What is Global CMP Membranes Market?

The Global CMP Membranes Market refers to the worldwide industry focused on the production and distribution of Chemical Mechanical Planarization (CMP) membranes. These membranes are crucial components in the semiconductor manufacturing process, specifically in the planarization phase, where they help achieve a smooth and even surface on semiconductor wafers. CMP membranes are used to support the wafer during the polishing process, ensuring uniform pressure distribution and preventing damage. The market for CMP membranes is driven by the increasing demand for semiconductors in various applications, including consumer electronics, automotive, and telecommunications. As technology advances, the need for more efficient and precise semiconductor manufacturing processes grows, further propelling the demand for CMP membranes. The market is characterized by continuous innovation, with manufacturers striving to develop membranes that offer improved performance, durability, and cost-effectiveness. Additionally, the market is influenced by the trends in the semiconductor industry, such as the shift towards smaller node sizes and the integration of advanced materials, which require more sophisticated CMP processes. Overall, the Global CMP Membranes Market plays a vital role in the semiconductor supply chain, supporting the production of high-performance electronic devices.

5-zone, 6-zone and 7-zone, Below 5-zone (3-zone, etc.), by Size, 300mm CMP Membranes, 200mm CMP Membranes in the Global CMP Membranes Market:

In the Global CMP Membranes Market, the classification of membranes by zones and sizes is crucial for meeting the diverse needs of semiconductor manufacturing. The 5-zone, 6-zone, and 7-zone CMP membranes refer to the number of distinct pressure zones within the membrane, which allow for precise control over the polishing process. Each zone can be individually adjusted to apply specific pressure levels, enhancing the uniformity and quality of the wafer surface. The 5-zone membranes are typically used for standard applications, providing a balance between performance and cost. The 6-zone membranes offer additional control, making them suitable for more complex polishing tasks that require higher precision. The 7-zone membranes represent the most advanced option, offering the highest level of control and customization, ideal for cutting-edge semiconductor manufacturing processes. Below 5-zone membranes, such as 3-zone membranes, are generally used for less demanding applications where cost efficiency is a priority. In terms of size, CMP membranes are commonly available in 300mm and 200mm diameters, corresponding to the size of the wafers they are designed to polish. The 300mm CMP membranes are widely used in modern semiconductor fabs, as they align with the industry's trend towards larger wafer sizes for increased production efficiency. The 200mm CMP membranes, while less common in new fabs, are still in demand for legacy systems and specific applications. The choice between different zone configurations and sizes depends on the specific requirements of the semiconductor manufacturing process, including the type of devices being produced, the materials used, and the desired level of precision. Manufacturers in the Global CMP Membranes Market continuously innovate to develop membranes that meet the evolving needs of the semiconductor industry, focusing on enhancing performance, durability, and cost-effectiveness. This innovation is driven by the increasing complexity of semiconductor devices, which require more sophisticated CMP processes to achieve the desired level of performance and reliability. As a result, the market for CMP membranes is characterized by a wide range of products, each designed to address specific challenges in semiconductor manufacturing.

in the Global CMP Membranes Market:

The Global CMP Membranes Market serves a variety of applications across the semiconductor industry, playing a critical role in the production of integrated circuits and other electronic components. One of the primary applications of CMP membranes is in the fabrication of microprocessors, where they are used to achieve the precise planarization required for the intricate layering of circuits. This process is essential for ensuring the performance and reliability of microprocessors, which are the brains of computers and many other electronic devices. CMP membranes are also used in the production of memory chips, including DRAM and NAND flash, which are vital components in a wide range of consumer electronics, from smartphones to laptops. The demand for these memory chips is driven by the increasing need for data storage and processing power, which in turn fuels the demand for CMP membranes. Another significant application of CMP membranes is in the manufacturing of application-specific integrated circuits (ASICs), which are customized for specific tasks and used in various industries, including automotive, telecommunications, and healthcare. The precision and control offered by CMP membranes are crucial for the production of these specialized circuits, which often require complex designs and high levels of performance. Additionally, CMP membranes are used in the production of power semiconductors, which are essential for managing and converting electrical energy in a wide range of applications, from renewable energy systems to electric vehicles. The growing demand for energy-efficient technologies and the transition towards renewable energy sources are driving the need for advanced power semiconductors, further boosting the demand for CMP membranes. In summary, the Global CMP Membranes Market supports a diverse range of applications in the semiconductor industry, each with its own set of requirements and challenges. The versatility and precision of CMP membranes make them indispensable tools in the production of high-performance electronic devices, enabling the continued advancement of technology and innovation across various sectors.

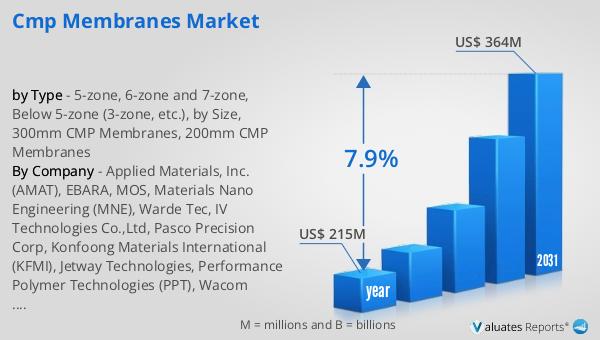

Global CMP Membranes Market Outlook:

The global CMP Membranes Market was valued at $215 million in 2024 and is anticipated to expand to $364 million by 2031, reflecting a compound annual growth rate (CAGR) of 7.9% over the forecast period. The market is dominated by the top five manufacturers, including Applied Materials Inc., AMAT, EBARA, MOS, IV Technologies Co. Ltd, and Warde Tec, which collectively account for over 90% of the market share. China emerges as the largest market, holding a share exceeding 45%, followed by South Korea and North America, with shares of approximately 22% and 14%, respectively. In terms of product types, the 5-zone, 6-zone, and 7-zone CMP membranes constitute the largest segment, capturing more than 80% of the total market. The Americas and Asia Pacific regions are expected to experience significant growth, with projected increases of 25.1% and 17.5%, respectively. Conversely, Europe is anticipated to show marginal growth of 0.5%, while Japan is forecasted to experience a slight decline of 1.1%. This growth trajectory is primarily driven by the Memory and Logic sectors, which are projected to soar to over $200 billion in 2025, each representing an upward trend of over 25% for Memory and over 10% for Logic compared to the previous year.

| Report Metric | Details |

| Report Name | CMP Membranes Market |

| Accounted market size in year | US$ 215 million |

| Forecasted market size in 2031 | US$ 364 million |

| CAGR | 7.9% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Applied Materials, Inc. (AMAT), EBARA, MOS, Materials Nano Engineering (MNE), Warde Tec, IV Technologies Co.,Ltd, Pasco Precision Corp, Konfoong Materials International (KFMI), Jetway Technologies, Performance Polymer Technologies (PPT), Wacom Manufacturing, RION, Inc. |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |