What is Global Backup Camera Market?

The global backup camera market is an essential segment of the automotive industry, focusing on enhancing vehicle safety and driver convenience. Backup cameras, also known as rear-view cameras, are designed to prevent accidents by providing drivers with a clear view of the area behind their vehicles. This technology is particularly useful in reducing blind spots and assisting drivers in parking and reversing maneuvers. The market for backup cameras has seen significant growth due to increasing safety regulations and consumer demand for advanced safety features in vehicles. As more countries implement stringent safety standards, the adoption of backup cameras is expected to rise. Additionally, technological advancements have led to the development of more sophisticated camera systems, further driving market growth. The global backup camera market is characterized by a diverse range of products, including CCD and CMOS cameras, each offering unique benefits. As the automotive industry continues to evolve, the demand for backup cameras is likely to remain strong, driven by the need for enhanced safety and convenience in both passenger and commercial vehicles.

CCD Cameras, CMOS Cameras in the Global Backup Camera Market:

In the global backup camera market, CCD (Charge-Coupled Device) and CMOS (Complementary Metal-Oxide-Semiconductor) cameras are two prevalent technologies, each with distinct characteristics and applications. CCD cameras are known for their high-quality image capture, offering superior image resolution and sensitivity to light. This makes them ideal for environments with varying lighting conditions, such as nighttime driving or poorly lit areas. CCD cameras work by transferring charge across the chip and reading it at one corner of the array, which can result in higher power consumption and cost. However, their ability to produce clear and detailed images makes them a preferred choice for premium vehicles where image quality is paramount. On the other hand, CMOS cameras are widely used in the backup camera market due to their cost-effectiveness and lower power consumption. CMOS technology allows for the integration of additional functions on the chip, such as image processing, which can enhance the overall performance of the camera system. While CMOS cameras may not match the image quality of CCD cameras in low-light conditions, they offer sufficient performance for most standard applications, making them a popular choice for a wide range of vehicles. The global backup camera market has seen a significant shift towards CMOS cameras, driven by their affordability and the increasing demand for backup cameras in mid-range and economy vehicles. As manufacturers continue to innovate, the gap in image quality between CCD and CMOS cameras is narrowing, with advancements in CMOS technology leading to improved performance in challenging lighting conditions. This trend is expected to continue, with CMOS cameras maintaining a dominant position in the market due to their versatility and cost advantages. Both CCD and CMOS cameras play crucial roles in the global backup camera market, catering to different segments and consumer preferences. While CCD cameras remain the go-to option for high-end vehicles requiring exceptional image clarity, CMOS cameras are favored for their practicality and efficiency in everyday driving scenarios. As the market evolves, the choice between CCD and CMOS cameras will largely depend on the specific needs and budget of consumers, as well as the ongoing advancements in camera technology.

Passenger Cars, Commercial Vehicles in the Global Backup Camera Market:

The usage of backup cameras in passenger cars and commercial vehicles highlights the growing importance of safety and convenience in the automotive industry. In passenger cars, backup cameras have become a standard feature, driven by consumer demand for enhanced safety and ease of use. These cameras provide drivers with a clear view of the area behind the vehicle, reducing the risk of accidents during parking and reversing. The integration of backup cameras in passenger cars is also influenced by regulatory requirements, as many countries have mandated the inclusion of rear-view cameras in new vehicles to improve road safety. This has led to a significant increase in the adoption of backup cameras in passenger cars, with manufacturers offering a variety of options to cater to different consumer preferences and budgets. In commercial vehicles, backup cameras play a crucial role in ensuring the safety of both drivers and pedestrians. Commercial vehicles, such as trucks and buses, often have larger blind spots compared to passenger cars, making backup cameras an essential tool for preventing accidents. These cameras assist drivers in maneuvering large vehicles in tight spaces, reducing the likelihood of collisions and property damage. The use of backup cameras in commercial vehicles is also driven by the need to comply with safety regulations and improve operational efficiency. By providing drivers with a clear view of the rear, backup cameras help reduce the time and effort required for parking and reversing, leading to increased productivity and reduced downtime. As the global backup camera market continues to grow, the adoption of these systems in both passenger cars and commercial vehicles is expected to rise, driven by the ongoing emphasis on safety and technological advancements. The integration of backup cameras in vehicles not only enhances safety but also contributes to a more comfortable and convenient driving experience, making them an indispensable feature in modern automotive design.

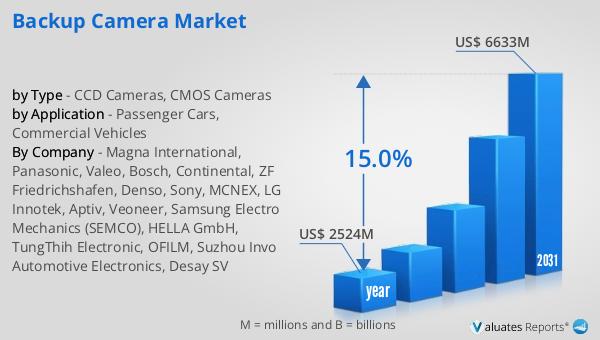

Global Backup Camera Market Outlook:

The global backup camera market is experiencing robust growth, with its valuation reaching approximately $2,524 million in 2024. Projections indicate that this market will expand significantly, reaching an estimated size of $6,633 million by 2031, reflecting a compound annual growth rate (CAGR) of 15.0% over the forecast period. The market is dominated by the top five manufacturers, who collectively hold a substantial share of over 42%. Europe and China emerge as the leading producers of backup cameras, together accounting for more than 27% of the market share. Within the product categories, CMOS cameras stand out as the largest segment, commanding a significant share of over 81%. This dominance is attributed to their cost-effectiveness and widespread adoption across various vehicle types. In terms of application, passenger cars represent the largest segment, with a commanding share of over 76%. This is driven by the increasing demand for safety features in passenger vehicles and regulatory mandates requiring the installation of backup cameras. As the market continues to evolve, the focus remains on enhancing safety and convenience for drivers, with technological advancements playing a pivotal role in shaping the future of the global backup camera market.

| Report Metric | Details |

| Report Name | Backup Camera Market |

| Accounted market size in year | US$ 2524 million |

| Forecasted market size in 2031 | US$ 6633 million |

| CAGR | 15.0% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Magna International, Panasonic, Valeo, Bosch, Continental, ZF Friedrichshafen, Denso, Sony, MCNEX, LG Innotek, Aptiv, Veoneer, Samsung Electro Mechanics (SEMCO), HELLA GmbH, TungThih Electronic, OFILM, Suzhou Invo Automotive Electronics, Desay SV |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |