enhances the pipe's resistance to corrosion and wear, making it suitable for environments where aggressive chemicals or high temperatures are present. Clad pipes are often used in applications where the cost of using solid corrosion-resistant alloys would be prohibitive, providing a cost-effective solution without compromising on performance. The cladding process involves advanced metallurgical techniques to ensure a strong bond between the layers, resulting in a pipe that combines the strength of the base material with the corrosion resistance of the cladding. This makes clad pipes particularly valuable in industries such as oil and gas, chemical processing, and power generation, where they are used to transport corrosive fluids and gases. On the other hand, non-metal composite pipes are constructed using a combination of non-metallic materials, typically involving a thermoplastic or thermosetting resin matrix reinforced with fibers such as glass or carbon. These pipes offer several advantages over traditional metal pipes, including reduced weight, improved corrosion resistance, and enhanced flexibility. Non-metal composite pipes are particularly well-suited for applications where weight savings and corrosion resistance are critical, such as in offshore oil and gas platforms, chemical processing plants, and water treatment facilities. The use of advanced composite materials allows for the production of pipes with tailored properties, such as increased strength, stiffness, or thermal resistance, depending on the specific requirements of the application. Additionally, non-metal composite pipes are often easier to install and maintain than their metal counterparts, as they do not require welding or complex jointing techniques. This can result in significant cost savings over the life of the installation, particularly in remote or challenging environments. The Global Composite Pipes for Water Treatment Market is characterized by ongoing innovation and development, with manufacturers continually seeking to improve the performance and cost-effectiveness of both clad and non-metal composite pipe solutions. Advances in materials science and manufacturing techniques have led to the development of new composite materials with enhanced properties, such as increased resistance to abrasion, impact, and chemical attack. These innovations are driving the adoption of composite pipes in a wider range of applications, as industries seek to improve the efficiency and sustainability of their operations. As the demand for advanced water treatment technologies continues to grow, the market for composite pipes is expected to expand, driven by the need for durable, cost-effective, and environmentally friendly piping solutions. The versatility and performance of clad and non-metal composite pipes make them an attractive option for a wide range of industries, from municipal water treatment to high-pressure oil and gas applications.

Municipal, Power Generation, Chemical, Oil & Gas, Metals & Mining, Others in the Global Composite Pipes For Water Treatment Market:

The Global Composite Pipes for Water Treatment Market finds extensive usage across various sectors, each with unique requirements and challenges. In the municipal sector, composite pipes are increasingly used for water distribution and wastewater management systems. Their corrosion resistance and durability make them ideal for transporting treated water and sewage, reducing the risk of leaks and contamination. Municipalities are under constant pressure to upgrade aging infrastructure and improve water quality, and composite pipes offer a reliable and cost-effective solution. Additionally, their lightweight nature simplifies installation and reduces labor costs, making them an attractive option for large-scale municipal projects. In the power generation industry, composite pipes are used to transport cooling water, steam, and other fluids essential to the operation of power plants. The high temperatures and pressures involved in power generation require materials that can withstand extreme conditions, and composite pipes offer the necessary strength and thermal resistance. Their corrosion-resistant properties also make them suitable for use in environments where aggressive chemicals are present, such as in nuclear power plants or facilities using seawater for cooling. The use of composite pipes in power generation helps improve the efficiency and reliability of plant operations, reducing maintenance costs and downtime. The chemical industry also benefits from the use of composite pipes, as they are resistant to a wide range of chemicals and can handle the aggressive environments often found in chemical processing plants. Composite pipes are used to transport acids, alkalis, solvents, and other corrosive substances, providing a safe and reliable means of conveyance. Their ability to withstand chemical attack and high temperatures makes them an ideal choice for applications where traditional metal pipes would quickly degrade. The use of composite pipes in the chemical industry helps ensure the safe and efficient operation of processing facilities, reducing the risk of leaks and environmental contamination. In the oil and gas sector, composite pipes are used for a variety of applications, including the transportation of crude oil, natural gas, and produced water. Their corrosion resistance and ability to withstand high pressures make them suitable for use in both onshore and offshore environments. Composite pipes are often used in subsea applications, where their lightweight nature and flexibility offer significant advantages over traditional steel pipes. The use of composite pipes in the oil and gas industry helps improve the safety and efficiency of operations, reducing the risk of leaks and spills. The metals and mining industry also utilizes composite pipes for transporting slurry, tailings, and other abrasive materials. The abrasion-resistant properties of composite pipes make them ideal for handling the harsh conditions often found in mining operations. Their lightweight nature and ease of installation also make them suitable for use in remote or challenging environments, where traditional metal pipes would be difficult to install and maintain. The use of composite pipes in the metals and mining industry helps improve the efficiency and sustainability of operations, reducing the environmental impact of mining activities. In addition to these sectors, composite pipes are used in a variety of other applications, including marine, aerospace, and construction. Their versatility and performance make them an attractive option for a wide range of industries, as they offer a durable, cost-effective, and environmentally friendly solution for transporting fluids and gases. As the demand for advanced water treatment technologies continues to grow, the market for composite pipes is expected to expand, driven by the need for reliable and sustainable infrastructure solutions.

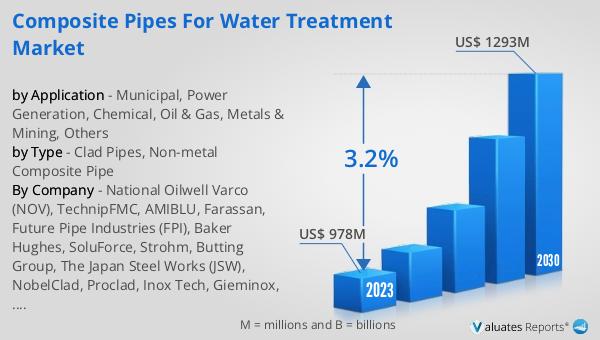

Global Composite Pipes For Water Treatment Market Outlook:

The outlook for the Global Composite Pipes for Water Treatment Market indicates a promising growth trajectory, with the market expected to expand from $1,070 million in 2024 to $1,330 million by 2031, reflecting a compound annual growth rate (CAGR) of 3.2% from 2025 to 2031. This growth is primarily driven by the increasing demand for composite pipes across various critical product segments and diverse end-use applications. As industries continue to seek efficient and sustainable solutions for water treatment, the adoption of composite pipes is expected to rise. These pipes offer several advantages, including enhanced durability, corrosion resistance, and reduced weight, making them an attractive option for a wide range of applications. However, the market is not without challenges. Evolving U.S. tariff policies are introducing trade cost volatility and supply chain uncertainty, which could impact the availability and pricing of raw materials and finished products. Despite these challenges, the market is poised for steady growth, driven by technological advancements and the increasing emphasis on sustainable infrastructure development. As manufacturers continue to innovate and improve the performance and cost-effectiveness of composite pipe solutions, the Global Composite Pipes for Water Treatment Market is expected to remain a key player in the broader piping industry.

| Report Metric | Details |

| Report Name | Composite Pipes For Water Treatment Market |

| Accounted market size in 2024 | US$ 1070 million |

| Forecasted market size in 2031 | US$ 1330 million |

| CAGR | 3.2% |

| Base Year | 2024 |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Sales by Region |

|

| By Company | National Oilwell Varco (NOV), TechnipFMC, AMIBLU, Farassan, Future Pipe Industries (FPI), Baker Hughes, SoluForce, Strohm, Butting Group, The Japan Steel Works (JSW), NobelClad, Proclad, Inox Tech, Gieminox, Cladtek Holdings, EEW Group, Canadoil Group, Xinxing Ductile, Jiangsu New Sunshine, Zhejiang Jiuli Group, Xian Sunward Aeromat, Jiangsu Shunlong, Jiangsu Zhongxin, Lianyungang Zhongfu Lianzhong |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |